Answered step by step

Verified Expert Solution

Question

1 Approved Answer

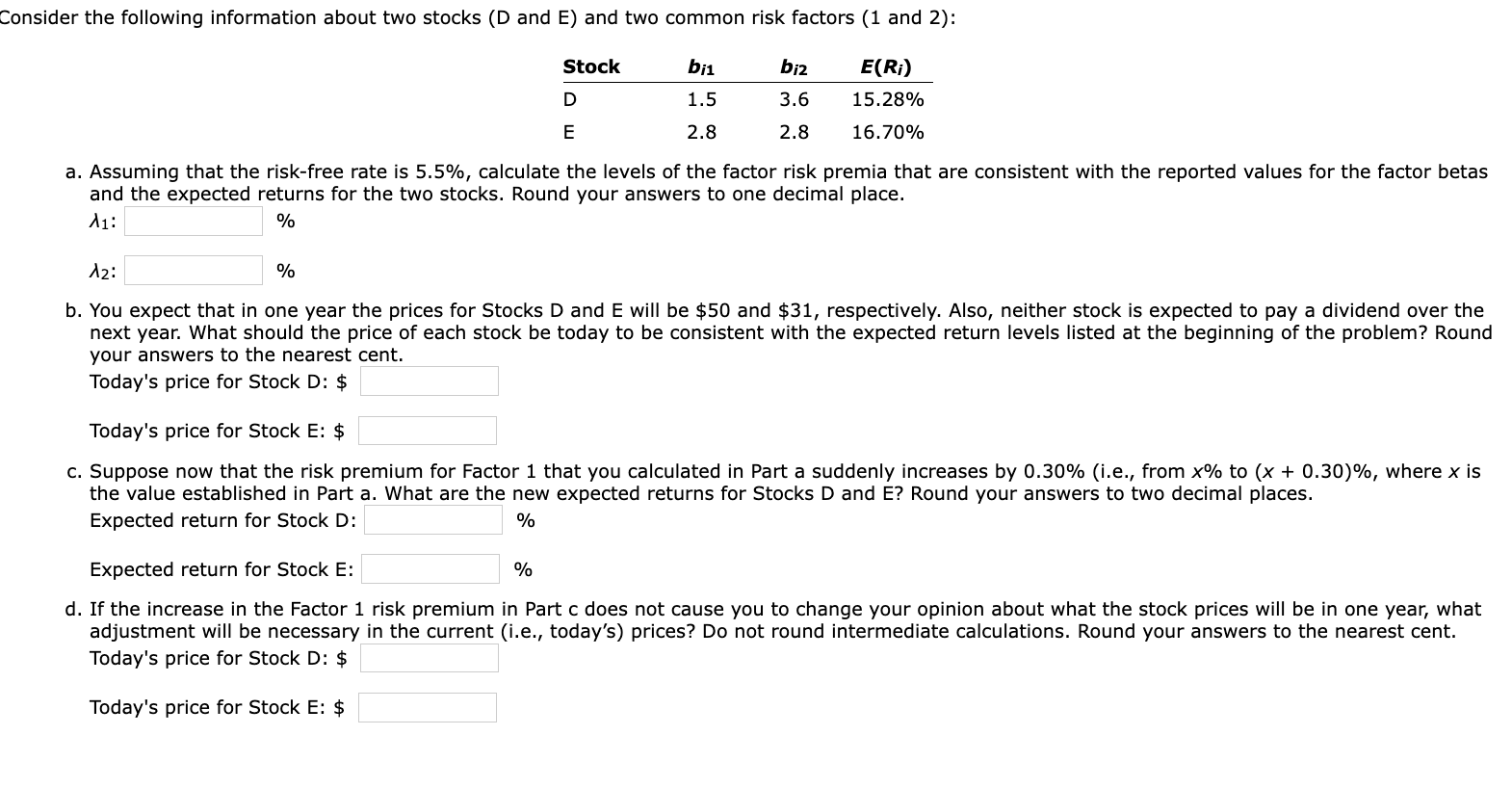

Consider the following information about two stocks (D and E) and two common risk factors (1 and 2): Stock bi1 biz 1.5 2.8 3.6

Consider the following information about two stocks (D and E) and two common risk factors (1 and 2): Stock bi1 biz 1.5 2.8 3.6 2.8 E(Ri) 15.28% 16.70% D E a. Assuming that the risk-free rate is 5.5%, calculate the levels of the factor risk premia that are consistent with the reported values for the factor betas and the expected returns for the two stocks. Round your answers to one decimal place. A1: A2: % % b. You expect that in one year the prices for Stocks D and E will be $50 and $31, respectively. Also, neither stock is expected to pay a dividend over the next year. What should the price of each stock be today to be consistent with the expected return levels listed at the beginning of the problem? Round your answers to the nearest cent. Today's price for Stock D: $ Today's price for Stock E: $ c. Suppose now that the risk premium for Factor 1 that you calculated in Part a suddenly increases by 0.30% (i.e., from x% to (x + 0.30) %, where x is the value established in Part a. What are the new expected returns for Stocks D and E? Round your answers to two decimal places. Expected return for Stock D: Expected return for Stock E: % % d. If the increase in the Factor 1 risk premium in Part c does not cause you to change your opinion about what the stock prices will be in one year, what adjustment will be necessary in the current (i.e., today's) prices? Do not round intermediate calculations. Round your answers to the nearest cent. Today's price for Stock D: $ Today's price for Stock E: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started