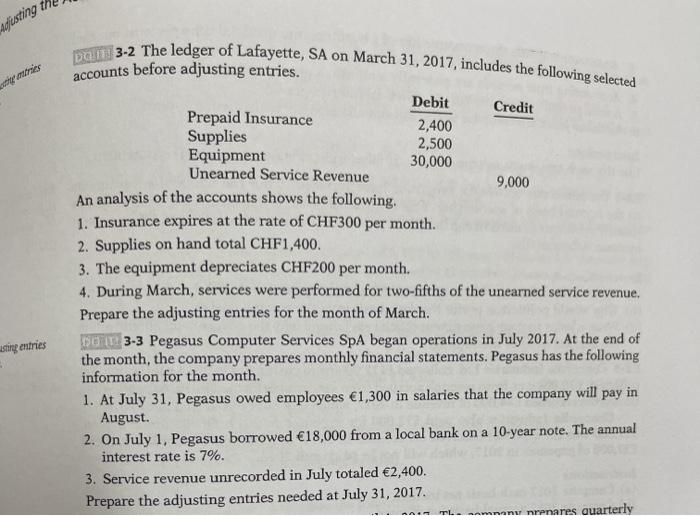

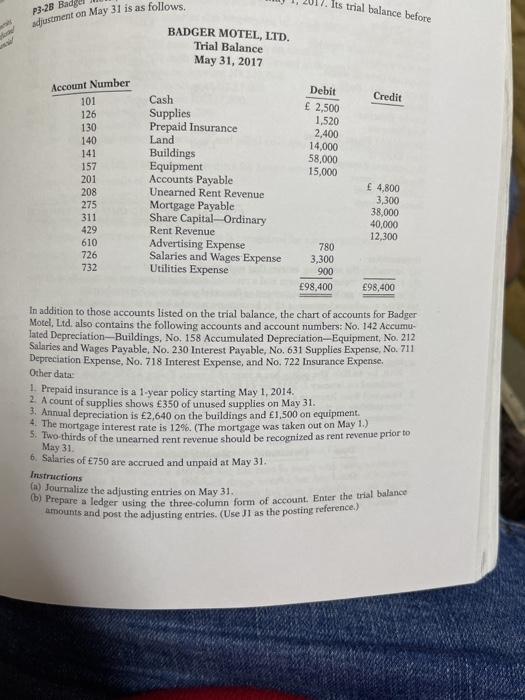

Afisting Credit DGIE 3-2 The ledger of Lafayette, SA on March 31, 2017, includes the following selected accounts before adjusting entries. Debit Prepaid Insurance 2,400 Supplies 2,500 Equipment 30,000 Unearned Service Revenue 9,000 An analysis of the accounts shows the following, 1. Insurance expires at the rate of CHF300 per month. 2. Supplies on hand total CHF1,400. 3. The equipment depreciates CHF200 per month 4. During March, services were performed for two-fifths of the unearned service revenue, Prepare the adjusting entries for the month of March. DOPE 3-3 Pegasus Computer Services SpA began operations in July 2017. At the end of the month, the company prepares monthly financial statements. Pegasus has the following information for the month. 1. At July 31, Pegasus owed employees 1,300 in salaries that the company will pay in August. 2. On July 1, Pegasus borrowed 18,000 from a local bank on a 10-year note. The annual interest rate is 7%. 3. Service revenue unrecorded in July totaled 2,400. Prepare the adjusting entries needed at July 31, 2017 Manu nrenares quarterly sting entries TL Its trial balance before P3-2B Bad adjustment on May 31 is as follows. BADGER MOTEL, LTD. Trial Balance May 31, 2017 Credit Account Number 101 126 130 140 141 157 201 208 275 311 429 610 726 732 Debit 2,500 1,520 2,400 14,000 58,000 15,000 Cash Supplies Prepaid Insurance Land Buildings Equipment Accounts Payable Unearned Rent Revenue Mortgage Payable Share Capital - Ordinary Rent Revenue Advertising Expense Salaries and Wages Expense Utilities Expense 4,800 3,300 38,000 40,000 12,300 780 3,300 900 98,400 98,400 In addition to those accounts listed on the trial balance, the chart of accounts for Badger Motel, Ltd. also contains the following accounts and account numbers: No. 142 Accumu- lated Depreciation--Buildings, No. 158 Accumulated Depreciation-Equipment, No. 212 Salaries and Wages Payable, No. 230 Interest Payable, No. 631 Supplies Expense, No. 711 Depreciation Expense, No. 718 Interest Expense, and No. 722 Insurance Expense. Other data 1. Prepaid insurance is a 1-year policy starting May 1, 2014 ? A count of supplies shows 350 of unused supplies on May 31. Annual depreciation is 2,640 on the buildings and 1,500 on equipment The mortgage interest rate is 12%. (The mortgage was taken out on May 1.) 5. Two-thirds of the unearned rent revenue should be recognized as rent revenue prior to May 31 6. Salaries of 750 are accrued and unpaid at May 31 Instructions (a) May 31. Prepare a ledger using the three column form of account. Enter the trial balance amounts and post the adjusting entries. (Use Jl as the posting reference.)