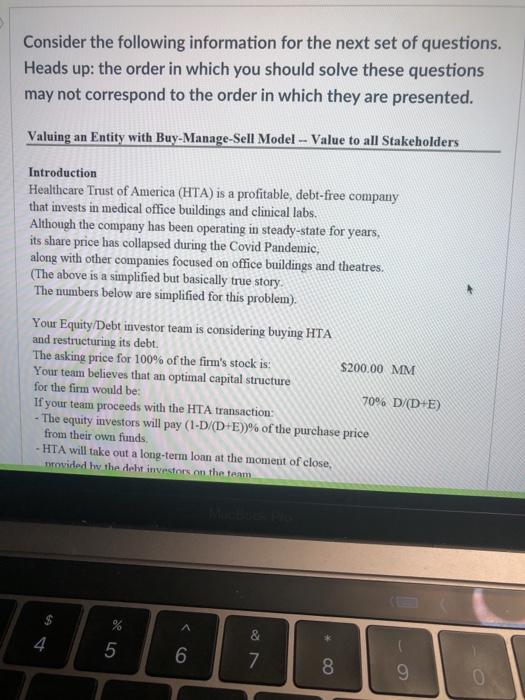

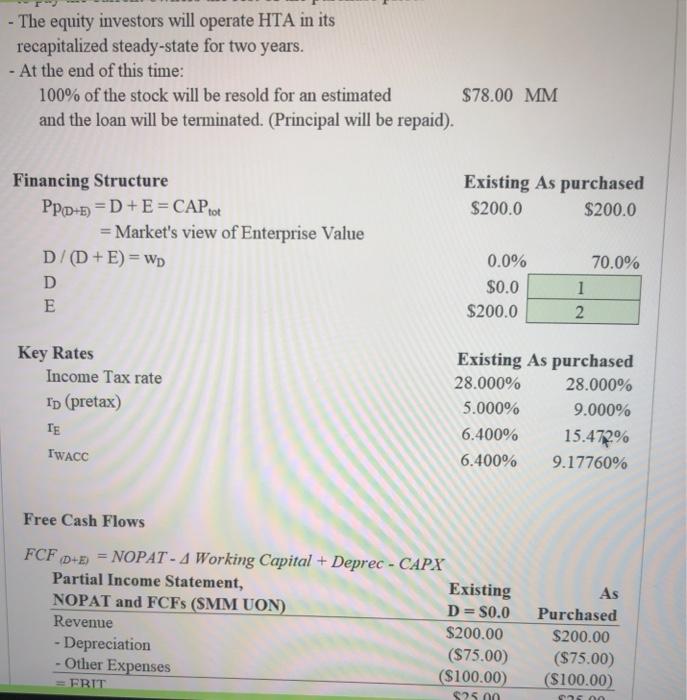

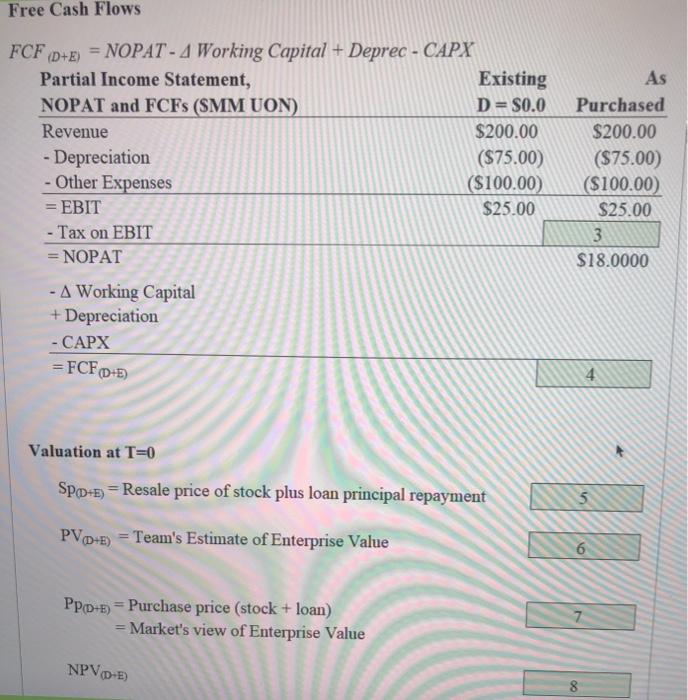

Consider the following information for the next set of questions. Heads up: the order in which you should solve these questions may not correspond to the order in which they are presented. Valuing an Entity with Buy-Manage-Sell Model -- Value to all Stakeholders Introduction Healthcare Trust of America (HTA) is a profitable, debt-free company that invests in medical office buildings and clinical labs. Although the company has been operating in steady-state for years, its share price has collapsed during the Covid Pandemic, along with other companies focused on office buildings and theatres. (The above is a simplified but basically true story The numbers below are simplified for this problem). Your Equity/Debt investor team is considering buying HTA and restructuring its debt. The asking price for 100% of the firm's stock is: $200.00 MM Your team believes that an optimal capital structure for the firm would be: 70% D/D-E) If your team proceeds with the HTA transaction: - The equity investors will pay (1-D/(D+E))% of the purchase price from their own funds. - HTA will take out a long-term loan at the moment of close, rovided by the debt investors on the team A & 4. 5 6 7 00 9 - The equity investors will operate HTA in its recapitalized steady-state for two years. - At the end of this time: 100% of the stock will be resold for an estimated $78.00 MM and the loan will be terminated. (Principal will be repaid). Existing As purchased $200.0 $200.0 Financing Structure PPD-B) =D + E = CAPO = Market's view of Enterprise Value D/(D+E) = Wp D E 0.0% $0.0 $200.0 70.0% 1 2 Key Rates Income Tax rate Ip (pretax) TE Existing As purchased 28.000% 28.000% 5.000% 9.000% 6.400% 15.472% 6.400% 9.17760% TWACC Free Cash Flows FCF (D+E) = NOPAT - 4 Working Capital + Deprec - CAPX Partial Income Statement, Existing NOPAT and FCFS (SMM UON) D=S0.0 Revenue $200.00 - Depreciation ($75.00) - Other Expenses ($100.00) = FRIT As Purchased $200.00 ($75.00) ($100.00) $250 500 Free Cash Flows FCF (D+E) = NOPAT - 4 Working Capital + Deprec - CAPX E) A Partial Income Statement, Existing NOPAT and FCFS (SMM UON) D=S0.0 Revenue $200.00 - Depreciation ($75.00) - Other Expenses ($100.00) = EBIT $25.00 - Tax on EBIT =NOPAT As Purchased $200.00 ($75.00) ($100.00) $25.00 3 $18.0000 - A Working Capital + Depreciation - CAPX = FCFp-E) 4 4. Valuation at T=0 SPD-5) = Resale price of stock plus loan principal repayment 5 PV-E) = Team's Estimate of Enterprise Value 6 PP(p-) = Purchase price (stock + loan) = Market's view of Enterprise Value 7 NPVD-E) 8 Consider the following information for the next set of questions. Heads up: the order in which you should solve these questions may not correspond to the order in which they are presented. Valuing an Entity with Buy-Manage-Sell Model -- Value to all Stakeholders Introduction Healthcare Trust of America (HTA) is a profitable, debt-free company that invests in medical office buildings and clinical labs. Although the company has been operating in steady-state for years, its share price has collapsed during the Covid Pandemic, along with other companies focused on office buildings and theatres. (The above is a simplified but basically true story The numbers below are simplified for this problem). Your Equity/Debt investor team is considering buying HTA and restructuring its debt. The asking price for 100% of the firm's stock is: $200.00 MM Your team believes that an optimal capital structure for the firm would be: 70% D/D-E) If your team proceeds with the HTA transaction: - The equity investors will pay (1-D/(D+E))% of the purchase price from their own funds. - HTA will take out a long-term loan at the moment of close, rovided by the debt investors on the team A & 4. 5 6 7 00 9 - The equity investors will operate HTA in its recapitalized steady-state for two years. - At the end of this time: 100% of the stock will be resold for an estimated $78.00 MM and the loan will be terminated. (Principal will be repaid). Existing As purchased $200.0 $200.0 Financing Structure PPD-B) =D + E = CAPO = Market's view of Enterprise Value D/(D+E) = Wp D E 0.0% $0.0 $200.0 70.0% 1 2 Key Rates Income Tax rate Ip (pretax) TE Existing As purchased 28.000% 28.000% 5.000% 9.000% 6.400% 15.472% 6.400% 9.17760% TWACC Free Cash Flows FCF (D+E) = NOPAT - 4 Working Capital + Deprec - CAPX Partial Income Statement, Existing NOPAT and FCFS (SMM UON) D=S0.0 Revenue $200.00 - Depreciation ($75.00) - Other Expenses ($100.00) = FRIT As Purchased $200.00 ($75.00) ($100.00) $250 500 Free Cash Flows FCF (D+E) = NOPAT - 4 Working Capital + Deprec - CAPX E) A Partial Income Statement, Existing NOPAT and FCFS (SMM UON) D=S0.0 Revenue $200.00 - Depreciation ($75.00) - Other Expenses ($100.00) = EBIT $25.00 - Tax on EBIT =NOPAT As Purchased $200.00 ($75.00) ($100.00) $25.00 3 $18.0000 - A Working Capital + Depreciation - CAPX = FCFp-E) 4 4. Valuation at T=0 SPD-5) = Resale price of stock plus loan principal repayment 5 PV-E) = Team's Estimate of Enterprise Value 6 PP(p-) = Purchase price (stock + loan) = Market's view of Enterprise Value 7 NPVD-E) 8