Question

Consider a stock currently priced at $50. You are seeking to calculate the volatility skew/smirk for European options on the stock that have 7 days

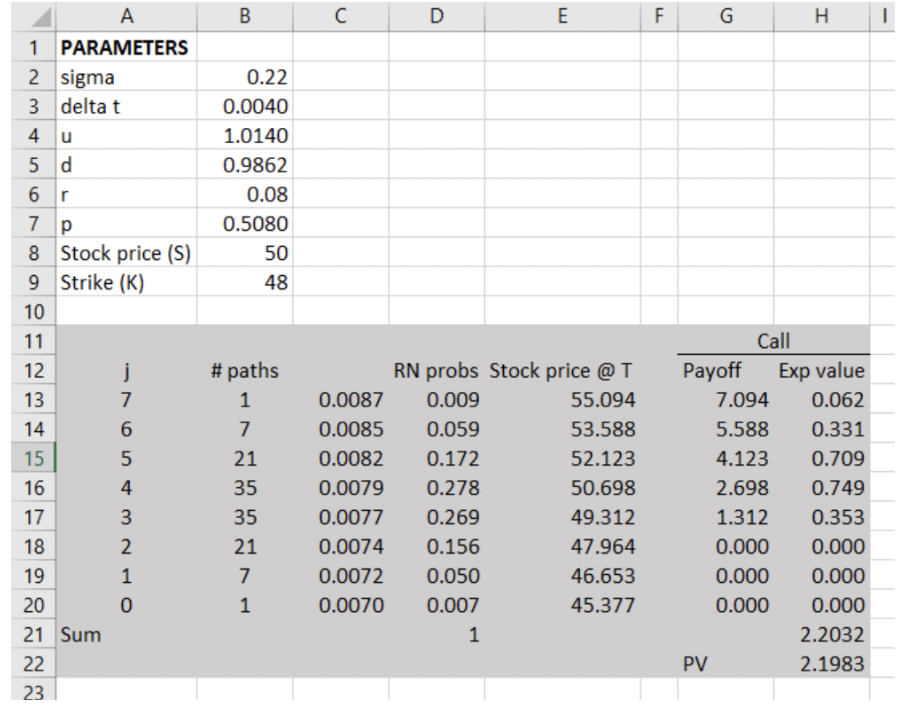

Consider a stock currently priced at $50. You are seeking to calculate the volatility skew/smirk for European options on the stock that have 7 days to maturity using the binomial option pricing model. To assist you with this, consider the following spreadsheet that seeks to price a European call with a strike of $48. The spreadsheet assumes a volatility of 22% p.a. and a constant risk-free rate of 8% p.a. continuously compounded.

a) Using risk neutral pricing principles, carefully explain how the spreadsheet calculates the value of the European call option. Your discussion should focus on explaining all the columns in the highlighted section of the spreadsheet. b) Explain how you could slightly modify the spreadsheet and use solver to extract the implied volatility of the European option with a strike of $48. c) Using your modified spreadsheet as outlined in part b), explain how you would then go about constructing the volatility skew/smirk for a 7-day maturity. d) Outline one reason why you may expect to see a skew/smirk.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started