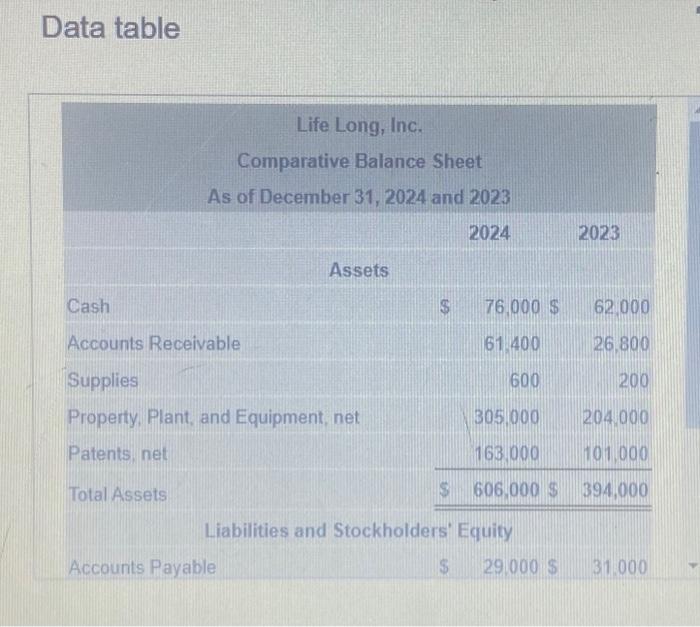

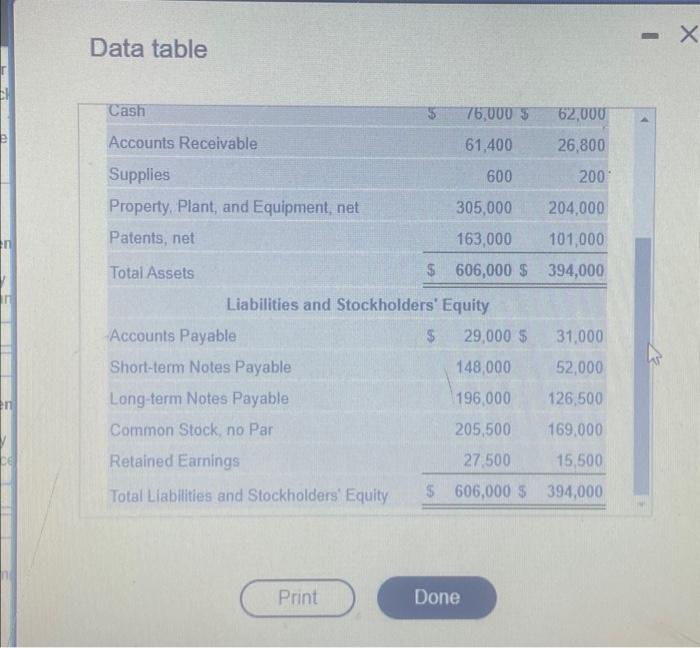

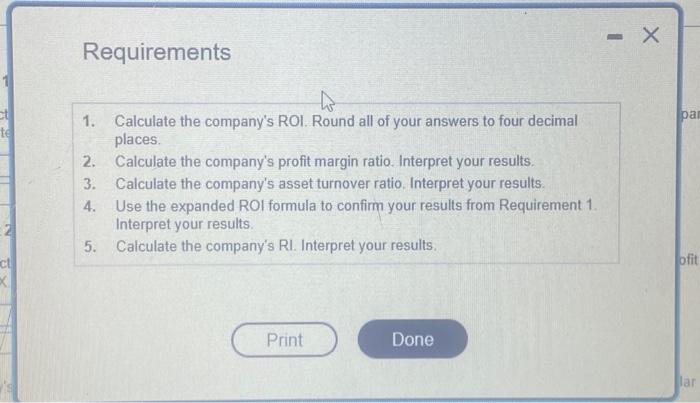

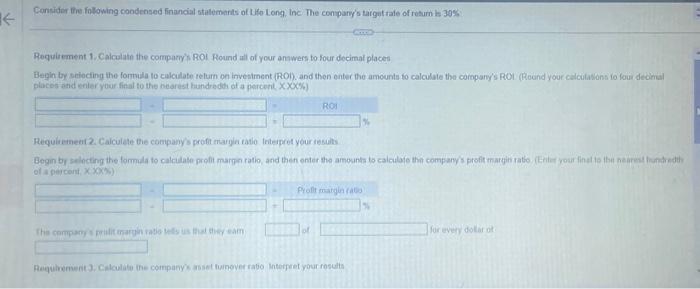

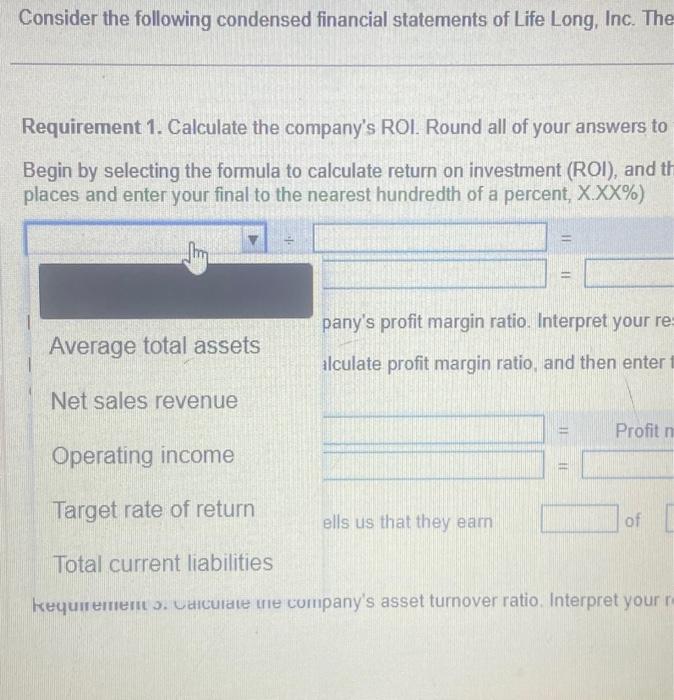

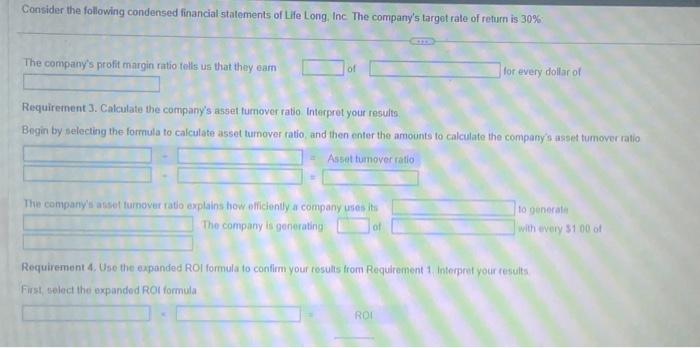

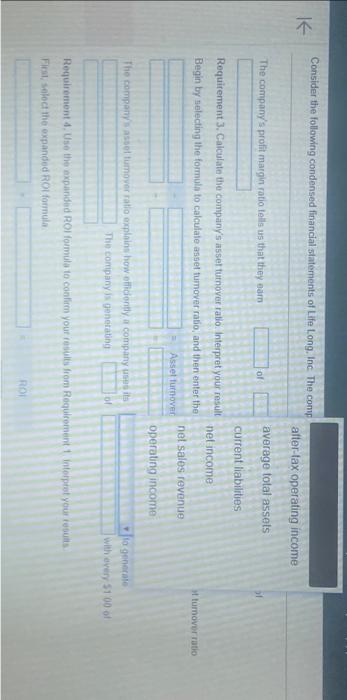

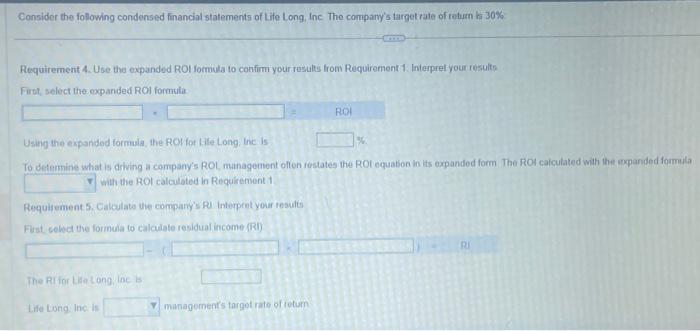

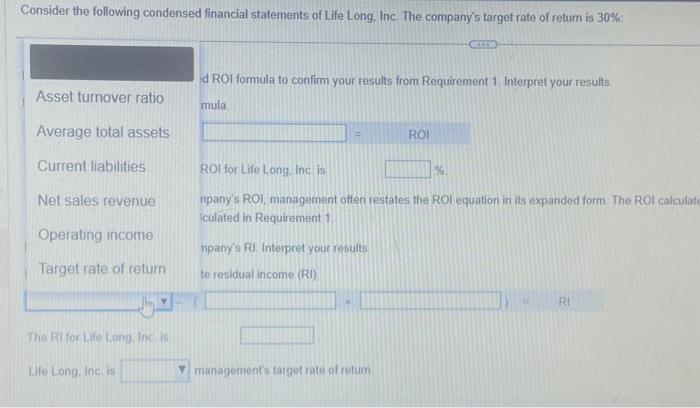

Consider the following condensed financial statements of Life Long, Inc. The company's target rate of retum is 30% : (Click the icon to view the comparative balance sheet.) (Click the icon to view the income statement.) Read the requirements Data table Data table Data table Requirements 1. Calculate the company's ROI. Round all of your answers to four decimal places. 2. Calculate the company's profit margin ratio. Interpret your results. 3. Calculate the company's asset turnover ratio. Interpret your results. 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. 5. Calculate the company's RI. Interpret your results. Consider fte folowing condensed financial stalemants of Uto Long. inc The conpary's taigntrate of resurn le 39%5 Requirement 1, Calculath the compary's ROI Found all of your anawers to four decimal places Begin by seigocing the formula to culcilate telum on invesiment (ROl), and then enter the amounts fo calculate the cormpary's ROI (RRoend your calcutakons io four decimal places end enier your final to the nearest handreded of a porceni x% Requaetnent2. Calculete the companys pront maryin tadio Iritepcot your iesults Pyofi matain (160 for every doliar of Aaquibement3, Catculaty ine company's asset luingever rabo Interpet your rosulis Consider the following condensed financial statements of Life Long, Inc. The Requirement 1. Calculate the company's ROI. Round all of your answers to Begin by selecting the formula to calculate return on investment (ROI), and th places and enter your final to the nearest hundredth of a percent, X.XX% ) pany's profit margin ratio. Interpret your re: Ilculate profit margin ratio, and then enter 1 = Profit n = ells us that they eam of impany's asset turnover ratio. Interpret your Consider the following condensed financial statements of Life Long, Inc. The company's targot rale of return is 30\%: The