Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Produce the following calculations: Gross & Net Margin, EBIT & AT Inventory Turnover ROA, EBIT & AT ROE, AT Current Ratio Debt/Equity Receivables turnover Fixed

Produce the following calculations:

- Gross & Net Margin, EBIT & AT

- Inventory Turnover

- ROA, EBIT & AT

- ROE, AT

- Current Ratio

- Debt/Equity

- Receivables turnover

- Fixed asset turnover

- Total asset turnover

- Quick ratio

- Working Capital

- Total Debt Ratio

- Equity Multiplier

- P/E

- DPS

- Other significant ratios

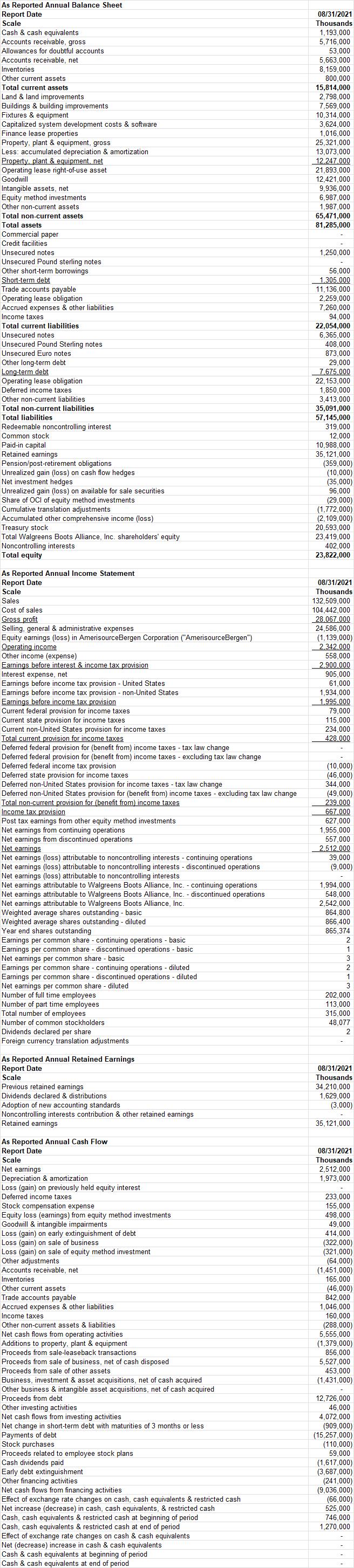

As Reported Annual Balance Sheet Report Date Scale Cash & cash equivalents Accounts receivable, gross Allowances for doubtful accounts Accounts receivable, net Inventories Other current assets Total current assets. Land & land improvements Buildings & building improvements Fixtures & equipment Capitalized system development costs & software Finance lease properties Property, plant & equipment, gross Less: accumulated depreciation & amortization Property, plant & equipment, net Operating lease right-of-use asset Goodwill Intangible assets, net Equity method investments Other non-current assets Total non-current assets Total assets Commercial paper Credit facilities Unsecured notes Unsecured Pound sterling notes Other short-term borrowings Short-term debt Trade accounts payable Operating lease obligation Accrued expenses & other liabilities Income taxes Total current liabilities Unsecured notes Unsecured Pound Sterling notes Unsecured Euro notes Other long-term debt. Long-term debt Operating lease obligation Deferred income taxes Other non-current liabilities Total non-current liabilities Total liabilities Redeemable noncontrolling interest Common stock Paid-in capital Retained earnings Pension/post-retirement obligations Unrealized gain (loss) on cash flow hedges Net investment hedges Unrealized gain (loss) on available for sale securities Share of OCI of equity method investments Cumulative translation adjustments Accumulated other comprehensive income (loss) Treasury stock Total Walgreens Boots Alliance, Inc. shareholders' equity Noncontrolling interests Total equity As Reported Annual Income Statement Report Date Scale Sales Cost of sales Gross profit Selling, general & administrative expenses Equity earnings (loss) in AmerisourceBergen Corporation ("AmerisourceBergen") Operating income Other income (expense) Earnings before interest & income tax provision Interest expense, net Earnings before income tax provision - United States Earnings before income tax rovision non-United States Earnings before income tax provision Current federal provision for income taxes Current state provision for income taxes Current non-United States provision for income taxes Total current provision for income taxes Deferred federal provision for (benefit from) income taxes - tax law change Deferred federal provision for (benefit from) income taxes - excluding tax law change Deferred federal income tax provision Deferred state provision for income taxes Deferred non-United States provision for income taxes - tax law change Deferred non-United States provision for (benefit from) income taxes - excluding tax law change Total non-current provision for (benefit from) income taxes Income tax provision Post tax earnings from other equity method investments Net earnings from continuing operations Net earnings from discontinued operations Net earnings Net earnings (loss) attributable to noncontrolling interests - continuing operations Net earnings (loss) attributable to noncontrolling interests - discontinued operations Net earnings (loss) attributable to noncontrolling interests Net earnings attributable to Walgreens Boots Alliance, Inc. - continuing operations Net earnings attributable to Walgreens Boots Alliance, Inc. - discontinued operations Net earnings attributable to Walgreens Boots Alliance, Inc. Weighted average shares outstanding - basic Weighted average shares outstanding - diluted Year end shares outstanding Earnings