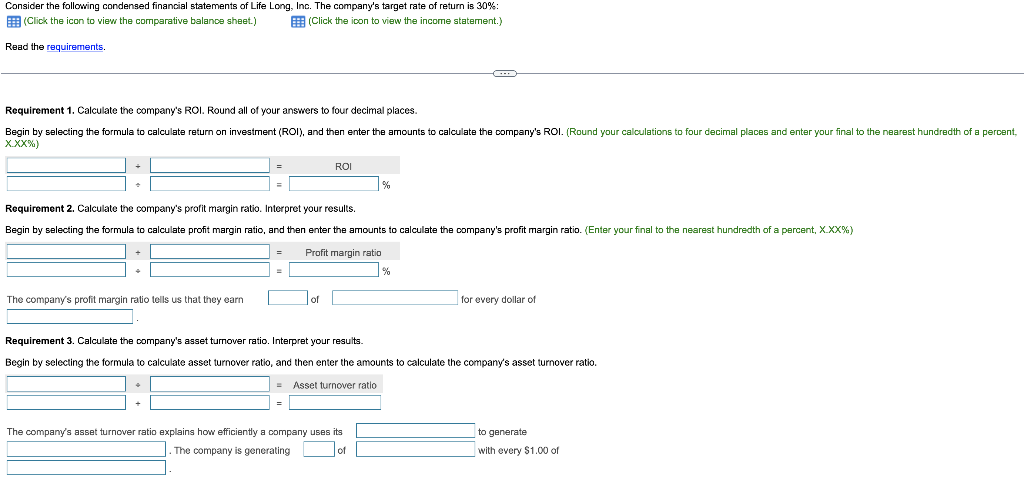

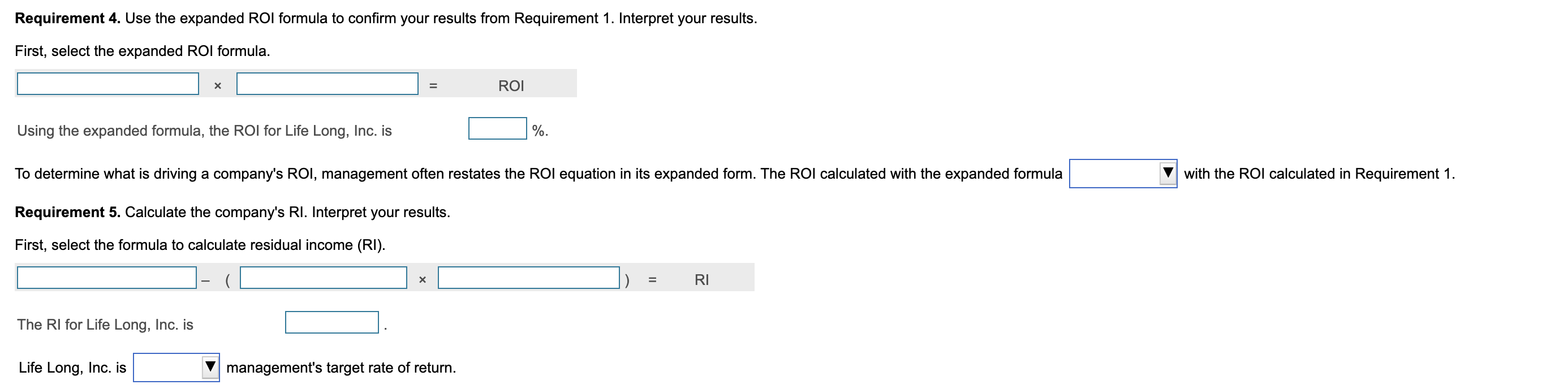

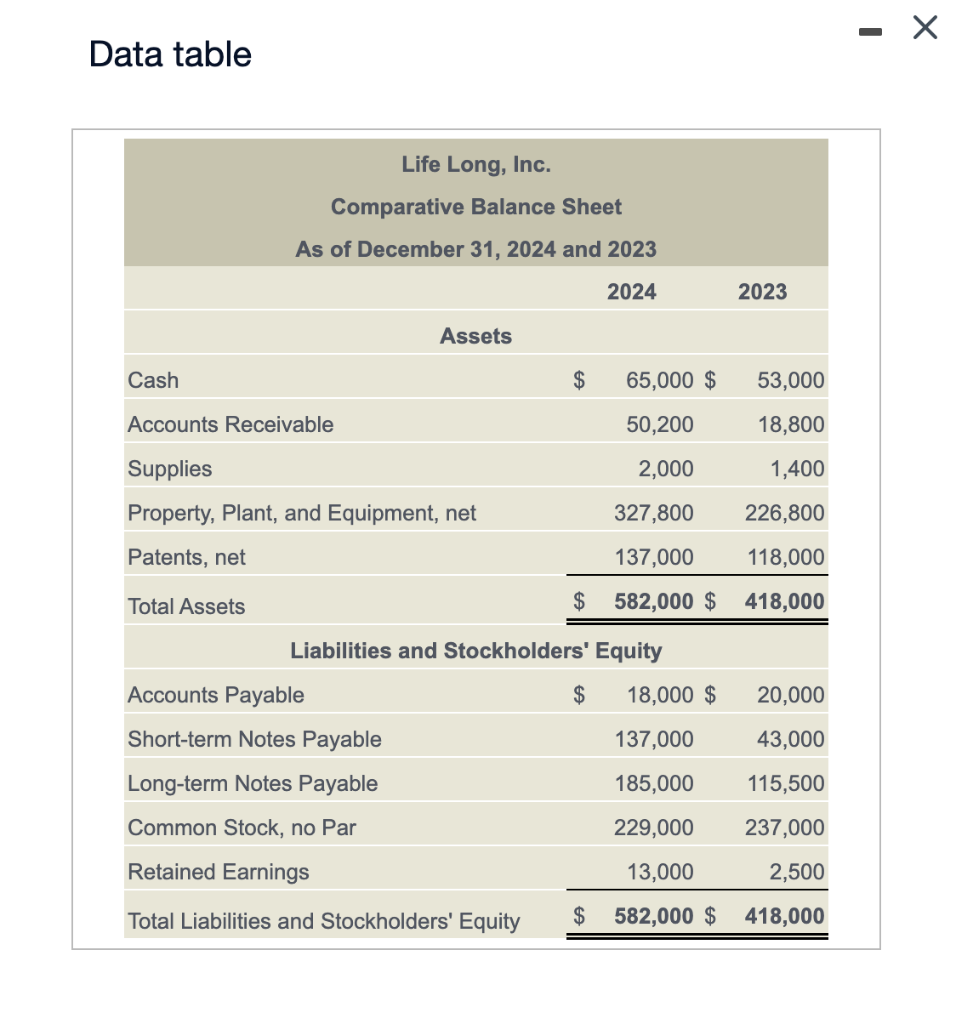

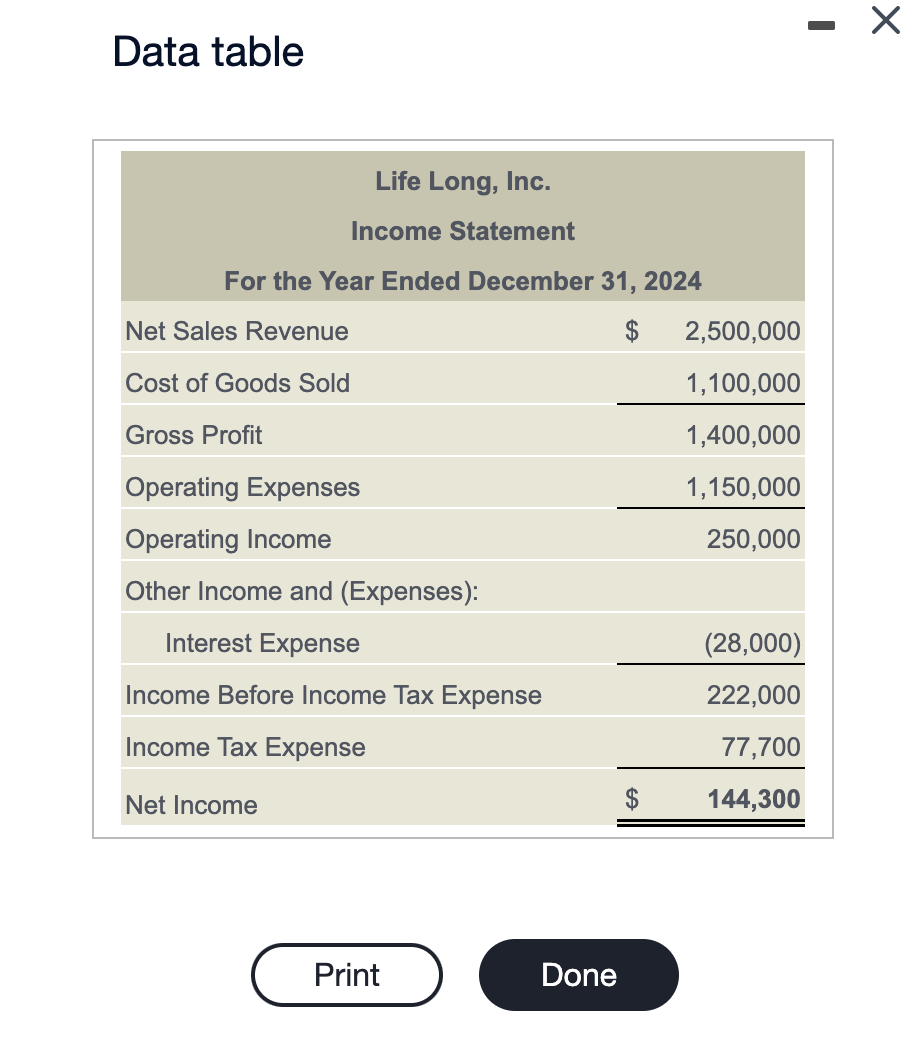

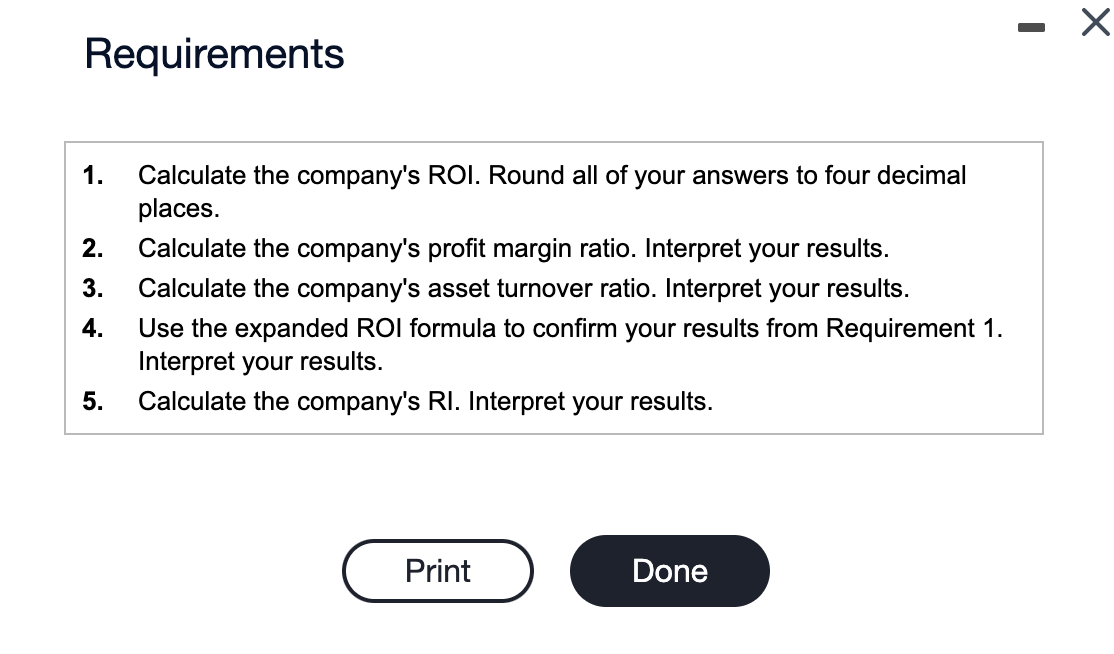

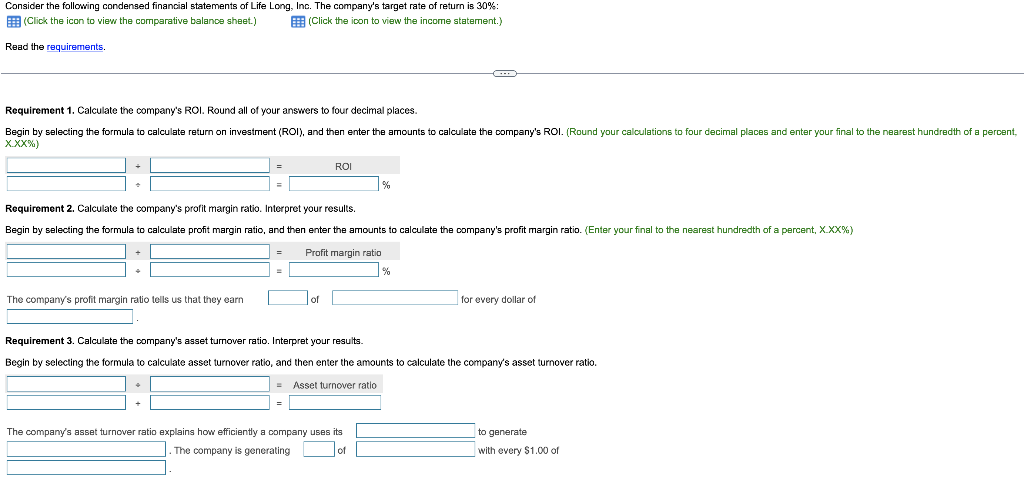

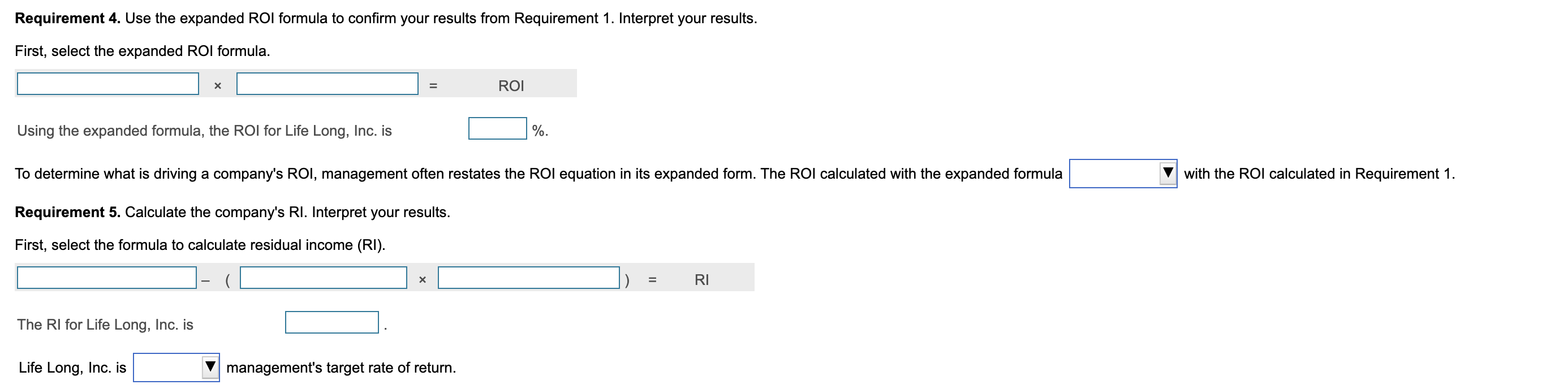

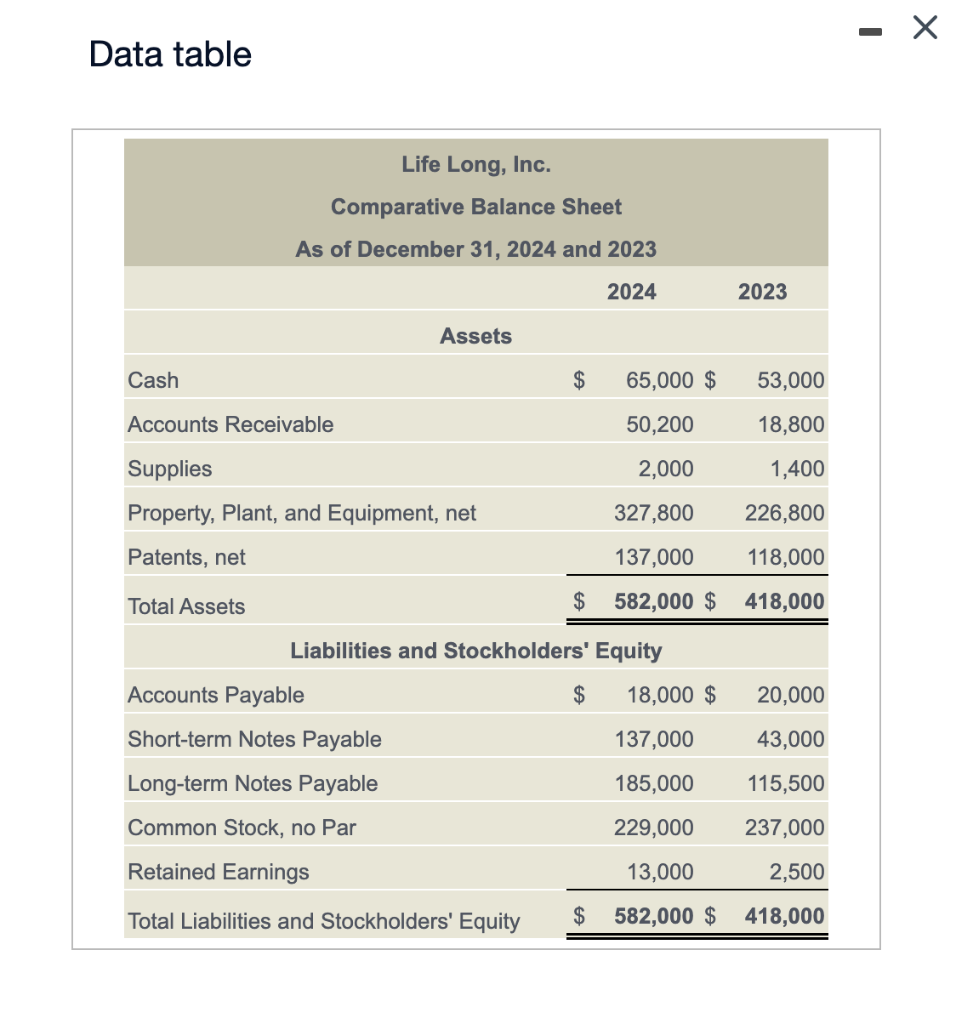

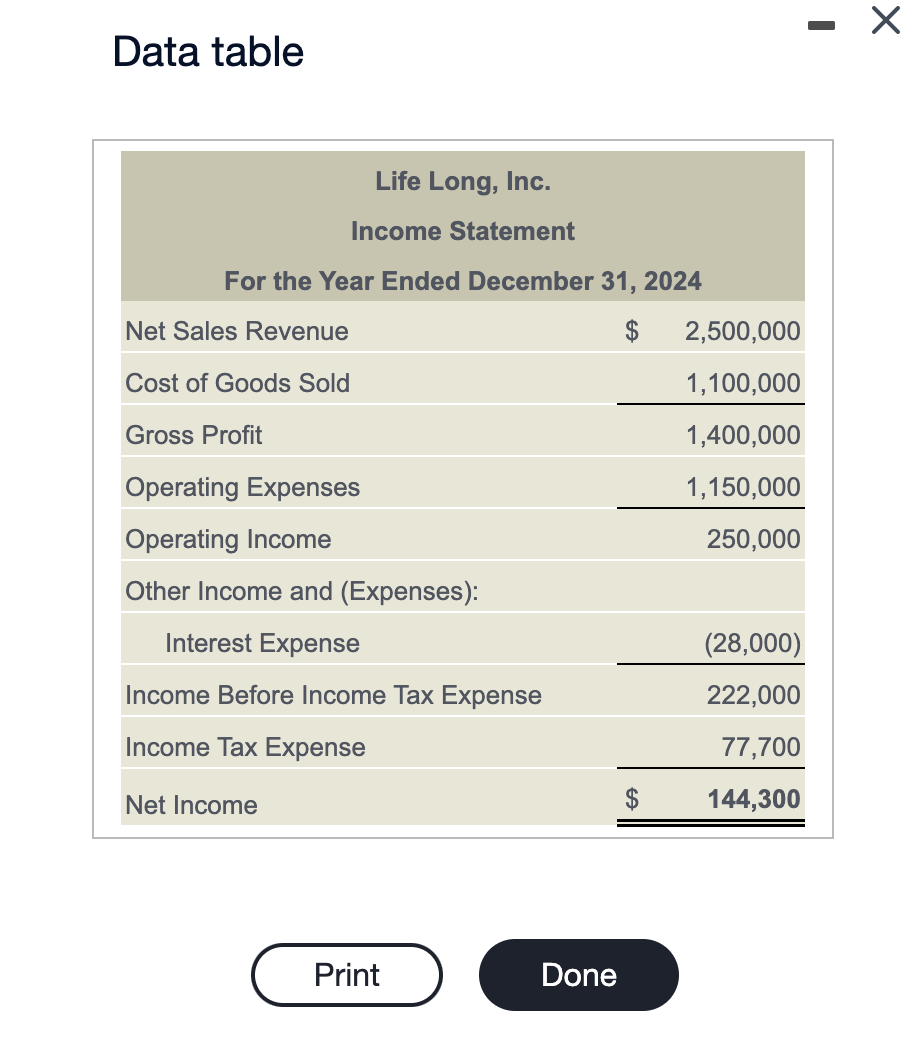

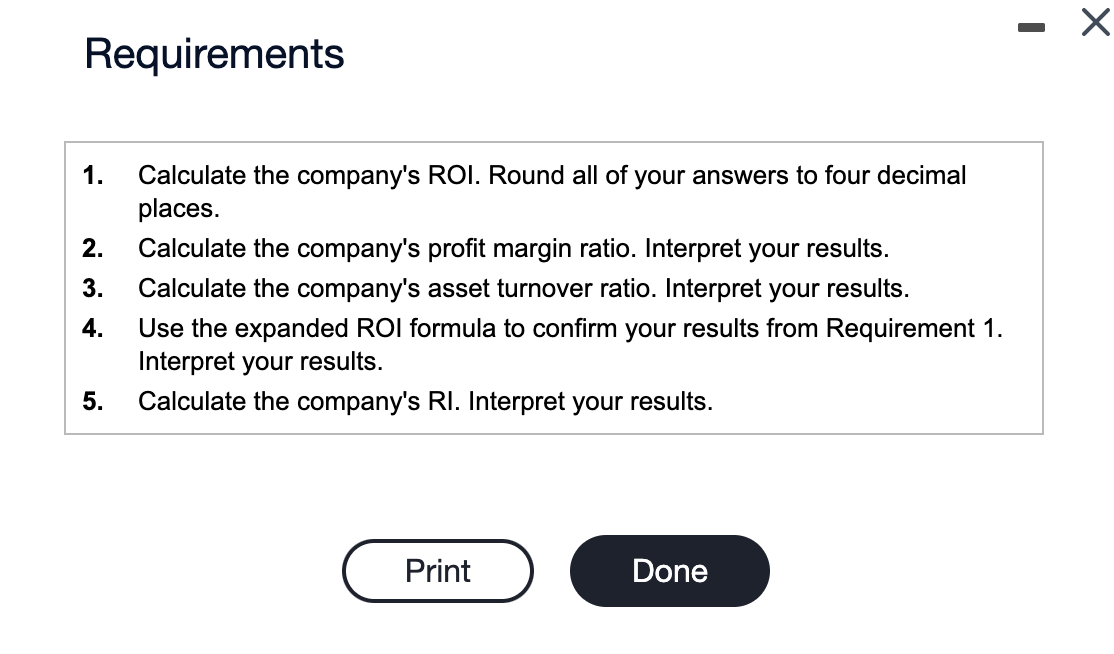

Consider the following condensed financial statements of Life Long, Inc. The company's target rate of return is 30% : (Click the icon to view the comparative balance sheet. (Click the icon to view the income statement.) Read the requirements. Requirement 