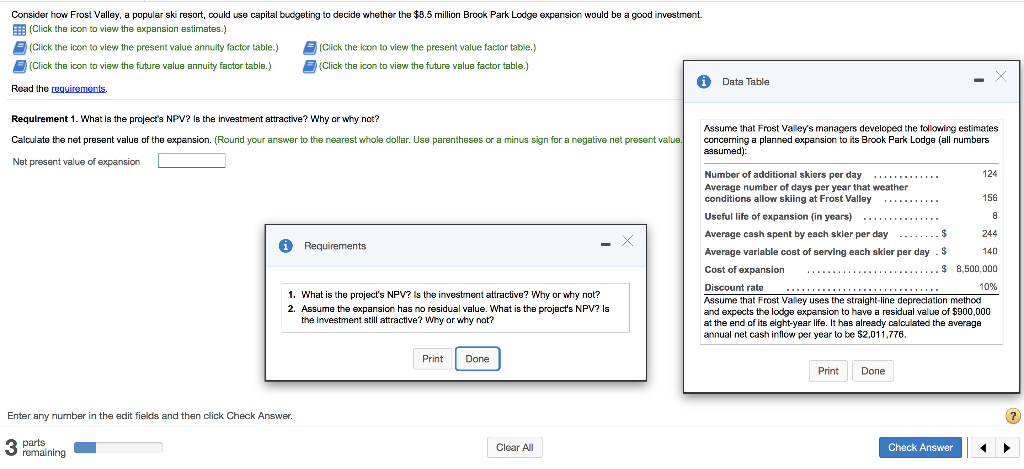

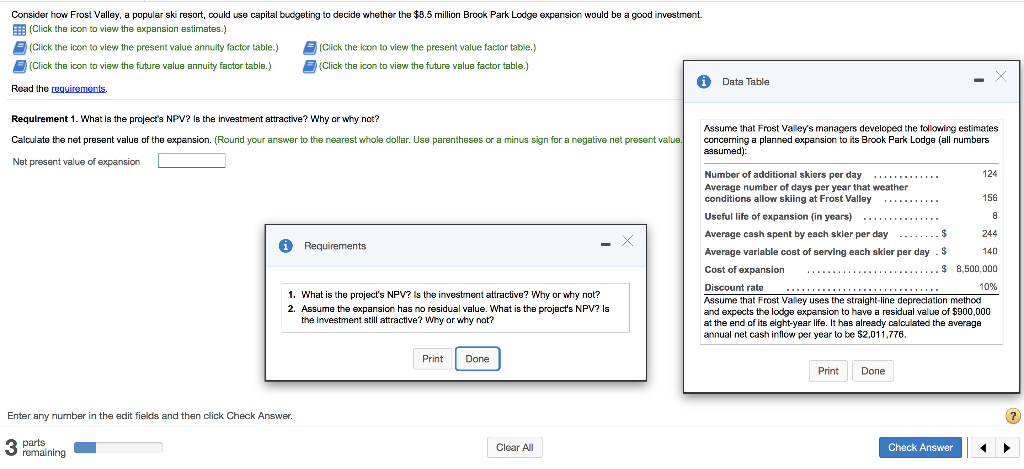

Consider how Frost Valley, a popular ski resort, could use capital budgeting to decide whether the $8.5 million Brook Park Lodge expansion would be a good investment. (Click the icon to view the expansion estimates.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the present value factor table.) (Click the icon to view the future value annuity factor table.) (Click the icon to view the future value factor table.) 6 Data Table Read the requirements , Requirement 1. What is the project's NPV? Is the investment attractive? Why or why not? Calculate the net present value of the expansion. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value. Net present value of expansion Assume that Frost Valley's managers developed the following estimates concerning a planned expansion to its Brook Park Lodge (all numbers assumed): Requirements Number of additional skiers per day 124 Average number of days per year that weather conditions allow skiing at Frost Valley 156 Useful life of expansion (in years) .... 8 Average cash spent by each skler per day ........$ 244 Average variable cost of serving each skier per day . $ 140 Cost of expansion ... $ 8.500.000 Discount rate 10% Assume that Frost Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $900.000 at the end of its eight-year life. It has already calculated the average annual net cash in flow per year to be $2,011,776. 1. What is the project's NPV? Is the investment attractive? Why or why not? 2. Assume the expansion has no residual value. What is the project's NPV? Is the investment still attractive? Why or why not? Print Done Print Done Enter any number in the edit fields and then click Check Answer. 2 3 parts remaining - Clear All clear All Check Answer Consider how Frost Valley, a popular ski resort, could use capital budgeting to decide whether the $8.5 million Brook Park Lodge expansion would be a good investment. (Click the icon to view the expansion estimates.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the present value factor table.) (Click the icon to view the future value annuity factor table.) (Click the icon to view the future value factor table.) 6 Data Table Read the requirements , Requirement 1. What is the project's NPV? Is the investment attractive? Why or why not? Calculate the net present value of the expansion. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value. Net present value of expansion Assume that Frost Valley's managers developed the following estimates concerning a planned expansion to its Brook Park Lodge (all numbers assumed): Requirements Number of additional skiers per day 124 Average number of days per year that weather conditions allow skiing at Frost Valley 156 Useful life of expansion (in years) .... 8 Average cash spent by each skler per day ........$ 244 Average variable cost of serving each skier per day . $ 140 Cost of expansion ... $ 8.500.000 Discount rate 10% Assume that Frost Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $900.000 at the end of its eight-year life. It has already calculated the average annual net cash in flow per year to be $2,011,776. 1. What is the project's NPV? Is the investment attractive? Why or why not? 2. Assume the expansion has no residual value. What is the project's NPV? Is the investment still attractive? Why or why not? Print Done Print Done Enter any number in the edit fields and then click Check Answer. 2 3 parts remaining - Clear All clear All Check