Answered step by step

Verified Expert Solution

Question

1 Approved Answer

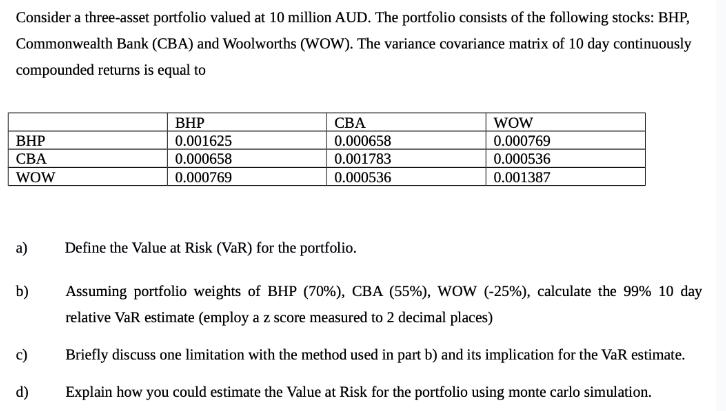

Consider a three-asset portfolio valued at 10 million AUD. The portfolio consists of the following stocks: BHP, Commonwealth Bank (CBA) and Woolworths (WOW). The

Consider a three-asset portfolio valued at 10 million AUD. The portfolio consists of the following stocks: BHP, Commonwealth Bank (CBA) and Woolworths (WOW). The variance covariance matrix of 10 day continuously compounded returns is equal to CBA WOW a) b) c) d) BHP 0.001625 0.000658 0.000769 CBA 0.000658 0.001783 0.000536 WOW 0.000769 0.000536 0.001387 Define the Value at Risk (VaR) for the portfolio. Assuming portfolio weights of BHP (70%), CBA (55%), WOW (-25%), calculate the 99% 10 day relative VaR estimate (employ a z score measured to 2 decimal places) Briefly discuss one limitation with the method used in part b) and its implication for the VaR estimate. Explain how you could estimate the Value at Risk for the portfolio using monte carlo simulation.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a The Value at Risk VaR for a portfolio is a statistical measure that represents the maximum potential loss the portfolio could incur at a specified l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started