1. Calculate the company's ROl. Round all of your answers to four decimal places. x.Xx3) Requirement 2. Calculate the company's profit margin ratio. Interpret your results. Begin by selecting the formula to calculate profit margin ratio, and then enter the amounts to calculate the company's profit margin ratio. (Enter your final to the nearest hundredth of a percent, X.XXX) =Profitmarginratio= The company's profit margin ratio tells us that they earn of for every dollar of Requirement 3. Calculate the company's asset turnover ratio. Interpret your results. Begin by selecting the formula to calculate asset turnover ratio, and then enter the amounts to calculate the company's asset turnover ratio. =Assetturnoverratio= The company's asset turnover ratio explains how efficiently a company uses its to generate . The company is generating of with every $1.00 of Requirement 4. Use the expanded ROI formula to confirm your results from Requirement 1 . Interpret your results. First, select the expanded ROI formula. Using the expanded formula, the ROI for Life Long, Inc. is To determine what is driving a company's ROI, management often restates the ROI equation in its expanded form. The ROI calculated with the expanded formula with the ROI calculated in Requirement 1. Requirement 5. Calculate the company's RI. Interpret your results. First, select the formula to calculate residual income (RI). The RI for Life Long, Inc. is Life Long, Inc. is management's target rate of return. Data table Data table Requirements 1. Calculate the company's ROI. Round all of your answers to four decimal places. 2. Calculate the company's profit margin ratio. Interpret your results. 3. Calculate the company's asset turnover ratio. Interpret your results. 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. 5. Calculate the company's RI. Interpret your results. Consider the following condensed financial statements of Life Long, Inc. The company's target rate of return is 30% : (Click