Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a utility providing water service as a natural monopoly to residents of a city. The market comprises n identical households, each of which

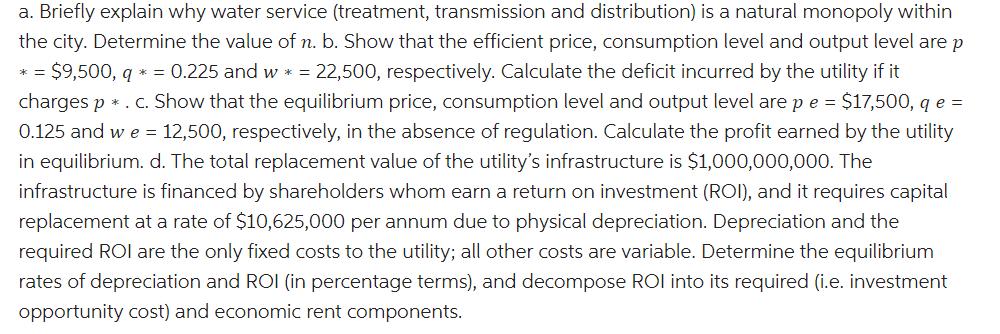

Consider a utility providing water service as a natural monopoly to residents of a city. The market comprises n identical households, each of which has an inverse demand function of p(q) = 27,500 80,000q where q is the number of megalitres (ML) of water demanded annually and p is the price per megalitre (1 ML = 1,000m3). Letting w denote total output in megalitres, inverse market demand is p(w) = 27,500 - 0.8w and the annual total cost to the utility of providing water is TC(w) = 90,625,000 + 5,000w + 0.1w 2. Thus, marginal revenue, average cost and marginal cost are, respectively, as follows: MR(w) = 27,500 1.6w; AC(w) = 90,625,000/w + 5,000 + 0.1w; and MC(w) = 5,000 + 0.2w. a. Briefly explain why water service (treatment, transmission and distribution) is a natural monopoly within the city. Determine the value of n. b. Show that the efficient price, consumption level and output level are p $9,500, q * = 0.225 and w * = 22,500, respectively. Calculate the deficit incurred by the utility if it charges p *. c. Show that the equilibrium price, consumption level and output level are p e = $17,500, q e = 0.125 and w e = 12,500, respectively, in the absence of regulation. Calculate the profit earned by the utility in equilibrium. d. The total replacement value of the utility's infrastructure is $1,000,000,000. The infrastructure is financed by shareholders whom earn a return on investment (ROI), and it requires capital replacement at a rate of $10,625,000 per annum due to physical depreciation. Depreciation and the required ROI are the only fixed costs to the utility; all other costs are variable. Determine the equilibrium rates of depreciation and ROI (in percentage terms), and decompose ROI into its required (i.e. investment opportunity cost) and economic rent components.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The answer of the following question is given below in a detailed manner as follo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started