Answered step by step

Verified Expert Solution

Question

1 Approved Answer

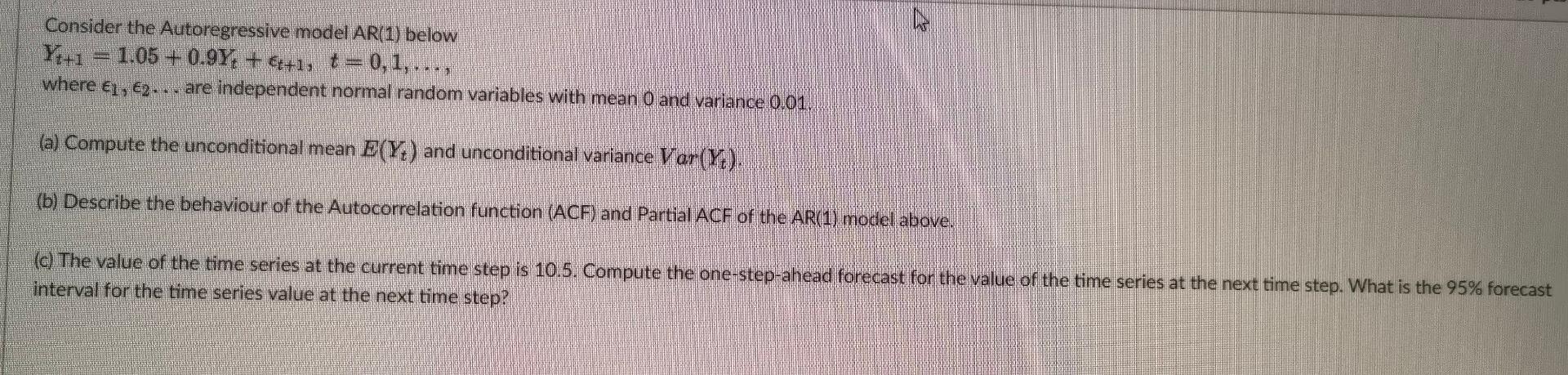

Consider the Autoregressive model AR(1) below 1.05+0.9Y+&+1, t=0,1,..., where E1, E2... are independent normal random variables with mean 0 and variance 0.01, (a) Compute the

Consider the Autoregressive model AR(1) below 1.05+0.9Y+&+1, t=0,1,..., where E1, E2... are independent normal random variables with mean 0 and variance 0.01, (a) Compute the unconditional mean E(Y) and unconditional variance Var (Y). (b) Describe the behaviour of the Autocorrelation function (ACF) and Partial ACF of the AR(1) model above. (c) The value of the time series at the current time step is 10.5. Compute the one-step-ahead forecast for the value of the time series at the next time step. What is the 95% forecast interval for the time series value at the next time step? Consider the Autoregressive model AR(1) below 1.05+0.9Y+&+1, t=0,1,..., where E1, E2... are independent normal random variables with mean 0 and variance 0.01, (a) Compute the unconditional mean E(Y) and unconditional variance Var (Y). (b) Describe the behaviour of the Autocorrelation function (ACF) and Partial ACF of the AR(1) model above. (c) The value of the time series at the current time step is 10.5. Compute the one-step-ahead forecast for the value of the time series at the next time step. What is the 95% forecast interval for the time series value at the next time step

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started