company's profit margin ratio tolls us that they eam lor every dollar of Requiretnent 3. Calculate the company's asset turnover ratio Interpret your results Begin by selecting the formula to calculate asset tumover ratio, and then enter the amounts to calculate the company's asset tumover ratio =Assettumoverratio The company's atset turnover tatio explains how elficiently a company uses iti to generati The company is generating with every $100 of Requirement 4. Use the expanded ROl formula to conilim your results trom Requirement 1 . interpret your tesults First, select the expanded ROr formula Consider the following condensed financial siatements of Life Long. Inc. The comp after-tax operating income The company's profit margin ratio lells us that they earn average total assets current liabilities Requirement 3. Calculate the company's asset turnover ratio. Interpret your result netincome Begin by selecting the formula to calculale assel fumover ratio, and then enter the At tumover ratio net sales revenue operating income The compery s asset tumover ratio exploins how eficiontly a company uses its dogenerate The comipany is generating withevery 5100 of Requirement 4. Use the expanded ROl formula to confirm your results from Requirement 1 intorpaot your tesuats Ficsi, select the expanded Rot fornula Consider the following condensed financial statements of Life Long, Inc. The campany's targetrate of toturn hi 30% Requirement 4. Use the expanded ROI fommula to confirm your results from Requirement 1. Interpret your results Firts, select the expanded ROA formula Using the expanded formula, the FOu fot Life Long, Inc is Io detemine what is driving a company's ROL, muthagenent ofton rostates the ROI eguabon in its expandod form The ROA calculated with thy oxpanded formila Whth the ROl calculated in Reguirenent 1 Requirement 5. Cakculate the compurany's Ru interpet your results First select the formula to calculate residuat income (IRl) The Pilior Lisa longilne is Life Long. Inc. is managements targot rate of cetum Consider the following condensed financial statements of Life Long, Inc. The company's target rate of retum is 30% : d ROI formula to confim your results from Requirement 1 . Interpret your results. mula