Answered step by step

Verified Expert Solution

Question

1 Approved Answer

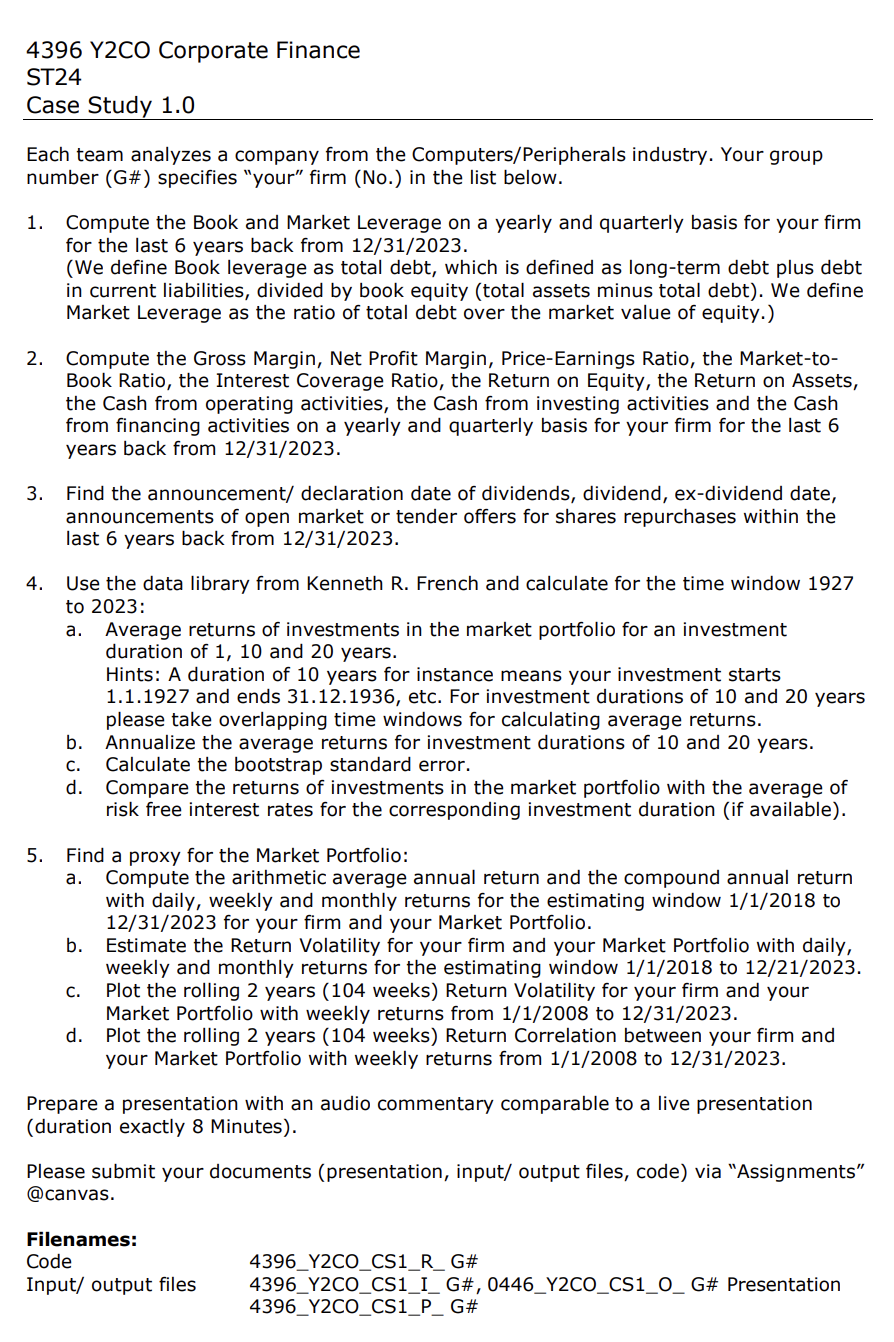

4 3 9 6 Y 2 CO Corporate Finance ST 2 4 Case Study 1 . 0 Each team analyzes a company from the Computers

YCO Corporate Finance

ST

Case Study

Each team analyzes a company from the ComputersPeripherals industry. Your group

number G# specifies "your" firm No in the list below.

Compute the Book and Market Leverage on a yearly and quarterly basis for your firm

for the last years back from

We define Book leverage as total debt, which is defined as longterm debt plus debt

in current liabilities, divided by book equity total assets minus total debt We define

Market Leverage as the ratio of total debt over the market value of equity.

Compute the Gross Margin, Net Profit Margin, PriceEarnings Ratio, the Marketto

Book Ratio, the Interest Coverage Ratio, the Return on Equity, the Return on Assets,

the Cash from operating activities, the Cash from investing activities and the Cash

from financing activities on a yearly and quarterly basis for your firm for the last

years back from

Find the announcement declaration date of dividends, dividend, exdividend date,

announcements of open market or tender offers for shares repurchases within the

last years back from

Use the data library from Kenneth R French and calculate for the time window

to :

a Average returns of investments in the market portfolio for an investment

duration of and years.

Hints: A duration of years for instance means your investment starts

and ends etc. For investment durations of and years

please take overlapping time windows for calculating average returns.

b Annualize the average returns for investment durations of and years.

c Calculate the bootstrap standard error.

d Compare the returns of investments in the market portfolio with the average of

risk free interest rates for the corresponding investment duration if available

Find a proxy for the Market Portfolio:

a Compute the arithmetic average annual return and the compound annual return

with daily, weekly and monthly returns for the estimating window to

for your firm and your Market Portfolio.

b Estimate the Return Volatility for your firm and your Market Portfolio with daily,

weekly and monthly returns for the estimating window to

c Plot the rolling years weeks Return Volatility for your firm and your

Market Portfolio with weekly returns from to

d Plot the rolling years weeks Return Correlation between your firm and

your Market Portfolio with weekly returns from to

Prepare a presentation with an audio commentary comparable to a live presentation

duration exactly Minutes

Please submit your documents presentation input output files, code via "Assignments"

@canvas.

Filenames:

Code YCOCSRG#

Input output files YCOCSIG#YCOCSOG# Presentation

YCOCSPG#

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started