Question

Using the provided script for simulating trajectories of (St) with the log-normal Black- Scholes dynamics, implement the Monte Carlo method for pricing Asian Calls.

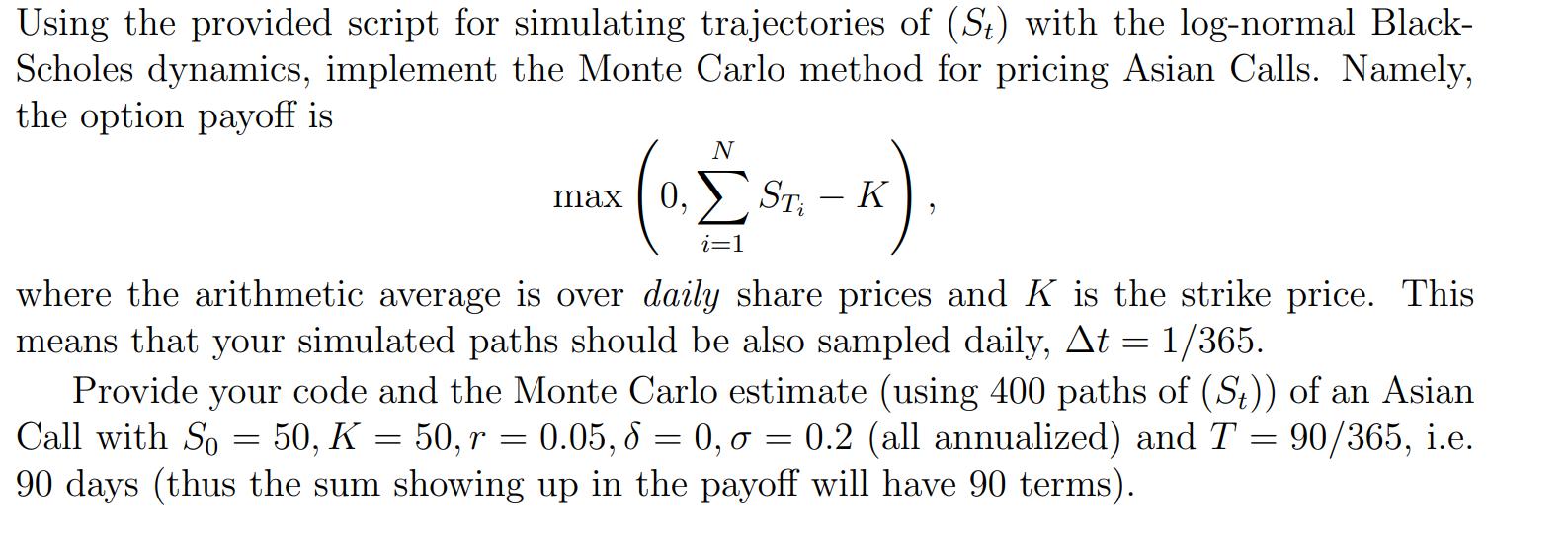

Using the provided script for simulating trajectories of (St) with the log-normal Black- Scholes dynamics, implement the Monte Carlo method for pricing Asian Calls. Namely, the option payoff is max N 0, ST. - K i=1 where the arithmetic average is over daily share prices and K is the strike price. This means that your simulated paths should be also sampled daily, At = 1/365. Provide your code and the Monte Carlo estimate (using 400 paths of (St)) of an Asian Call with So 50, K = 50, r = 0.05, 8 = 0, = 0.2 (all annualized) and T = 90/365, i.e. 90 days (thus the sum showing up in the payoff will have 90 terms). = :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Market Practice In Financial Modelling

Authors: Tan Chia Chiang

1st Edition

9814366544, 978-9814366540

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App