per common share - continuing operations - basic Earnings per common share - discontinued operations - basic Net earnings per common share - basic Earnings per common share - continuing operations - diluted Earnings per common share - discontinued operations - diluted Net earnings per common share - diluted Number of full time employees Number of part time employees Total number of employees Number of common stockholders Dividends declared per share Foreign currency translation adjustments As Reported Annual Retained Earnings Report Date Scale Previous retained earnings Dividends declared & distributions Adoption f new accounting standards Noncontrolling interests contribution & other retained earnings Retained earnings As Reported Annual Cash Flow Report Date Scale Net earnings Depreciation & amortization Loss (gain) on previously held equity interest Deferred income taxes Stock compensation expense Equity loss (earnings) from equity method investments Goodwill & intangible impairments Loss (gain) on early extinguishment of debt Loss (gain) on sale of business. Loss (gain) on sale of equity method investment Other adjustments Accounts receivable, net Inventories Other current assets Trade accounts payable Accrued expenses & other liabilities Income taxes Other non-current assets & liabilities Net cash flows from operating activities Additions to property, plant & equipment Proceeds from sale-leaseback transactions Proceeds from sale of business, net of cash disposed Proceeds from sale of other assets Business, investment & asset acquisitions, net of cash acquired Other business & intangible asset acquisitions, net of cash acquired Proceeds from debt Other investing activities Net cash flows from investing activities Net change in short-term debt with maturities of 3 months or less Payments of debt Stock purchases Proceeds related to employee stock plans Cash dividends paid Early debt extinguishment Other financing activities Net cash flows from financing activities Effect of exchange rate changes on cash, cash equivalents & restricted cash Net increase (decrease) in cash, cash equivalents, & restricted cash Cash, cash equivalents & restricted cash at beginning of period Cash, cash equivalents & restricted cash at end of period Effect of exchange rate changes on cash & cash equivalents Net (decrease) increase in cash & cash equivalents Cash & cash equivalents at beginning of period Cash & cash equivalents at end of period 08/31/2021 Thousands 1,193,000 5,716,000 53,000 5,663,000 8,159,000 800,000 15,814,000 2,798,000 7,569,000 10,314,000 3,624,000 1,016,000 25,321,000 13,073,000 12,247.000 21,893,000 12,421,000 9,936,000 6,987,000 1,987,000 65,471,000 81,285,000 1,250,000 56,000 1.305.000 11,136,000 2,259,000 7,260,000 94,000 22,054,000 6,365,000 408,000 873,000 29.000 7.675.000 22,153,000 1,850,000 3,413,000 35,091,000 57,145,000 319.000 12,000 10,988,000 35,121,000 (359,000) (10,000) (35,000) 96,000 (29,000) (1,772,000) (2,109,000). 20,593,000 23,419,000 402,000 23,822,000 08/31/2021 Thousands 132,509,000 104,442,000 28.067.000 24,586,000 (1,139,000) 2,342,000 558,000 2.900.000 905,000 61,000 1,934,000 1.995.000 79,000 115,000 234,000 428,000 (10,000) (46,000) 344,000 (49,000) 239.000 667,000 627,000 1,955,000 557,000 2,512,000 39,000 (9,000) 1,994,000 548,000 2,542,000 864,800 866.400 865,374 1 2 1 3 202,000 113,000 315,000 48,077 08/31/2021 Thousands 34,210,000 1,629,000 (3,000) 35,121,000 08/31/2021 Thousands 2,512,000 1,973,000 233,000 155,000 498,000 49,000 414,000 (322,000) (321,000) (64,000) (1,451,000) 165,000 (46,000) 842,000 1,046,000 160,000 (288,000) 5,555,000 (1,379,000) 856,000 5,527,000 453,000 (1,431,000) 12,726,000 46,000 4,072,000 (909,000) (15,257,000) (110,000) 59,000 (1,617,000) (3,687,000) (241,000) (9,036,000) (66,000) 525,000 746,000 1,270,000

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

solution Gross margin circulation Gross profitRevenue Net Margin Calculation Net incomeRevenue EBIT ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started