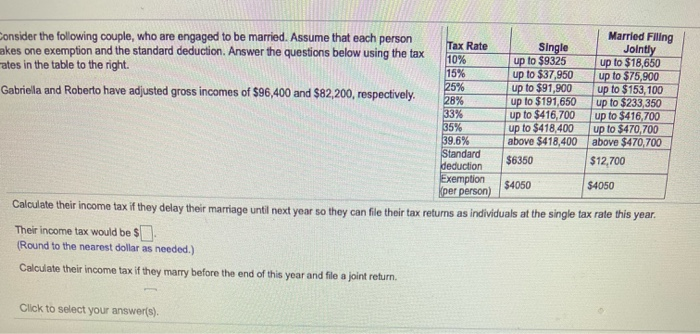

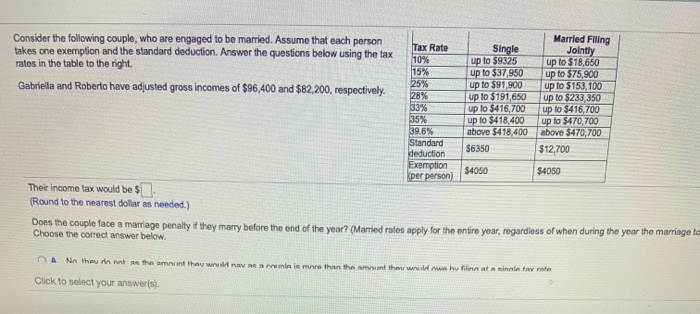

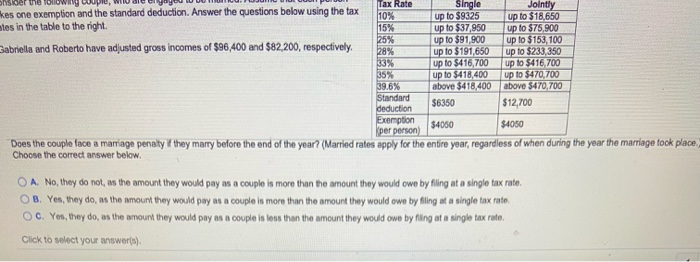

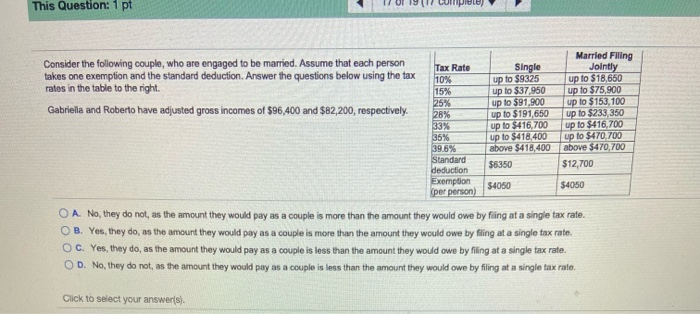

Consider the following couple, who are engaged to be married. Assume that each person Married Filing Tax Rate makes one exemption and the standard deduction. Answer the questions below using the tax Single Jointly 10% up to $9325 ates in the table to the right. up to $18,650 15% up to $37,950 up to $75,900 Gabriella and Roberto have adjusted gross incomes of $96,400 and $82,200, respectively. 25% up to $91,900 up to $153, 100 28% up to $191,650 up to $233,350 33% up to $416,700 up to $416,700 35% up to $418,400 up to $470,700 39.6% above $418,400 above $470,700 Standard $6350 deduction $12,700 Exemption $4050 $4050 (per person) Calculate their income tax if they delay their marriage until next year so they can file their tax returns as individuals at the single tax rate this year. Their income tax would be $ (Round to the nearest dollar as needed.) Calculate their income tax if they marry before the end of this year and file a joint return. Click to select your answer(s). Consider the following couple, who are engaged to be married. Assume that each person Married Filing Tax Rate takes one exemption and the standard deduction. Answer the questions below using the tax Single Jointly 10% rates in the table to the right up to $9325 up to $18,650 15% up to $37,950 up to $75,900 Gabriella and Roberto have adjusted gross incomes of $96,400 and $82,200, respectively 25% up to $91,900 up to $153,100 28% up to $191,650 up to $233,350 33% up to $416,700 up to $416,700 35% up to $418,400 up to $470,700 39.6% above $418,400 above $470,700 Standard $6350 deduction $12,700 Exemption $4050 $4050 per person) Their income tax would be $ (Round to the nearest dollar as needed.) Does the couple face a marriage penalty if they marry before the end of the year? (Married rates apply for the entire year, regardless of when during the year the marriage to Choose the correct answer below. NANA thout the amount they were ruinine more than the amount than wil why filing tingin tavat Click to select your answer(s). kes one exemption and the standard deduction. Answer the questions below using the tax ates in the table to the right. Gabriella and Roberto have adjusted gross incomes of $96,400 and $82,200, respectively, Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person Single up to $9325 up to $37.950 up to $91,900 up to $191,650 up to $416,700 up to $418,400 above $418,400 $6350 Jointly up to $18,650 up to $75,900 up to $153, 100 up to $233,350 up to $416,700 up to $470,700 above $470,700 $12,700 $4050 $4050 Does the couple face a marriage penalty i they marry before the end of the year? (Married rates apply for the entire year, regardless of when during the year the marriage took place. Choose the correct answer below. O A. No, they do not, as the amount they would pay as a couple is more than the amount they would owe by filing at a single tax rate. OB. Yes, they do, as the amount they would pay as a couple is more than the amount they would owo by filing at a single tax rato OC. Yes, they do, as the amount they would pay as a couple is less than the amount they would owe by fing at a single tax rato. Click to select your answers). This Question: 1 pt Consider the following couple, who are engaged to be married. Assume that each person takes one exemption and the standard deduction. Answer the questions below using the tax rates in the table to the right Gabriella and Roberto have adjusted gross incomes of $96,400 and $82,200, respectively. Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Single up to $9325 up to $37 950 up to $91,900 up to $191,650 up to $416,700 up to $410,400 above $418,400 $6350 Married Filing Jointly up to $18,650 up to $75,900 up to $153,100 up to $233,350 up to $416,700 up to $470.700 above $470,700 $12,700 $4050 $4050 OA. No, they do not, as the amount they would pay as a couple is more than the amount they would owe by filing at a single tax rate. OB. Yes, they do, as the amount they would pay as a couple is more than the amount they would owe by filing at a single tax rate. OC. Yes, they do, as the amount they would pay as a couple is less than the amount they would owe by filing at a single tax rate. OD. No, they do not, as the amount they would pay as a couple is less than the amount they would owe by filing at a single tax rate. Click to select your answer(s). Consider the following couple, who are engaged to be married. Assume that each person Married Filing Tax Rate makes one exemption and the standard deduction. Answer the questions below using the tax Single Jointly 10% up to $9325 ates in the table to the right. up to $18,650 15% up to $37,950 up to $75,900 Gabriella and Roberto have adjusted gross incomes of $96,400 and $82,200, respectively. 