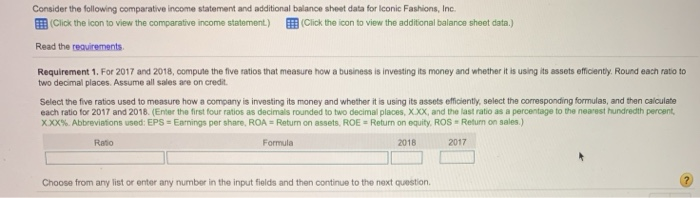

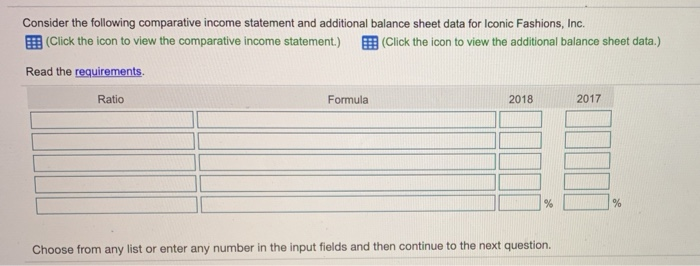

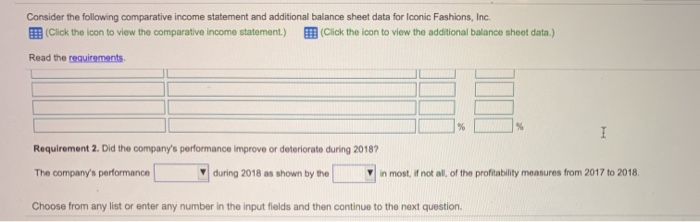

Consider the following comparative income statement and additional balance sheet data for Iconic Fashions, Inc. Click the icon to view the comparative income statement.) (Click the icon to view the additional balance sheet data.) Read the requirements Requirement 1. For 2017 and 2018, compute the five ratios that measure how a business is investing its money and whether it is using its assets officiently. Round each ratio to two decimal places. Assume all sales are on credit Select the five ratios used to measure how a company is investing its money and whether it is using its assets efficiently, select the corresponding formulas, and then calculate each ratio for 2017 and 2018. (Enter the first four ratios as decimals rounded to two decimal places, XXX, and the last ratio as a percentage to the nearest hundredth percent XXX%. Abbreviations used: EPS = Earnings per share, ROA = Return on assets, ROE = Return on equity, ROS - Return on sales.) Ratio Formula 2018 2017 Choose from any list or enter any number in the input fields and then continue to the next question Consider the following comparative income statement and additional balance sheet data for Iconic Fashions, Inc. Click the icon to view the comparative income statement.) (Click the icon to view the additional balance sheet data.) Read the requirements Ratio Formula 2018 2017 % % Choose from any list or enter any number in the input fields and then continue to the next question. Consider the following comparative income statement and additional balance sheet data for Iconic Fashions, Inc. (Click the icon to view the comparative income statement) Click the icon to view the additional balance sheet data.) Read the requirements % I % Requirement 2. Did the company's performance improve or deteriorato during 2018? The company's performance during 2018 as shown by the in most, if not all of the profitability measures from 2017 to 2018 Choose from any list or enter any number in the input fields and then continue to the next question. i Data Table X e sta e ind Iconic Fashions, Inc. Income Statement Years Ended December 31, 2018 and 2017 2018 |2017 Net sales $ 277,000 $ 135,000 307,000 151,000 orman d Cost of goods sold Gross profit Selling and general expenses 142,000 66,000 156,000 70,000 from aber in Print Done i Data Table X Gross profit 142,000 66,000 156,000 70,000 Selling and general expenses Income from operations 76,000 6,000 86,000 3,100 Interest expense Income before income tax 70,000 7,000 82,900 4,000 Income tax expense $ Net income 63,000 $ 78,900 Print Done Data Table 2018 2017 2016 Accounts receivable - - Inventory Total current assets 26,000 16,000 18,000 14,000 19,100 16,600 41,000 36,600 40,600 265,500 250,000 198,500 $ 306,500 $ 286,600 $ 239,100 Fixed assets.. Total assets... m Print Done