ROl for Life Long. Inc is =ROI npany's ROI, management often restales the ROI equation in its expanded form. The ROl calculat, Iculated in Requirement 1. npany's RI Interpret your resuits Consider the following condensed financial statements of Life Long, Inc. The company's target rate of retum is 30% : (Click the icon to view the comparative balance sheet.) (Click the icon to view the income statement.) Read the requirements Data table Data table Data table Requirements 1. Calculate the company's ROI. Round all of your answers to four decimal places. 2. Calculate the company's profit margin ratio. Interpret your results. 3. Calculate the company's asset turnover ratio. Interpret your results. 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. 5. Calculate the company's RI. Interpret your results. Consider fte folowing condensed financial stalemants of Uto Long. inc The conpary's taigntrate of resurn le 39%5 Requirement 1, Calculath the compary's ROI Found all of your anawers to four decimal places Begin by seigocing the formula to culcilate telum on invesiment (ROl), and then enter the amounts fo calculate the cormpary's ROI (RRoend your calcutakons io four decimal places end enier your final to the nearest handreded of a porceni x% Requaetnent2. Calculete the companys pront maryin tadio Iritepcot your iesults Pyofi matain (160 for every doliar of Aaquibement3, Catculaty ine company's asset luingever rabo Interpet your rosulis Consider the following condensed financial statements of Life Long, Inc. The Requirement 1. Calculate the company's ROI. Round all of your answers to Begin by selecting the formula to calculate return on investment (ROI), and th places and enter your final to the nearest hundredth of a percent, X.XX% ) pany's profit margin ratio. Interpret your re: Ilculate profit margin ratio, and then enter 1 = Profit n = ells us that they eam of impany's asset turnover ratio. Interpret your Consider the following condensed financial statements of Life Long, Inc. The company's targot rale of return is 30\%: The company's profit margin ratio tolls us that they eam lor every dollar of Requiretnent 3. Calculate the company's asset turnover ratio Interpret your results Begin by selecting the formula