Question

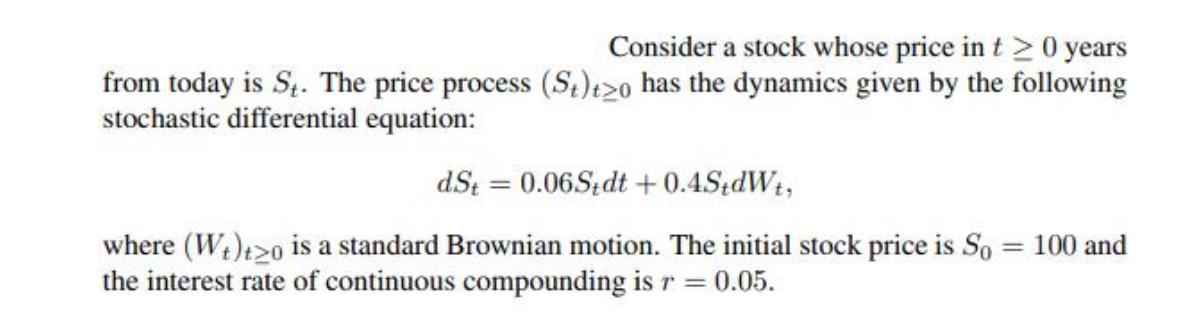

Consider a stock whose price in t > 0 years from today is St. The price process (St)tzo has the dynamics given by the

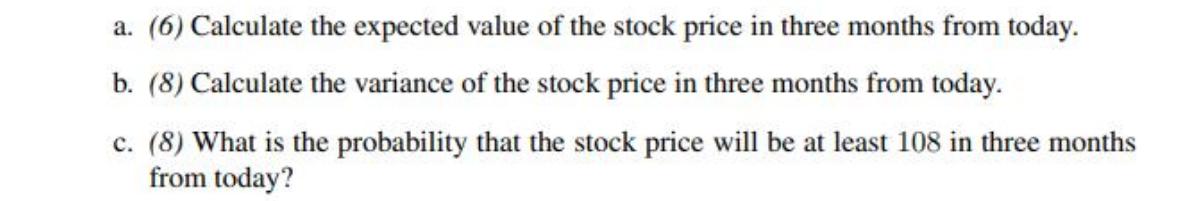

Consider a stock whose price in t > 0 years from today is St. The price process (St)tzo has the dynamics given by the following stochastic differential equation: dSt = 0.06Stdt +0.4StdWt, where (W) +20 is a standard Brownian motion. The initial stock price is So the interest rate of continuous compounding is r = 0.05. = 100 and a. (6) Calculate the expected value of the stock price in three months from today. b. (8) Calculate the variance of the stock price in three months from today. c. (8) What is the probability that the stock price will be at least 108 in three months from today?

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepwise calculations a Calculate the expected value of the stock pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Mathematical Models Of Financial Derivative

Authors: Yue-Kuen Kwok

2nd Edition

3642447937, 978-3642447938

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App