Answered step by step

Verified Expert Solution

Question

1 Approved Answer

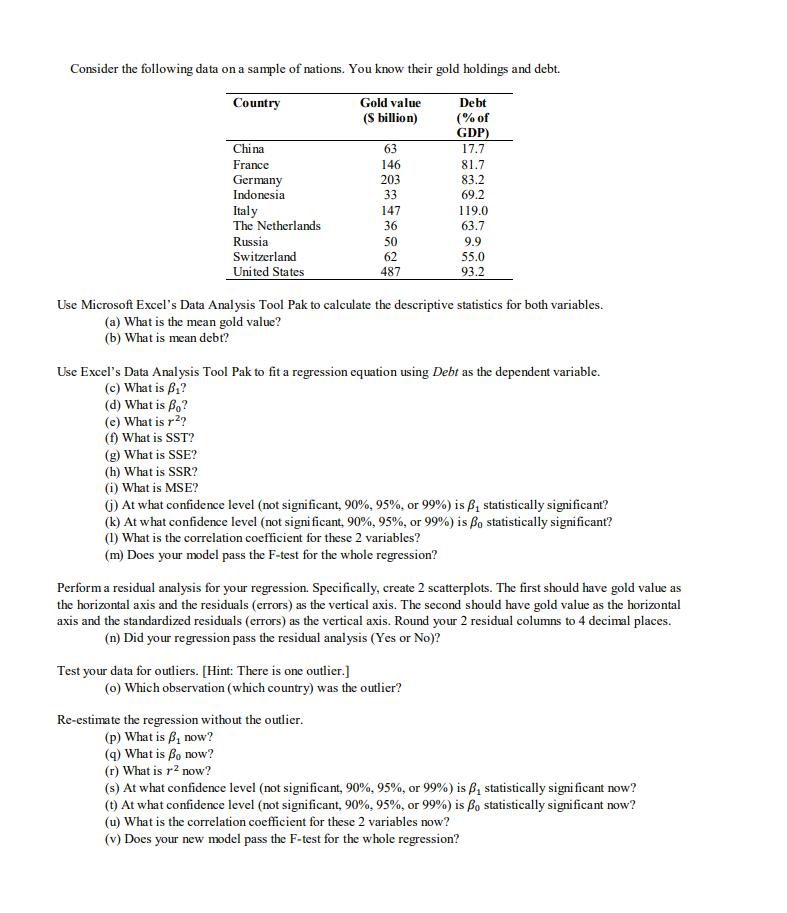

Consider the following data on a sample of nations. You know their gold holdings and debt. Country China France Germany Indonesia Italy The Netherlands

Consider the following data on a sample of nations. You know their gold holdings and debt. Country China France Germany Indonesia Italy The Netherlands Russia Switzerland United States Gold value (S billion) 63 146 203 33 Test your data for outliers. [Hint: There is one outlier.] (q) What is Bo now? (r) What is r now? 147 36 50 62 487 Re-estimate the regression without the outlier. (p) What is B, now? Use Microsoft Excel's Data Analysis Tool Pak to calculate the descriptive statistics for both variables. (a) What is the mean gold value? (b) What is mean debt? Debt (% of GDP) 17.7 Use Excel's Data Analysis Tool Pak to fit a regression equation using Debt as the dependent variable. (c) What is B? 81.7 83.2 69.2 (d) What is Bo? (e) What is r? (f) What is SST? (g) What is SSE? (h) What is SSR? (i) What is MSE? (j) At what confidence level (not significant, 90%, 95%, or 99 %) is B, statistically significant? (k) At what confidence level (not significant, 90%, 95%, or 99%) is o statistically significant? (1) What is the correlation coefficient for these 2 variables? (m) Does your model pass the F-test for the whole regression? (0) Which observation (which country) was the outlier? 119.0 63.7 9.9 55.0 93.2 Perform a residual analysis for your regression. Specifically, create 2 scatterplots. The first should have gold value as the horizontal axis and the residuals (errors) as the vertical axis. The second should have gold value as the horizontal axis and the standardized residuals (errors) as the vertical axis. Round your 2 residual columns to 4 decimal places. (n) Did your regression pass the residual analysis (Yes or No)? (s) At what confidence level (not significant, 90%, 95%, or 99 %) is B, statistically significant now? (t) At what confidence level (not significant, 90%, 95%, or 99%) is o statistically significant now? (u) What is the correlation coefficient for these 2 variables now? (v) Does your new model pass the F-test for the whole regression?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a The mean gold value is 13102 billion b The mean debt is 5404 c The coefficient B is 0715 d The int...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started