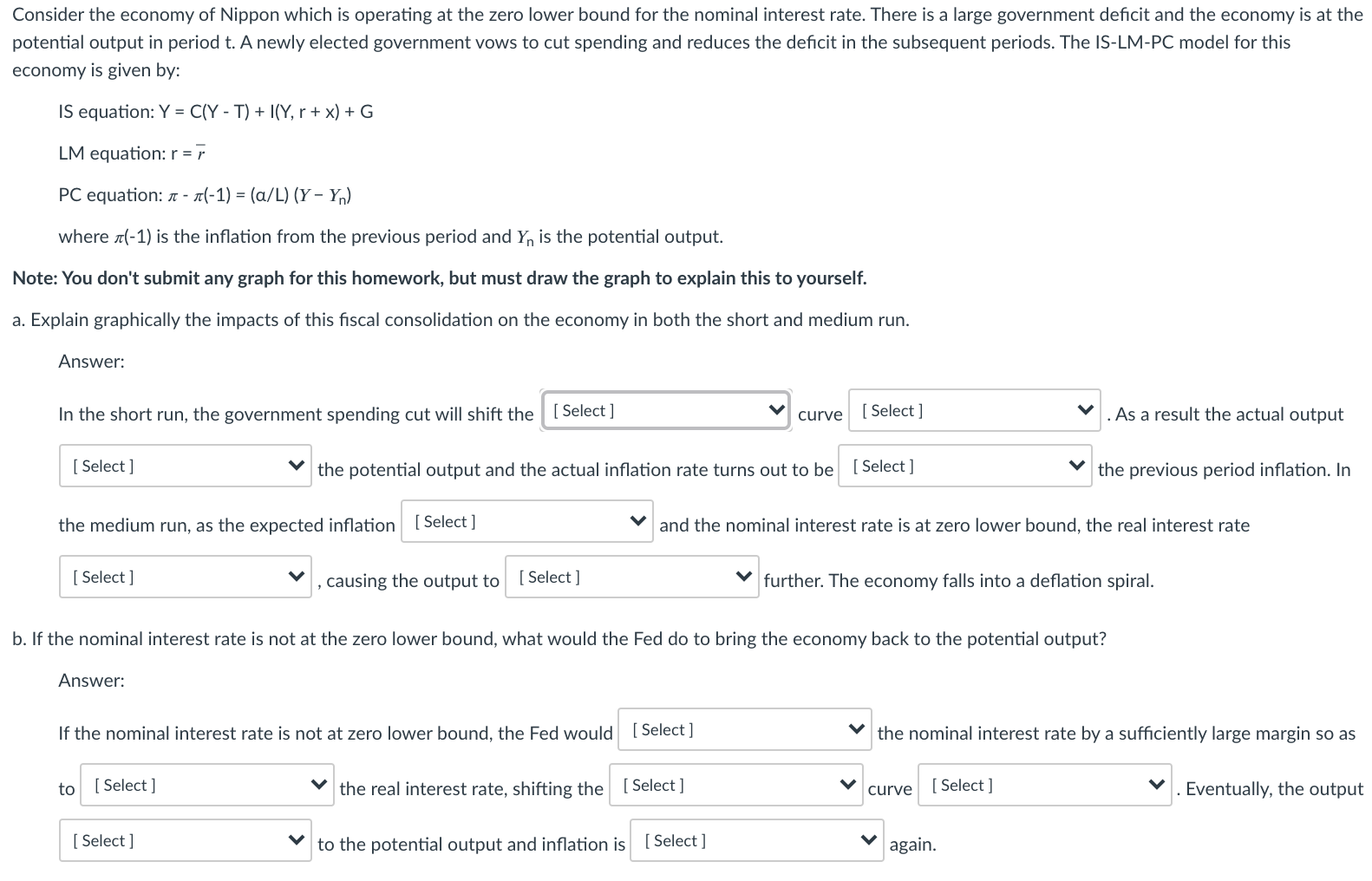

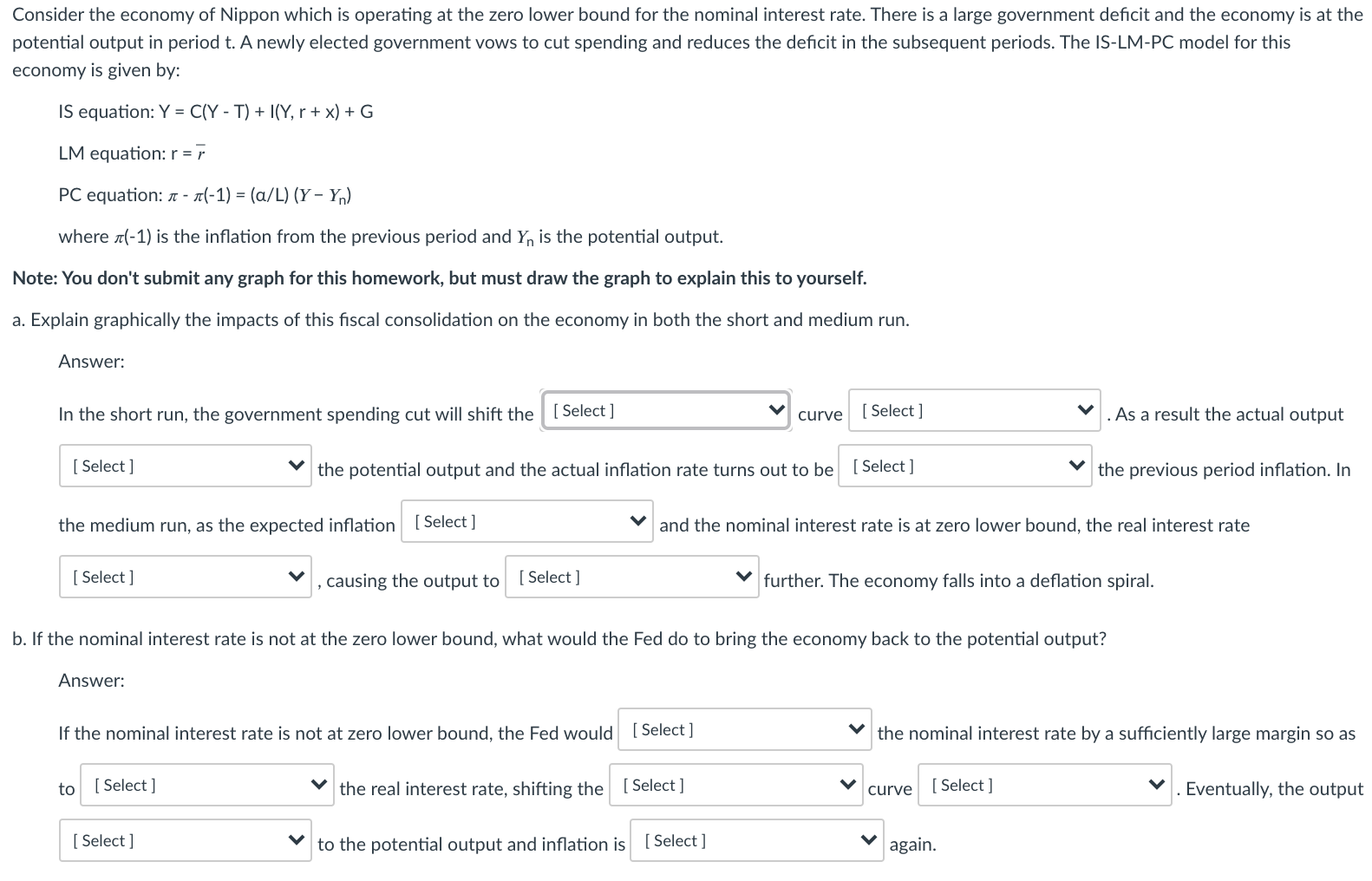

Consider the economy of Nippon which is operating at the zero lower bound for the nominal interest rate. There is a large government deficit and the economy is at the potential output in period t. A newly elected government vows to cut spending and reduces the deficit in the subsequent periods. The IS-LM-PC model for this economy is given by: IS equation: Y = C(Y - T) + |(Y, r + x) + G LM equation: r=r PC equation: 1 - 1(-1) = (a/L) (Y - Yn) where #(-1) is the inflation from the previous period and Yn is the potential output. Note: You don't submit any graph for this homework, but must draw the graph to explain this to yourself. a. Explain graphically the impacts of this fiscal consolidation on the economy in both the short and medium run. Answer: In the short run, the government spending cut will shift the [Select] curve [ Select ] . As a result the actual output [ Select ] the potential output and the actual inflation rate turns out to be [Select ] the previous period inflation. In the medium run, as the expected inflation [Select ] and the nominal interest rate is at zero lower bound, the real interest rate [ Select] causing the output to [ Select ] further. The economy falls into a deflation spiral. b. If the nominal interest rate is not at the zero lower bound, what would the Fed do to bring the economy back to the potential output? Answer: If the nominal interest rate is not at zero lower bound, the Fed would [Select ] the nominal interest rate by a sufficiently large margin so as to [ Select ] the real interest rate, shifting the [Select ] curve [ Select ] Eventually, the output [ Select ] to the potential