25% up to $91,900 up to $153, 100 28% up to $191,650 up to $233,350 33% up to $416,700 up to $416,700 35% up to $418,400 up to $470,700 39.6% above $418,400 above $470,700 Standard $6350 deduction $12,700 Exemption $4050 $4050 (per person) Calculate their income tax if they delay their marriage until next year so they can file their tax returns as individuals at the single tax rate this year. Their income tax would be $ (Round to the nearest dollar as needed.) Calculate their income tax if they marry before the end of this year and file a joint return. Click to select your answer(s). Consider the following couple, who are engaged to be married. Assume that each person Married Filing Tax Rate takes one exemption and the standard deduction. Answer the questions below using the tax Single Jointly 10% rates in the table to the right up to $9325 up to $18,650 15% up to $37,950 up to $75,900 Gabriella and Roberto have adjusted gross incomes of $96,400 and $82,200, respectively 25% up to $91,900 up to $153,100 28% up to $191,650 up to $233,350 33% up to $416,700 up to $416,700 35% up to $418,400 up to $470,700 39.6% above $418,400 above $470,700 Standard $6350 deduction $12,700 Exemption $4050 $4050 per person) Their income tax would be $ (Round to the nearest dollar as needed.) Does the couple face a marriage penalty if they marry before the end of the year? (Married rates apply for the entire year, regardless of when during the year the marriage to Choose the correct answer below. NANA thout the amount they were ruinine more than the amount than wil why filing tingin tavat Click to select your answer(s). kes one exemption and the standard deduction. Answer the questions below using the tax ates in the table to the right. Gabriella and Roberto have adjusted gross incomes of $96,400 and $82,200, respectively, Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person Single up to $9325 up to $37.950 up to $91,900 up to $191,650 up to $416,700 up to $418,400 above $418,400 $6350 Jointly up to $18,650 up to $75,900 up to $153, 100 up to $233,350 up to $416,700 up to $470,700 above $470,700 $12,700 $4050 $4050 Does the couple face a marriage penalty i they marry before the end of the year? (Married rates apply for the entire year, regardless of when during the year the marriage took place. Choose the correct answer below. O A. No, they do not, as the amount they would pay as a couple is more than the amount they would owe by filing at a single tax rate. OB. Yes, they do, as the amount they would pay as a couple is more than the amount they would owo by filing at a single tax rato OC. Yes, they do, as the amount they would pay as a couple is less than the amount they would owe by fing at a single tax rato. Click to select your answers). This Question: 1 pt Consider the following couple, who are engaged to be married. Assume that each person takes one exemption and the standard deduction. Answer the questions below using the tax rates in the table to the right Gabriella and Roberto have adjusted gross incomes of $96,400 and $82,200, respectively. Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Single up to $9325 up to $37 950 up to $91,900 up to $191,650 up to $416,700 up to $410,400 above $418,400 $6350 Married Filing Jointly up to $18,650 up to $75,900 up to $153,100 up to $233,350 up to $416,700 up to $470.700 above $470,700 $12,700 $4050 $4050 OA. No, they do not, as the amount they would pay as a couple is more than the amount they would owe by filing at a single tax rate. OB. Yes, they do, as the amount they would pay as a couple is more than the amount they would owe by filing at a single tax rate. OC. Yes, they do, as the amount they would pay as a couple is less than the amount they would owe by filing at a single tax rate. OD. No, they do not, as the amount they would pay as a couple is less than the amount they would owe by filing at a single tax rate. Click to select your answer(s)