Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an owner of an LPG carrier with a cargo capacity of 40000 mt. The vessel is currently carrying a cargo to be discharged

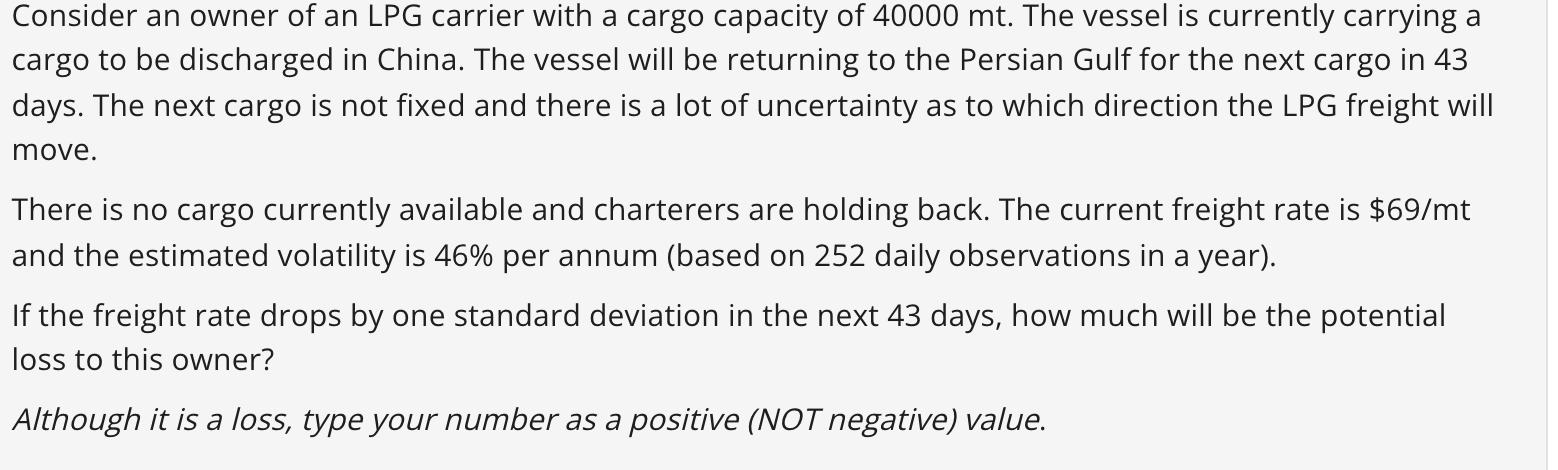

Consider an owner of an LPG carrier with a cargo capacity of 40000 mt. The vessel is currently carrying a cargo to be discharged in China. The vessel will be returning to the Persian Gulf for the next cargo in 43 days. The next cargo is not fixed and there is a lot of uncertainty as to which direction the LPG freight will move. There is no cargo currently available and charterers are holding back. The current freight rate is $69/mt and the estimated volatility is 46% per annum (based on 252 daily observations in a year). If the freight rate drops by one standard deviation in the next 43 days, how much will be the potential loss to this owner? Although it is a loss, type your number as a positive (NOT negative) value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Change in freight rate The scenario presented assumes that the freight rate will drop by one standar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started