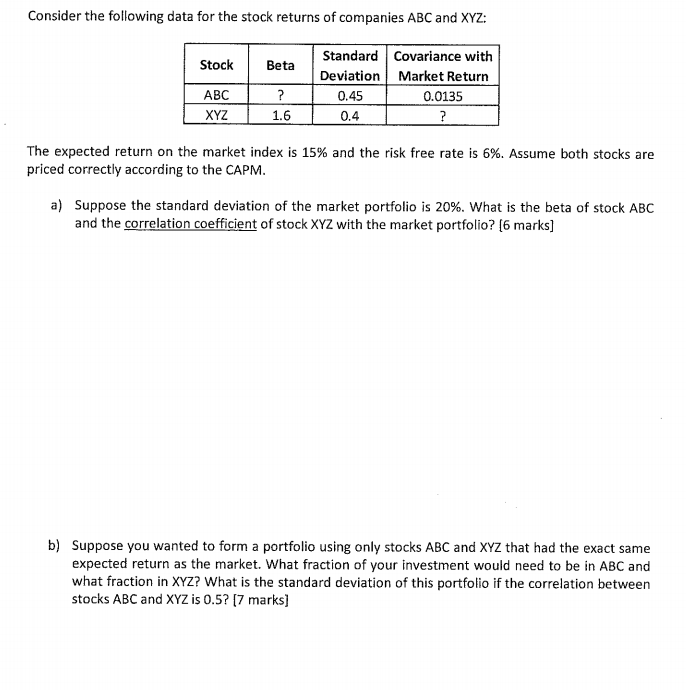

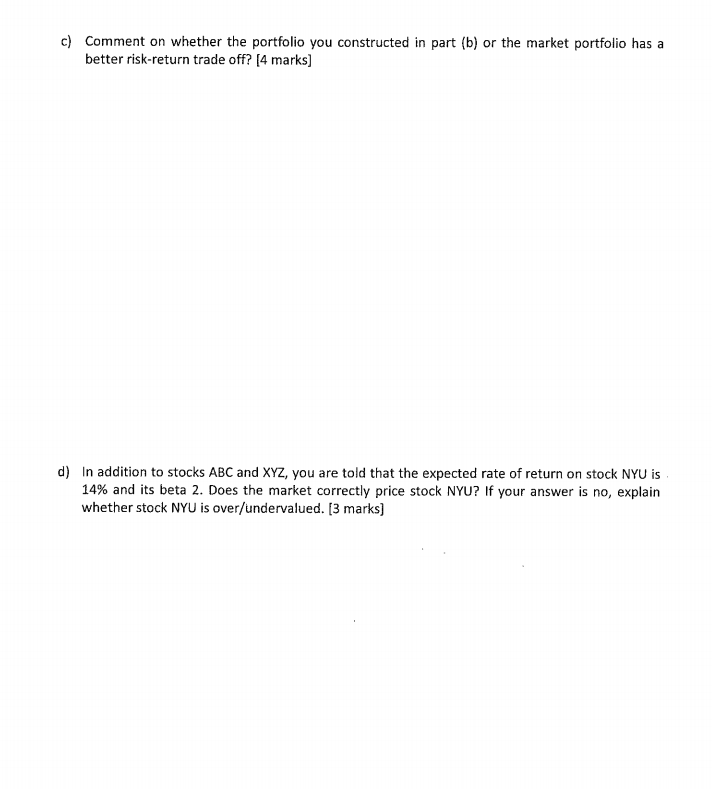

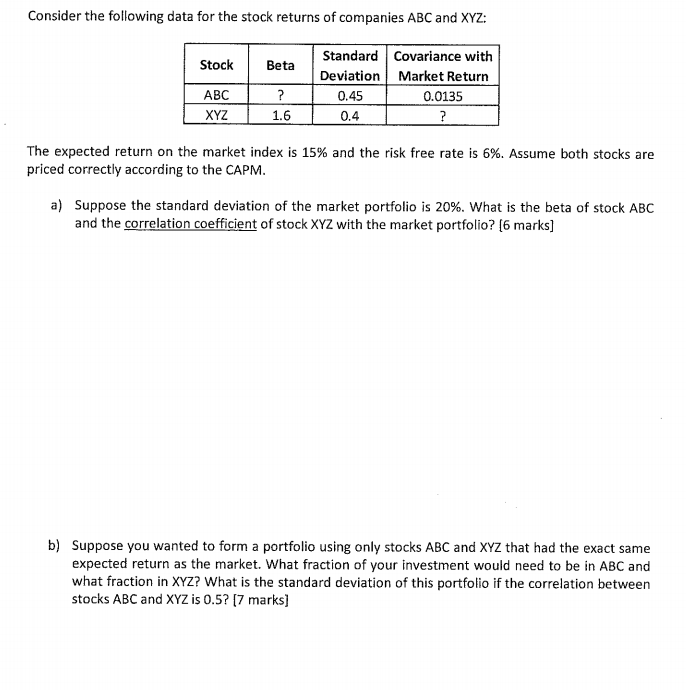

Consider the following data for the stock returns of companies ABC and XYZ: Standard Covariance with Deviation Market Return Stock Beta ABC XYZ 0.45 0.4 0.0135 1.6 The expected return on the market index is 15% and the risk free rate is 6%. Assume both stocks are priced correctly according to the CAPM. a) Suppose the standard deviation of the market portfolio is 20%, what is the beta of stock ABC and the correlation coefficient of stock XYZ with the market portolio? 6 marks] b) Suppose you wanted to form a portfolio using only stocks ABC and XYZ that had the exact same expected return as the market. What fraction of your investment would need to be in ABC and what fraction in XYZ? What is the standard deviation of this portfolio if the correlation between stocks ABC and XYZ is 0.5?[7 marks] c) Comment on whether the portfolio you constructed in part (b) or the market portfolio has a better risk-return trade off? [4 marks] d) In addition to stocks ABC and XYZ, you are told that the expected rate of return on stock NYU is 14% and its beta 2, Does the market correctly price stock NYU? If your answer is no, explain whether stock NYU is over/undervalued. [3 marks] Consider the following data for the stock returns of companies ABC and XYZ: Standard Covariance with Deviation Market Return Stock Beta ABC XYZ 0.45 0.4 0.0135 1.6 The expected return on the market index is 15% and the risk free rate is 6%. Assume both stocks are priced correctly according to the CAPM. a) Suppose the standard deviation of the market portfolio is 20%, what is the beta of stock ABC and the correlation coefficient of stock XYZ with the market portolio? 6 marks] b) Suppose you wanted to form a portfolio using only stocks ABC and XYZ that had the exact same expected return as the market. What fraction of your investment would need to be in ABC and what fraction in XYZ? What is the standard deviation of this portfolio if the correlation between stocks ABC and XYZ is 0.5?[7 marks] c) Comment on whether the portfolio you constructed in part (b) or the market portfolio has a better risk-return trade off? [4 marks] d) In addition to stocks ABC and XYZ, you are told that the expected rate of return on stock NYU is 14% and its beta 2, Does the market correctly price stock NYU? If your answer is no, explain whether stock NYU is over/undervalued. [3 marks]