Question

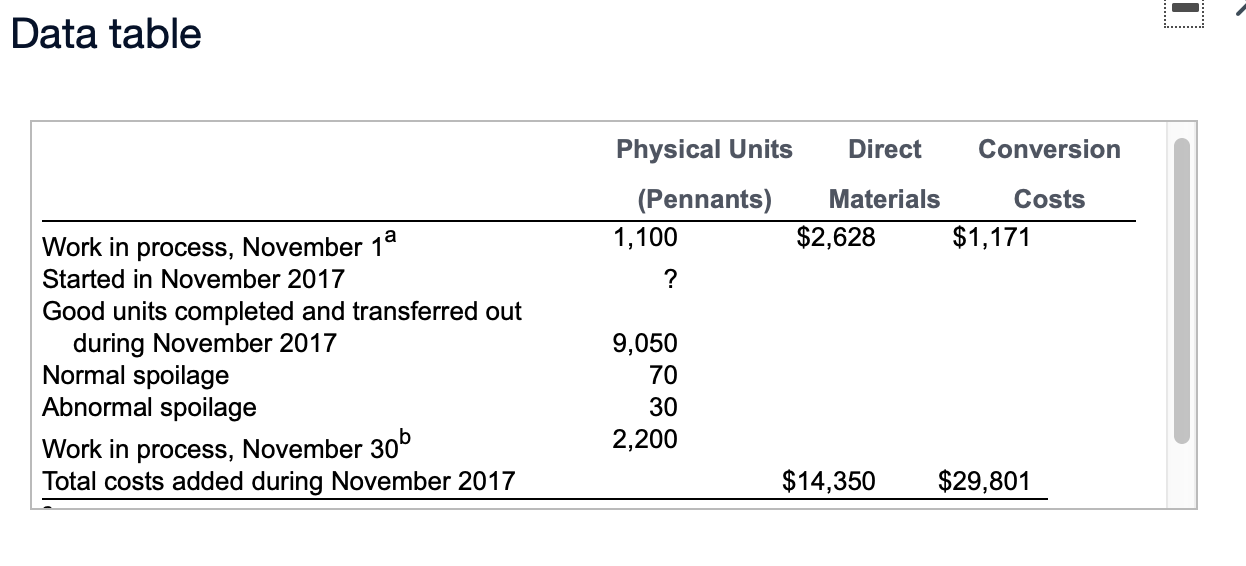

Consider the following data for November 2017 from Walton Manufacturing Company, which makes silk pennants and uses a process-costing system. All direct materials are added

Consider the following data for November 2017 from Walton Manufacturing Company, which makes silk pennants and uses a process-costing system. All direct materials are added at the beginning of the process, and conversion costs are added evenly during the process. Spoilage is detected upon inspection at the completion of the process. Spoiled units are disposed of at zero net disposal value. Suppose Walton Manufacturing Company uses the FIFO method of process costing.

a:Degree of completion: direct materials, 100%; conversion costs, 55%.

b:Degree of completion: direct materials, 100%; conversion costs, 10%.

Requirements:

Compute equivalent units for direct materials and conversion costs. Show physical units in the first column of your schedule.

- Data table Physical Units Direct Conversion (Pennants) 1,100 Materials Costs $2,628 $1,171 ? Work in process, November 18 Started in November 2017 Good units completed and transferred out during November 2017 Normal spoilage Abnormal spoilage Work in process, November 306 Total costs added during November 2017 9,050 70 30 2,200 $14,350 $29,801

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started