Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following hypothetical situation and numbers today. Today, I am 30 years old and would like to retire at age 62, 65, 67, etc.

Consider the following hypothetical situation and numbers today.

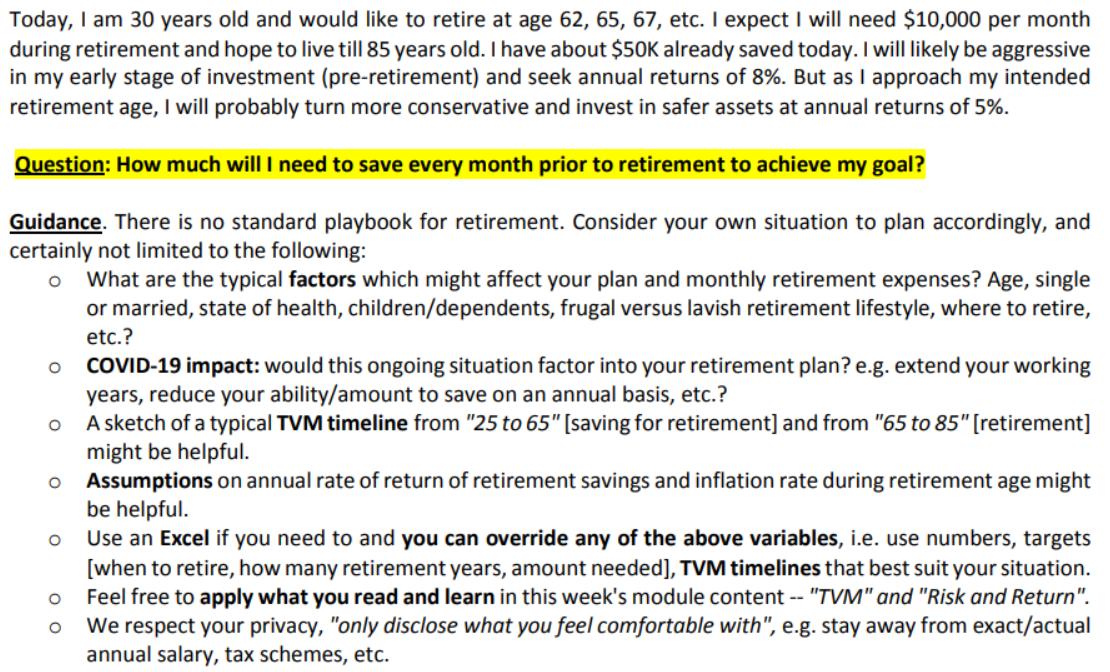

Today, I am 30 years old and would like to retire at age 62, 65, 67, etc. I expect I will need $10,000 per month during retirement and hope to live till 85 years old. I have about $50K already saved today. I will likely be aggressive in my early stage of investment (pre-retirement) and seek annual returns of 8%. But as I approach my intended retirement age, I will probably turn more conservative and invest in safer assets at annual returns of 5%. Question: How much will I need to save every month prior to retirement to achieve my goal? Guidance. There is no standard playbook for retirement. Consider your own situation to plan accordingly, and certainly not limited to the following: O What are the typical factors which might affect your plan and monthly retirement expenses? Age, single or married, state of health, children/dependents, frugal versus lavish retirement lifestyle, where to retire, etc.? COVID-19 impact: would this ongoing situation factor into your retirement plan? e.g. extend your working years, reduce your ability/amount to save on an annual basis, etc.? O A sketch of a typical TVM timeline from "25 to 65" [saving for retirement] and from "65 to 85" [retirement] might be helpful. O O O 00 Assumptions on annual rate of return of retirement savings and inflation rate during retirement age might be helpful. Use an Excel if you need to and you can override any of the above variables, i.e. use numbers, targets [when to retire, how many retirement years, amount needed], TVM timelines that best suit your situation. Feel free to apply what you read and learn in this week's module content -- "TVM" and "Risk and Return". We respect your privacy, "only disclose what you feel comfortable with", e.g. stay away from exact/actual annual salary, tax schemes, etc.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Assuming the following You are 30 years old today You would like to retire at age ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started