to calculate asset tumover ratio, and then enter the amounts to calculate the company's asset tumover ratio =Assettumoverratio The company's atset turnover tatio explains how elficiently a company uses iti to generati The company is generating with every $100 of Requirement 4. Use the expanded ROl formula to conilim your results trom Requirement 1 . interpret your tesults First, select the expanded ROr formula Consider the following condensed financial siatements of Life Long. Inc. The comp after-tax operating income The company's profit margin ratio lells us that they earn average total assets current liabilities Requirement 3. Calculate the company's asset turnover ratio. Interpret your result netincome Begin by selecting the formula to calculale assel fumover ratio, and then enter the At tumover ratio net sales revenue operating income The compery s asset tumover ratio exploins how eficiontly a company uses its dogenerate The comipany is generating withevery 5100 of Requirement 4. Use the expanded ROl formula to confirm your results from Requirement 1 intorpaot your tesuats Ficsi, select the expanded Rot fornula Consider the following condensed financial statements of Life Long, Inc. The campany's targetrate of toturn hi 30% Requirement 4. Use the expanded ROI fommula to confirm your results from Requirement 1. Interpret your results Firts, select the expanded ROA formula Using the expanded formula, the FOu fot Life Long, Inc is Io detemine what is driving a company's ROL, muthagenent ofton rostates the ROI eguabon in its expandod form The ROA calculated with thy oxpanded formila Whth the ROl calculated in Reguirenent 1 Requirement 5. Cakculate the compurany's Ru interpet your results First select the formula to calculate residuat income (IRl) The Pilior Lisa longilne is Life Long. Inc. is managements targot rate of cetum Consider the following condensed financial statements of Life Long, Inc. The company's target rate of retum is 30% : d ROI formula to confim your results from Requirement 1 . Interpret your results. mula ROl for Life Long. Inc is =ROI npany's ROI, management often restales the ROI equation in its expanded form. The ROl calculat, Iculated in Requirement 1. npany's RI Interpret your resuits