Answered step by step

Verified Expert Solution

Question

1 Approved Answer

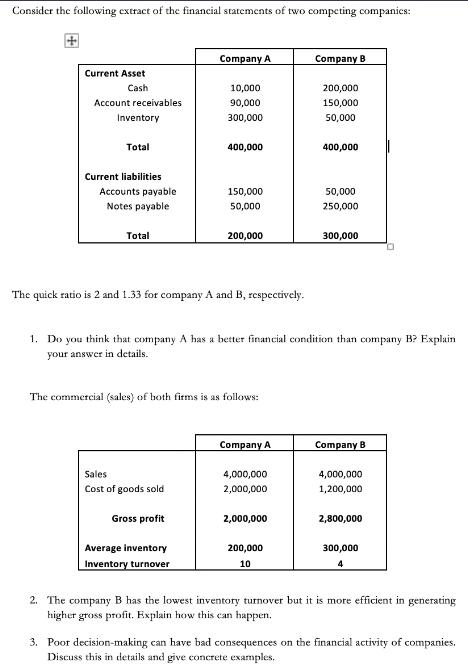

Consider the following data: Free Cash Flow 1 = $27 million; Free Cash Flow 2 = $43 million; Free Cash Flow 3 = $48 million.

Consider the following data:

Free Cash Flow 1 = $27 million;

Free Cash Flow 2 = $43 million;

Free Cash Flow 3 = $48 million.

Free Cash Flow 4= $62 million.

Assume that free cash flow grows at a rate of 6 percent for year 5 and beyond. If the weighted average cost of capital is 12 percent, calculate the value of the firm.

Problem 2

An Electronics shop provides specialty-manufacturing service. The initial outlay is $30 million and, management estimates that the firm might generate cash flows for years one through five equal to $5,000,000; $7,500,000; $10,500,000; $20,000,000; and $20,000,000.

The company uses a 20% discount rate for projects of this type.

Is this a good investment opportunity? Explain your answer.

Free Cash Flow 1 = $27 million;

Free Cash Flow 2 = $43 million;

Free Cash Flow 3 = $48 million.

Free Cash Flow 4= $62 million.

Assume that free cash flow grows at a rate of 6 percent for year 5 and beyond. If the weighted average cost of capital is 12 percent, calculate the value of the firm.

Problem 2

An Electronics shop provides specialty-manufacturing service. The initial outlay is $30 million and, management estimates that the firm might generate cash flows for years one through five equal to $5,000,000; $7,500,000; $10,500,000; $20,000,000; and $20,000,000.

The company uses a 20% discount rate for projects of this type.

Is this a good investment opportunity? Explain your answer.

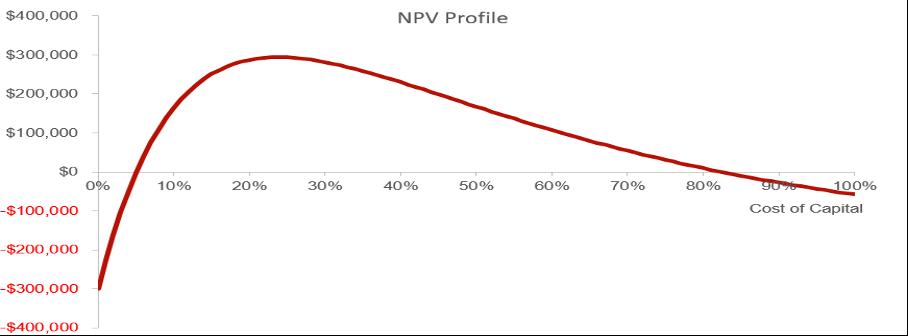

1. Explain why this project has two IRRs and not only one?

2. How can you make investing decision based on the above graph? Explain in details your answer.

3. If the cost of capital is 15%, are you going to accept investing in this project? Why.

4. What will be your decision if the cost of capital is 90%?

$400,000 $300,000 $200,000 $100,000 $0 -$100,000 -$200,000 -$300,000 -$400,000 0% 10% 20% 30% NPV Profile 40% 50% 60% 70% 80% 90% 100% Cost of Capital

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the firm in Problem 1 we can use the discounted cash flow DCF method The D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started