Question

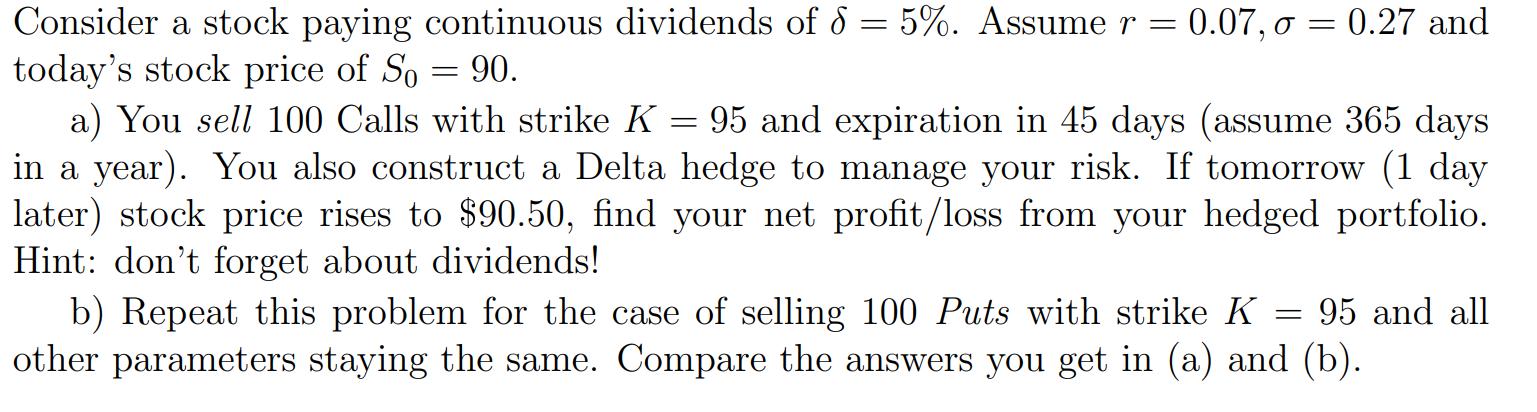

Consider a stock paying continuous dividends of 8 = 5%. Assume r = today's stock price of So = 90. a) You sell 100

Consider a stock paying continuous dividends of 8 = 5%. Assume r = today's stock price of So = 90. a) You sell 100 Calls with strike K = 0.07, = 0.27 and 95 and expiration in 45 days (assume 365 days in a year). You also construct a Delta hedge to manage your risk. If tomorrow (1 day later) stock price rises to $90.50, find your net profit/loss from your hedged portfolio. Hint: don't forget about dividends! b) Repeat this problem for the case of selling 100 Puts with strike K = 95 and all other parameters staying the same. Compare the answers you get in (a) and (b).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Basic Statistics

Authors: Charles Henry Brase, Corrinne Pellillo Brase

6th Edition

978-1133525097, 1133525091, 1111827028, 978-1133110316, 1133110312, 978-1111827021

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App