Answered step by step

Verified Expert Solution

Question

1 Approved Answer

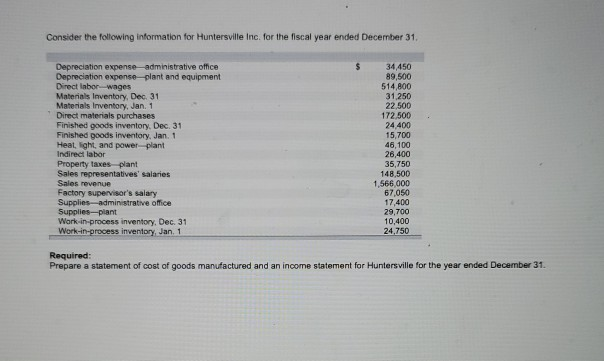

Consider the following information for Huntersville Inc. for the fiscal year ended December 31 $ Depreciation expense administrative office Depreciation expense-plant and equipment Direct laborwages

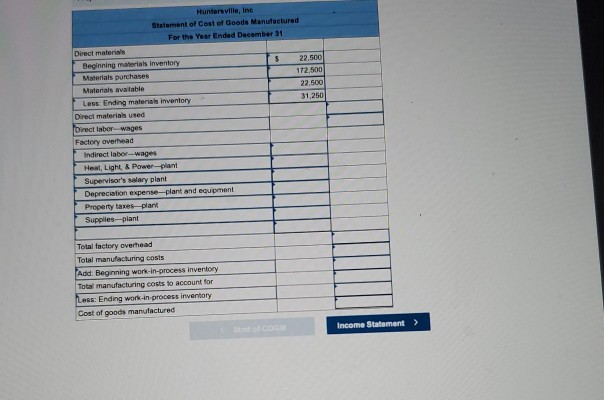

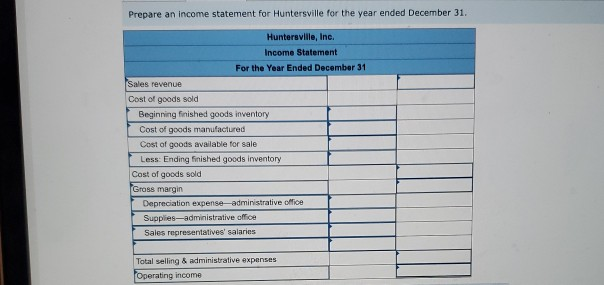

Consider the following information for Huntersville Inc. for the fiscal year ended December 31 $ Depreciation expense administrative office Depreciation expense-plant and equipment Direct laborwages Materials Inventory, Dec 31 Materials Inventory, Jan. 1 Direct materials purchases Finished goods inventory. Dec. 31 Finished goods inventory. Jan. 1 Heat,ight, and power plant Indirect labor Property taxes plant Sales representatives' salaries Sales revenue Factory supervisor's salary Supplies-administrative office Supplies-plant Work-in-process inventory, Dec. 31 Work-in-process inventory, Jan. 1 34,450 89,500 514,800 31,250 22 500 172,500 24.400 15,700 46.100 26,400 35,750 148,500 1,566,000 67,050 17,400 29,700 10,400 24.750 Required: Prepare a statement of cost of goods manufactured and an income statement for Huntersville for the year ended December 31 Huntersville, Inc Statement of Cost of Goods Manufactured For the Year Ended December 31 Direct materials Beginning materials inventory $ 22.500 Materials purchases 172 500 Materials available 22.500 Less: Ending materials inventory 31,250 Direct materials used Direct labor wages Factory overhead Indirect laborwages Heat, Light & Power plant Supervisor's salary plant Depreciation expense plant and equipment Property taxes plant Supplies-plant Total factory overhead Total manufacturing costs Add: Beginning work-in-process inventory Total manufacturing costs to account for Less: Ending work in process inventory Cost of goods manufactured Income Statement > Prepare an income statement for Huntersville for the year ended December 31 Huntersville, Inc. Income Statement For the Year Ended December 31 Sales revenue Cost of goods sold Beginning finished goods inventory Cost of goods manufactured Cost of goods available for sale Less: Ending finished goods inventory Cost of goods sold Gross margin Depreciation expense-administrative office Supplies-administrative office Sales representatives' salaries Total selling & administrative expenses Operating income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started