output and inflation is [ Select ] again. Consider the economy of Nippon which is operating at the zero lower bound for the nominal interest rate. There is a large government deficit and the economy is at the potential output in period t. A newly elected government vows to cut spending and reduces the deficit in the subsequent periods. The IS-LM-PC model for this economy is given by: IS equation: Y = C(Y - T) + |(Y, r + x) + G LM equation: r=r PC equation: 1 - 1(-1) = (a/L) (Y - Yn) where #(-1) is the inflation from the previous period and Yn is the potential output. Note: You don't submit any graph for this homework, but must draw the graph to explain this to yourself. a. Explain graphically the impacts of this fiscal consolidation on the economy in both the short and medium run. Answer: In the short run, the government spending cut will shift the [Select] curve [ Select ] . As a result the actual output [ Select ] the potential output and the actual inflation rate turns out to be [Select ] the previous period inflation. In the medium run, as the expected inflation [Select ] and the nominal interest rate is at zero lower bound, the real interest rate [ Select] causing the output to [ Select ] further. The economy falls into a deflation spiral. b. If the nominal interest rate is not at the zero lower bound, what would the Fed do to bring the economy back to the potential output? Answer: If the nominal interest rate is not at zero lower bound, the Fed would [Select ] the nominal interest rate by a sufficiently large margin so as to [ Select ] the real interest rate, shifting the [Select ] curve [ Select ] Eventually, the output [ Select ] to the potential output and inflation is [ Select ] again