Answered step by step

Verified Expert Solution

Question

1 Approved Answer

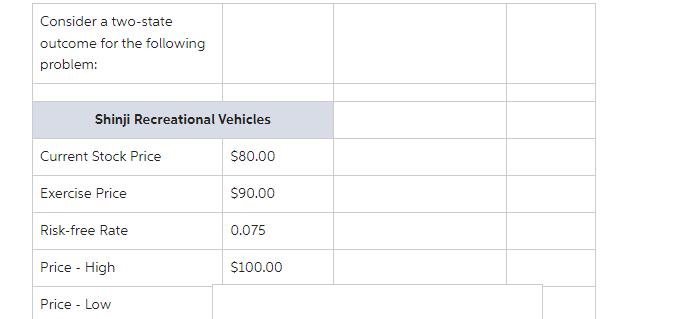

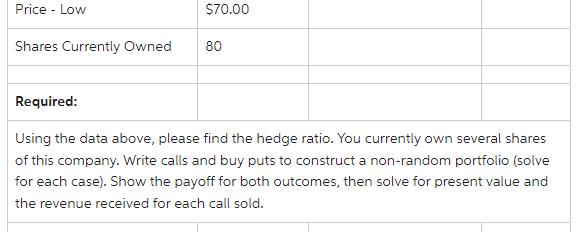

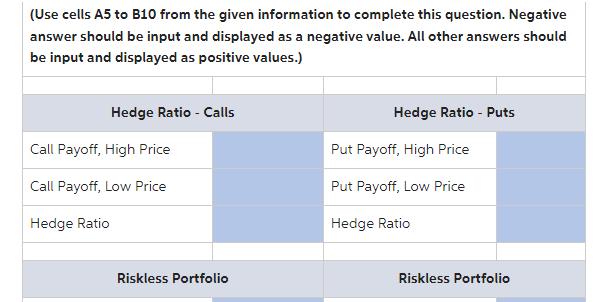

Consider a two-state outcome for the following problem: Shinji Recreational Vehicles Current Stock Price Exercise Price Risk-free Rate Price - High Price - Low

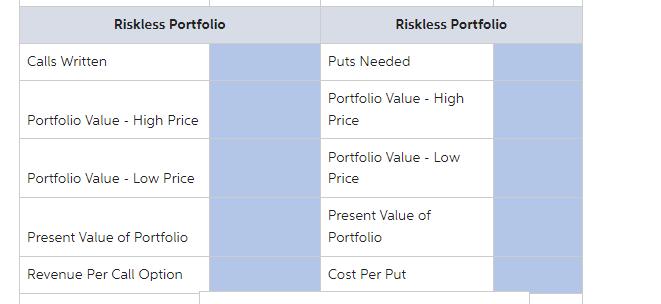

Consider a two-state outcome for the following problem: Shinji Recreational Vehicles Current Stock Price Exercise Price Risk-free Rate Price - High Price - Low $80.00 $90.00 0.075 $100.00 Price - Low Shares Currently Owned Required: $70.00 80 Using the data above, please find the hedge ratio. You currently own several shares of this company. Write calls and buy puts to construct a non-random portfolio (solve for each case). Show the payoff for both outcomes, then solve for present value and the revenue received for each call sold. (Use cells A5 to B10 from the given information to complete this question. Negative answer should be input and displayed as a negative value. All other answers should be input and displayed as positive values.) Hedge Ratio - Calls Call Payoff, High Price Call Payoff, Low Price Hedge Ratio Riskless Portfolio Hedge Ratio - Puts Put Payoff, High Price Put Payoff, Low Price Hedge Ratio Riskless Portfolio Calls Written Riskless Portfolio Portfolio Value - High Price Portfolio Value - Low Price Present Value of Portfolio Revenue Per Call Option Riskless Portfolio Puts Needed Portfolio Value - High Price Portfolio Value - Low Price Present Value of Portfolio Cost Per Put Consider a two-state outcome for the following problem: Shinji Recreational Vehicles Current Stock Price Exercise Price Risk-free Rate Price - High Price - Low $80.00 $90.00 0.075 $100.00 Price - Low Shares Currently Owned Required: $70.00 80 Using the data above, please find the hedge ratio. You currently own several shares of this company. Write calls and buy puts to construct a non-random portfolio (solve for each case). Show the payoff for both outcomes, then solve for present value and the revenue received for each call sold. (Use cells A5 to B10 from the given information to complete this question. Negative answer should be input and displayed as a negative value. All other answers should be input and displayed as positive values.) Hedge Ratio - Calls Call Payoff, High Price Call Payoff, Low Price Hedge Ratio Riskless Portfolio Hedge Ratio - Puts Put Payoff, High Price Put Payoff, Low Price Hedge Ratio Riskless Portfolio Calls Written Riskless Portfolio Portfolio Value - High Price Portfolio Value - Low Price Present Value of Portfolio Revenue Per Call Option Riskless Portfolio Puts Needed Portfolio Value - High Price Portfolio Value - Low Price Present Value of Portfolio Cost Per Put

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution Hedge Ratio Calls 100 90 100 80 05 This means that for every call option soldwe need to buy ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started