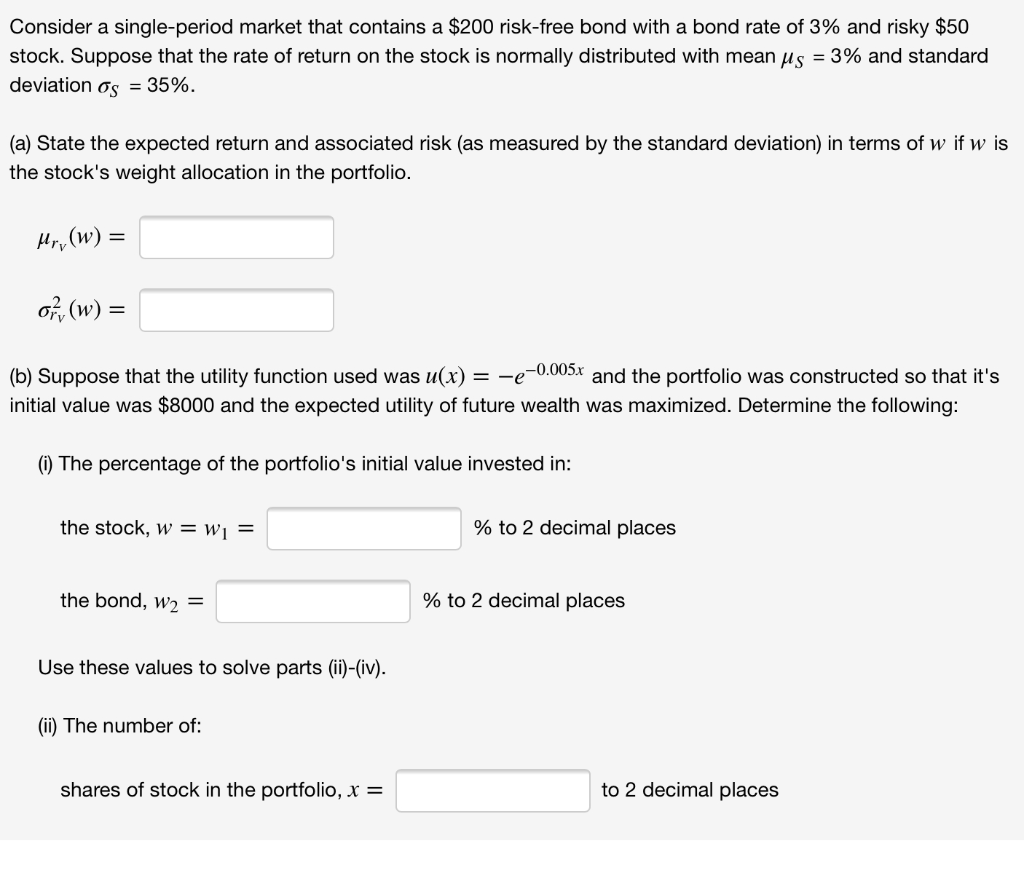

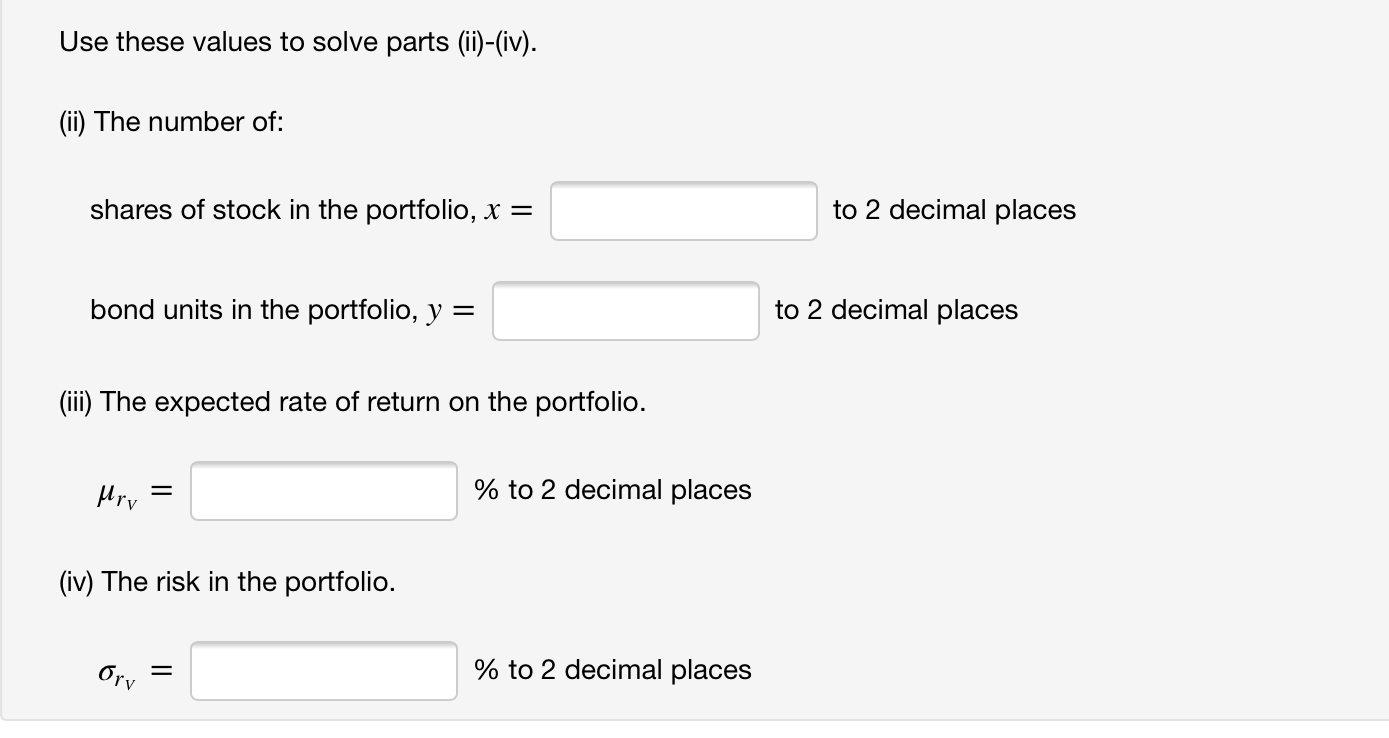

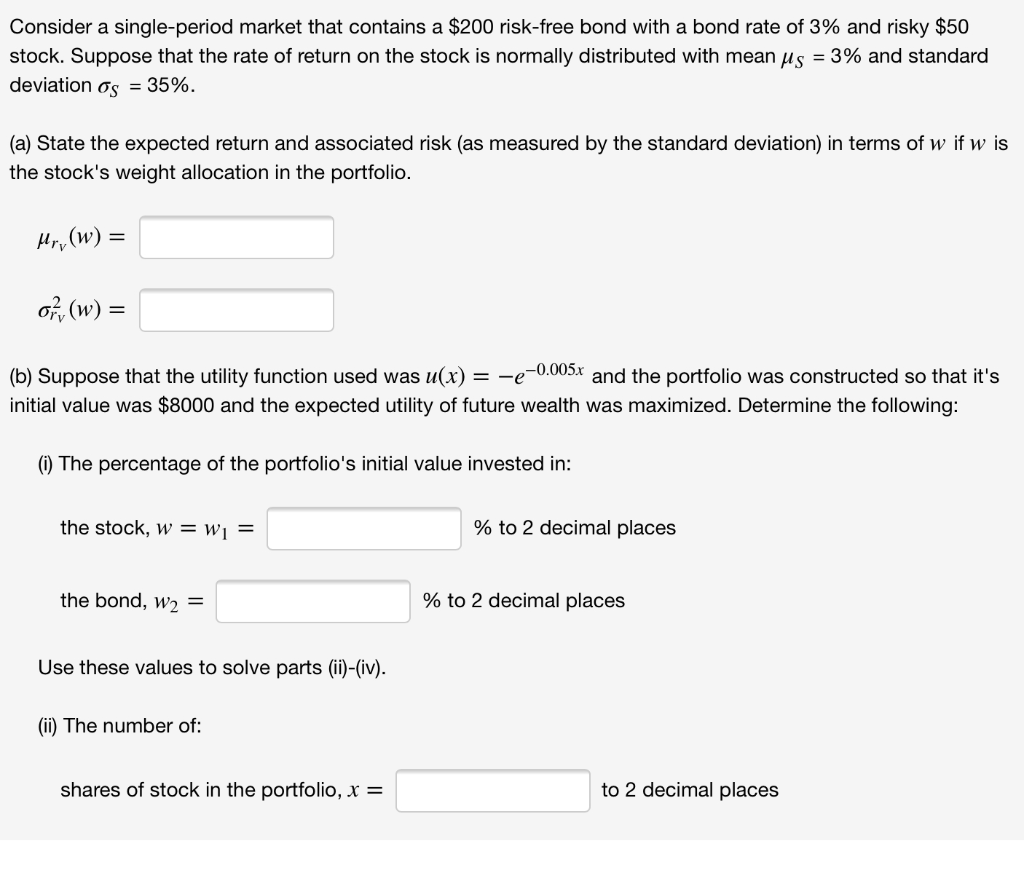

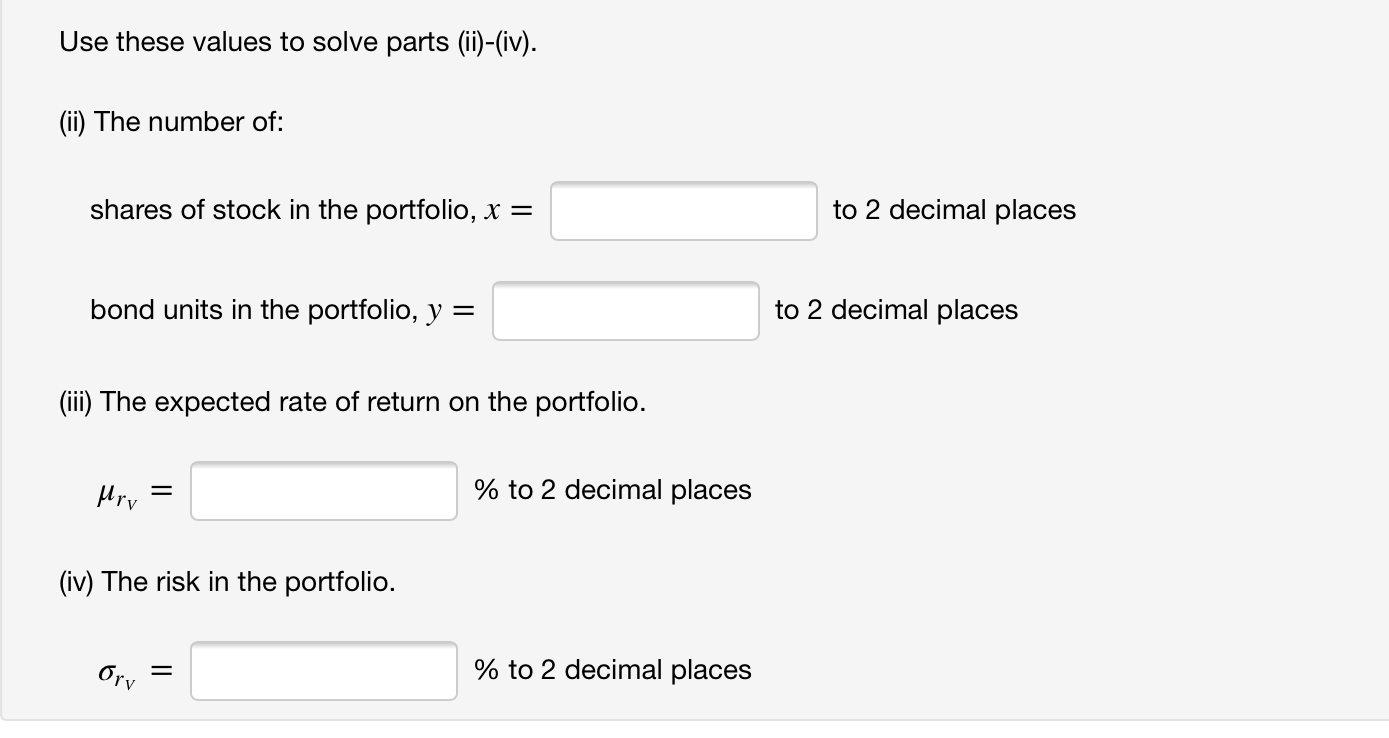

Consider a single-period market that contains a $200 risk-free bond with a bond rate of 3% and risky $50 stock. Suppose that the rate of return on the stock is normally distributed with mean us = 3% and standard deviation os = 35%. (a) State the expected return and associated risk (as measured by the standard deviation) in terms of w if w is the stock's weight allocation in the portfolio. Mr, (w) = of (w) = (b) Suppose that the utility function used was u(x) = -e-0.005x and the portfolio was constructed so that it's initial value was $8000 and the expected utility of future wealth was maximized. Determine the following: (i) The percentage of the portfolio's initial value invested in: