Question

Consider the following data for stocks A and B: a) If the riskless rate of return were 5%, what percentage of money invested in risky

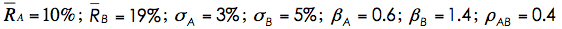

Consider the following data for stocks A and B:

a) If the riskless rate of return were 5%, what percentage of money invested in risky stocks should an investor place in each stock (assuming A and B are the only risky assets available)?

b) If the security market line describes equilibrium, and stocks A and B are in equilibrium, what is the return on the market portfolio and the riskless rate of interest?

c) If an investor can lend and borrow at the riskless rate determined in part b, but is restricted to holding only one of the two risky stocks in this problem, which stock should be held?

%, ? /oStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started