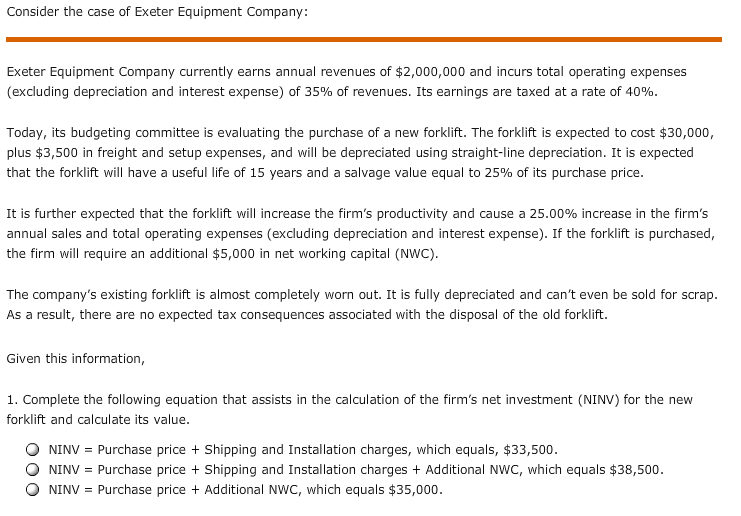

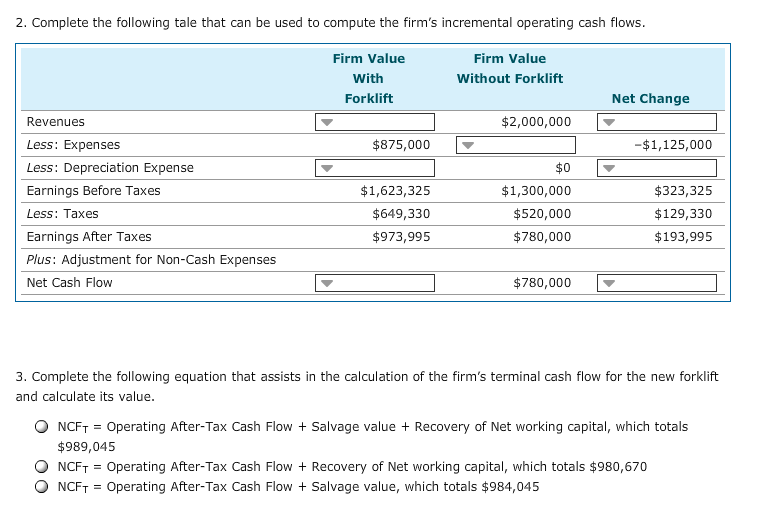

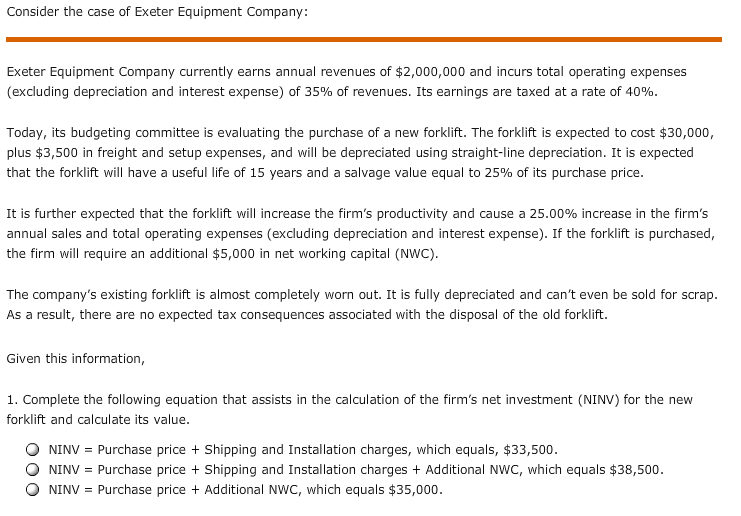

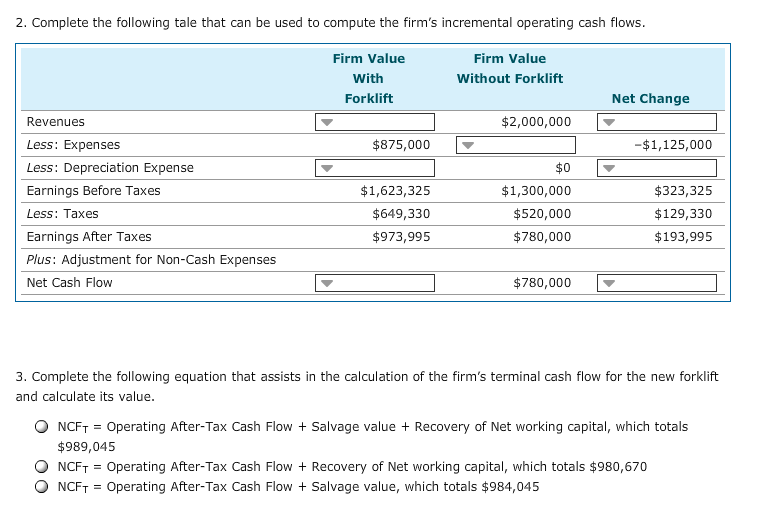

Consider the case of Exeter Equipment Company: Exeter Equipment Company currently earns annual revenues of $2,000,000 and incurs total operating expenses (excluding depreciation and interest expense) of 35% of revenues. Its earnings are taxed at a rate of 40%. Today, its budgeting committee is evaluating the purchase of a new forklift. The forklift is expected to cost $30,000 plus $3,500 in freight and setup expenses, and will be depreciated using straight-line depreciation. It is expected that the forklift will have a useful life of 15 years and a salvage value equal to 25% of its purchase price. It is further expected that the forklift will increase the firm's productivity and cause a 25.00% increase in the firm's annual sales and total operating expenses (excluding depreciation and interest expense). If the forklift is purchased, the firm will require an additional $5,000 in net working capital (NWC). The company's existing forklift is almost completely worn out. It is fully depreciated and can't even be sold for scrap. As a result, there are no expected tax consequences associated with the disposal of the old forklift. Given this information, 1. Complete the following equation that assists in the calculation of the firm's net investment (NINV) for the new forklift and calculate its value. O NINV = Purchase price + Shipping and Installation charges, which equals, $33,500. NINV = Purchase price + Shipping and Installation charges + Additional NWC, which equals $38,500. NINV = Purchase price + Additional NWC, which equals $35,000. O 2. Complete the following tale that can be used to compute the firm's incremental operating cash flows. Firm Value With Forklift Firm Value Without Forklift Net Change Revenues $2,000,000 $875,000 -$1,125,000 Less: Expenses Less: Depreciation Expense Earnings Before Taxes Less: Taxes Earnings After Taxes Plus: Adjustment for Non-Cash Expenses Net Cash Flow $1,623,325 $649,330 $973,995 $0 $1,300,000 $520,000 $780,000 $323,325 $129,330 $193,995 $780,000 3. Complete the following equation that assists in the calculation of the firm's terminal cash flow for the new forklift and calculate its value. O NCFT = Operating After-Tax Cash Flow + Salvage value + Recovery of Net working capital, which totals $989,045 ONCFT = Operating After-Tax Cash Flow + Recovery of Net working capital, which totals $980,670 O NCFT = Operating After-Tax Cash Flow + Salvage value, which totals $984,045