the stock, w = wi = % to 2 decimal places the bond, w2 = % to 2 decimal places Use these values to solve parts (ii)-(iv). (ii) The number of: shares of stock in the portfolio, x = to 2 decimal places Use these values to solve parts (ii)-(iv). (ii) The number of: shares of stock in the portfolio, x = to 2 decimal places bond units in the portfolio, y = to 2 decimal places (iii) The expected rate of return on the portfolio. Hry = % to 2 decimal places (iv) The risk in the portfolio. Orv = % to 2 decimal places Consider a single-period market that contains a $200 risk-free bond with a bond rate of 3% and risky $50 stock. Suppose that the rate of return on the stock is normally distributed with mean us = 3% and standard deviation os = 35%. (a) State the expected return and associated risk (as measured by the standard deviation) in terms of w if w is the stock's weight allocation in the portfolio. Mr, (w) = of (w) = (b) Suppose that the utility function used was u(x) = -e-0.005x and the portfolio was constructed so that it's initial value was $8000 and the expected utility of future wealth was maximized. Determine the following: (i) The percentage of the portfolio's initial value invested in: the stock, w = wi = % to 2 decimal places the bond, w2 = % to 2 decimal places Use these values to solve parts (ii)-(iv). (ii) The number of: shares of stock in the portfolio, x = to 2 decimal places Use these values to solve parts (ii)-(iv). (ii) The number of: shares of stock in the portfolio, x = to 2 decimal places bond units in the portfolio, y = to 2 decimal places (iii) The expected rate of return on the portfolio. Hry = % to 2 decimal places (iv) The risk in the portfolio. Orv = % to 2 decimal places