Answered step by step

Verified Expert Solution

Question

1 Approved Answer

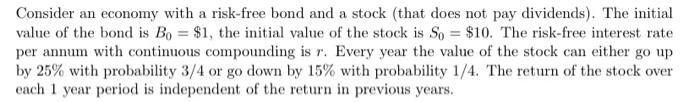

Consider an economy with a risk-free bond and a stock (that does not pay dividends). The initial value of the bond is Bo= $1,

Consider an economy with a risk-free bond and a stock (that does not pay dividends). The initial value of the bond is Bo= $1, the initial value of the stock is So= $10. The risk-free interest rate per annum with continuous compounding is r. Every year the value of the stock can either go up by 25% with probability 3/4 or go down by 15% with probability 1/4. The return of the stock over each 1 year period is independent of the return in previous years. a) Are there values of r such that the market admits arbitrage? If yes, what are these values? For the rest of question, assume r = ln(1.05). Approximate your answers to the 4th decimal digit. b) Let S3 be the value of the stock in 3 years. i) How many possible values are there for S3? ii) What's the real-world probability of each value of S3? iii) What's the risk-neutral probability of each value of S3? c) Compute the price of a power option, i.e., an option with maturity 3 years that pays (S3). d) Find a self-financing replicating portfolio for the power option defined in (c) (meaning, write the replicating portfolio at each time t and each possible value of S, until maturity). e) Assume that after 2 years the stock price is $10.625 and the observed market price for the power option defined in (c) (with maturity one year later) is $115. Find an arbitrage portfolio.

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a There are no values of r such that the market admits arbitrage This is because the stock prices are not perfectly correlated so there is always some risk involved in holding the stock b i There are ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started