Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following economy. There are two periods, t=0,1, and three assets: one risk-free asset with a rate of return rf, which is exogenously given,

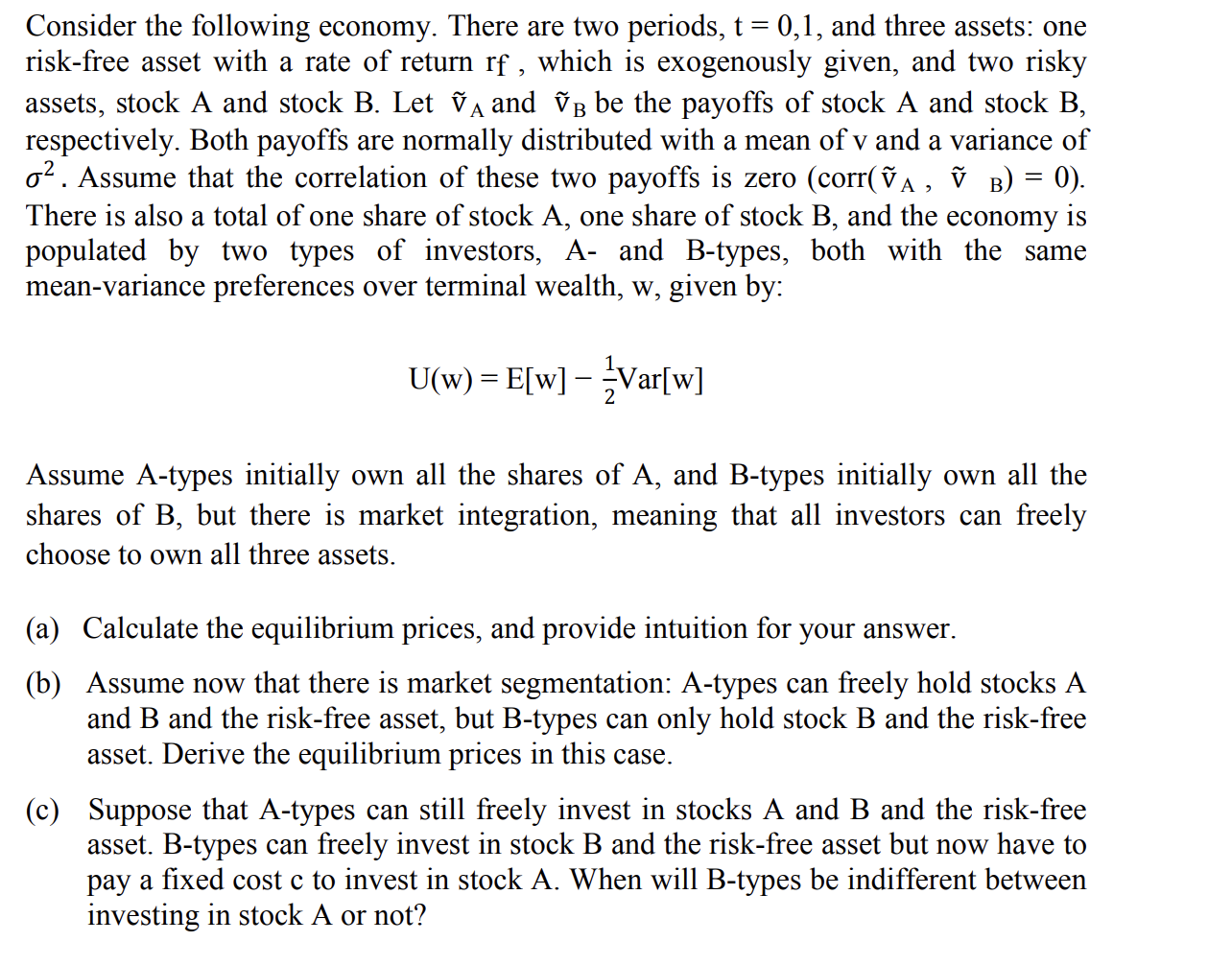

Consider the following economy. There are two periods, t=0,1, and three assets: one risk-free asset with a rate of return rf, which is exogenously given, and two risky assets, stock A and stock B. Let v~A and v~B be the payoffs of stock A and stock B, respectively. Both payoffs are normally distributed with a mean of v and a variance of 2. Assume that the correlation of these two payoffs is zero (corr(V~A,V~B)=0). There is also a total of one share of stock A, one share of stock B, and the economy is populated by two types of investors, A- and B-types, both with the same mean-variance preferences over terminal wealth, w, given by: U(w)=E[w]21Var[w] Assume A-types initially own all the shares of A, and B-types initially own all the shares of B, but there is market integration, meaning that all investors can freely choose to own all three assets. (a) Calculate the equilibrium prices, and provide intuition for your answer. (b) Assume now that there is market segmentation: A-types can freely hold stocks A and B and the risk-free asset, but B-types can only hold stock B and the risk-free asset. Derive the equilibrium prices in this case. (c) Suppose that A-types can still freely invest in stocks A and B and the risk-free asset. B-types can freely invest in stock B and the risk-free asset but now have to pay a fixed cost c to invest in stock A. When will B-types be indifferent between investing in stock A or not

Consider the following economy. There are two periods, t=0,1, and three assets: one risk-free asset with a rate of return rf, which is exogenously given, and two risky assets, stock A and stock B. Let v~A and v~B be the payoffs of stock A and stock B, respectively. Both payoffs are normally distributed with a mean of v and a variance of 2. Assume that the correlation of these two payoffs is zero (corr(V~A,V~B)=0). There is also a total of one share of stock A, one share of stock B, and the economy is populated by two types of investors, A- and B-types, both with the same mean-variance preferences over terminal wealth, w, given by: U(w)=E[w]21Var[w] Assume A-types initially own all the shares of A, and B-types initially own all the shares of B, but there is market integration, meaning that all investors can freely choose to own all three assets. (a) Calculate the equilibrium prices, and provide intuition for your answer. (b) Assume now that there is market segmentation: A-types can freely hold stocks A and B and the risk-free asset, but B-types can only hold stock B and the risk-free asset. Derive the equilibrium prices in this case. (c) Suppose that A-types can still freely invest in stocks A and B and the risk-free asset. B-types can freely invest in stock B and the risk-free asset but now have to pay a fixed cost c to invest in stock A. When will B-types be indifferent between investing in stock A or not Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started