Answered step by step

Verified Expert Solution

Question

1 Approved Answer

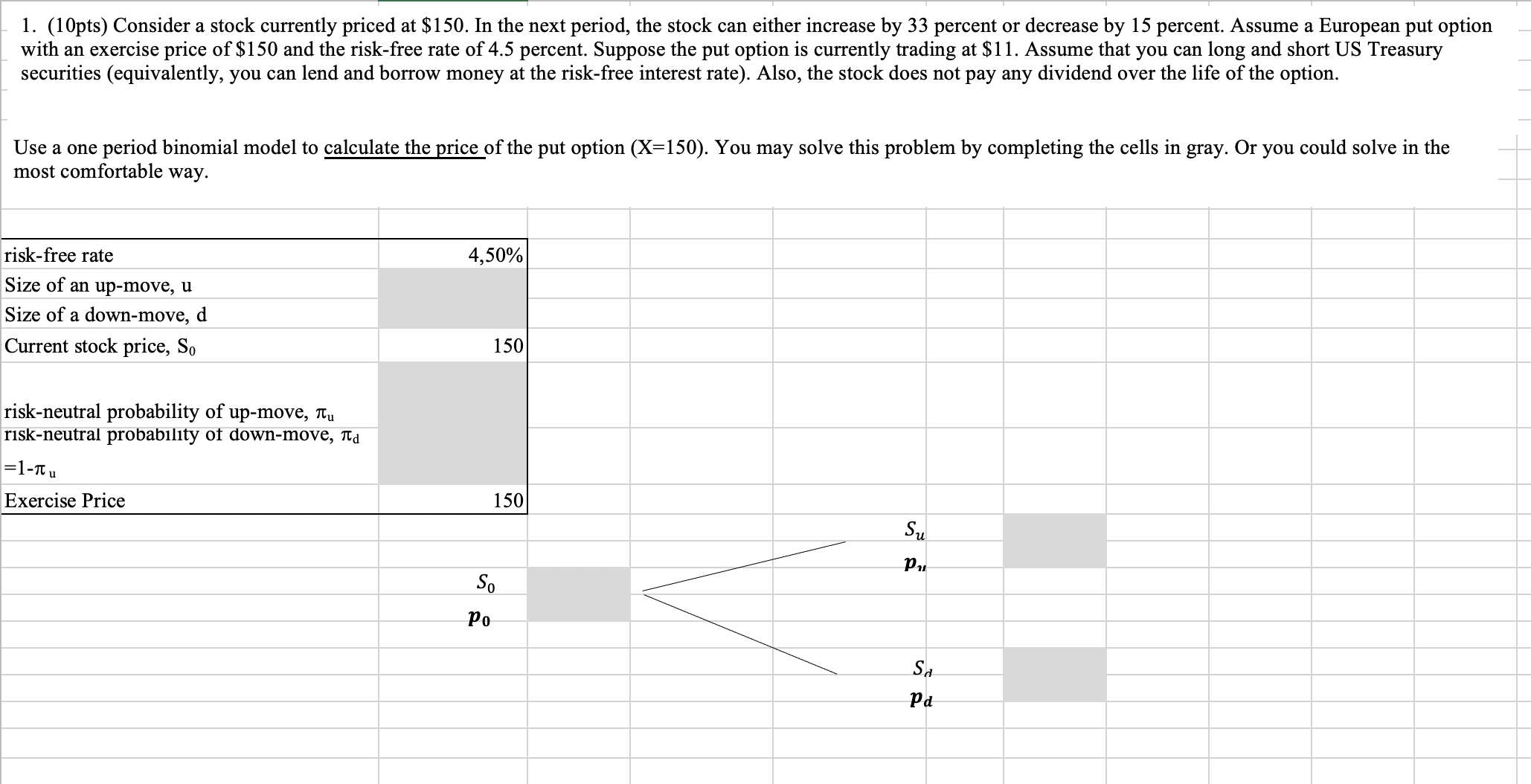

Consider a stock currently priced at $ 1 5 0 . In the next period, the stock can either increase by 3 3 percent or

Consider a stock currently priced at $ In the next period, the stock can either increase by percent or decrease by percent. Assume a European put option

with an exercise price of $ and the riskfree rate of percent. Suppose the put option is currently trading at $ Assume that you can long and short US Treasury

securities equivalently you can lend and borrow money at the riskfree interest rate Also, the stock does not pay any dividend over the life of the option.

Use a one period binomial model to calculate the price of the put option You may solve this problem by completing the cells in gray. Or you could solve in the

most comfortable way.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started