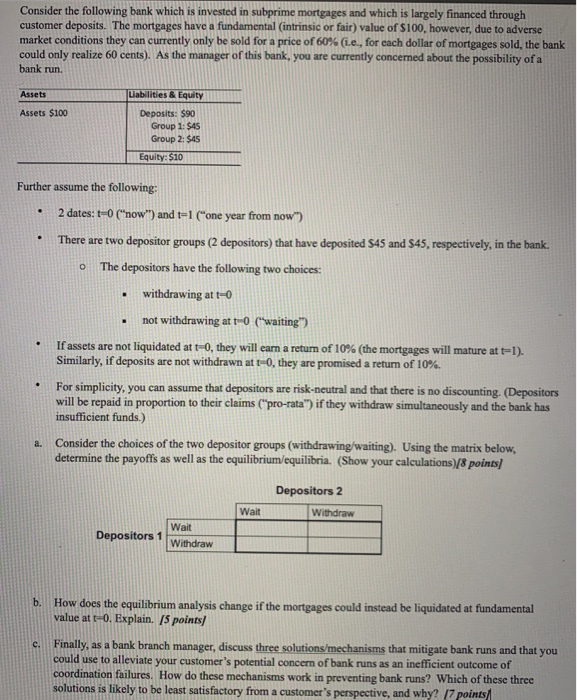

Consider the following bank which is invested in subprime mortgages and which is largely financed through customer deposits. The mortgages have a fundamental (intrinsic or fair) value of $100, however, due to adverse market conditions they can currently only be sold for a price of 60% (i.e., for each dollar of mortgages sold, the bank could only realize 60 cents). As the manager of this bank, you are currently concerned about the possibility of a bank run. Assets Liabilities & Equity Assets $100 Deposits: $90 Group 1: $45 Group 2: $45 Equity: $10 . o Further assume the following: 2 dates: t=0 ("now") and t-1 ("one year from now) There are two depositor groups (2 depositors) that have deposited $45 and 545, respectively, in the bank. The depositors have the following two choices: . withdrawing at t-o not withdrawing at t-0 (waiting") If assets are not liquidated at t-0, they will earn a return of 10% (the mortgages will mature at t=1). Similarly, if deposits are not withdrawn at t-0, they are promised a return of 10%. For simplicity, you can assume that depositors are risk-neutral and that there is no discounting. (Depositors will be repaid in proportion to their claims ("pro-rata") if they withdraw simultaneously and the bank has insufficient funds.) Consider the choices of the two depositor groups (withdrawing/waiting). Using the matrix below, determine the payoffs as well as the equilibrium/equilibria. (Show your calculations)/8 points) . . Depositors 2 Wait Withdraw Depositors 1 Wait Withdraw b. How does the equilibrium analysis change if the mortgages could instead be liquidated at fundamental value at t-0. Explain. [5 points c. Finally, as a bank branch manager, discuss three solutions/mechanisms that mitigate bank runs and that you could use to alleviate your customer's potential concern of bank runs as an inefficient outcome of coordination failures. How do these mechanisms work in preventing bank runs? Which of these three solutions is likely to be least satisfactory from a customer's perspective, and why? 17 points Consider the following bank which is invested in subprime mortgages and which is largely financed through customer deposits. The mortgages have a fundamental (intrinsic or fair) value of $100, however, due to adverse market conditions they can currently only be sold for a price of 60% (i.e., for each dollar of mortgages sold, the bank could only realize 60 cents). As the manager of this bank, you are currently concerned about the possibility of a bank run. Assets Liabilities & Equity Assets $100 Deposits: $90 Group 1: $45 Group 2: $45 Equity: $10 . o Further assume the following: 2 dates: t=0 ("now") and t-1 ("one year from now) There are two depositor groups (2 depositors) that have deposited $45 and 545, respectively, in the bank. The depositors have the following two choices: . withdrawing at t-o not withdrawing at t-0 (waiting") If assets are not liquidated at t-0, they will earn a return of 10% (the mortgages will mature at t=1). Similarly, if deposits are not withdrawn at t-0, they are promised a return of 10%. For simplicity, you can assume that depositors are risk-neutral and that there is no discounting. (Depositors will be repaid in proportion to their claims ("pro-rata") if they withdraw simultaneously and the bank has insufficient funds.) Consider the choices of the two depositor groups (withdrawing/waiting). Using the matrix below, determine the payoffs as well as the equilibrium/equilibria. (Show your calculations)/8 points) . . Depositors 2 Wait Withdraw Depositors 1 Wait Withdraw b. How does the equilibrium analysis change if the mortgages could instead be liquidated at fundamental value at t-0. Explain. [5 points c. Finally, as a bank branch manager, discuss three solutions/mechanisms that mitigate bank runs and that you could use to alleviate your customer's potential concern of bank runs as an inefficient outcome of coordination failures. How do these mechanisms work in preventing bank runs? Which of these three solutions is likely to be least satisfactory from a customer's perspective, and why? 17 points