the icon to view the comparative balance sheet. (Click the icon to view the income statement.) Read the requirements. Requirement 1. Calculate the company's ROl. Round all of your answers to four decimal places. x.Xx3) Requirement 2. Calculate the company's profit margin ratio. Interpret your results. Begin by selecting the formula to calculate profit margin ratio, and then enter the amounts to calculate the company's profit margin ratio. (Enter your final to the nearest hundredth of a percent, X.XXX) =Profitmarginratio= The company's profit margin ratio tells us that they earn of for every dollar of Requirement 3. Calculate the company's asset turnover ratio. Interpret your results. Begin by selecting the formula to calculate asset turnover ratio, and then enter the amounts to calculate the company's asset turnover ratio. =Assetturnoverratio= The company's asset turnover ratio explains how efficiently a company uses its to generate . The company is generating of with every $1.00 of Requirement 4. Use the expanded ROI formula to confirm your results from Requirement 1 . Interpret your results. First, select the expanded ROI formula. Using the expanded formula, the ROI for Life Long, Inc. is To determine what is driving a company's ROI, management often restates the ROI equation in its expanded form. The ROI calculated with the expanded formula with the ROI calculated in Requirement 1. Requirement 5. Calculate the company's RI. Interpret your results. First, select the formula to calculate residual income (RI). The RI for Life Long, Inc. is Life Long, Inc. is management's target rate of return. Data table Data table Requirements 1. Calculate the company's ROI. Round all of your answers to four decimal places. 2. Calculate the company's profit margin ratio. Interpret your results. 3. Calculate the company's asset turnover ratio. Interpret your results. 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. 5. Calculate the company's RI. Interpret your results