Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following information on a portfolio of three stocks: 2 . 7 5 points eBook Mint Print References Note: Don't forget to click the

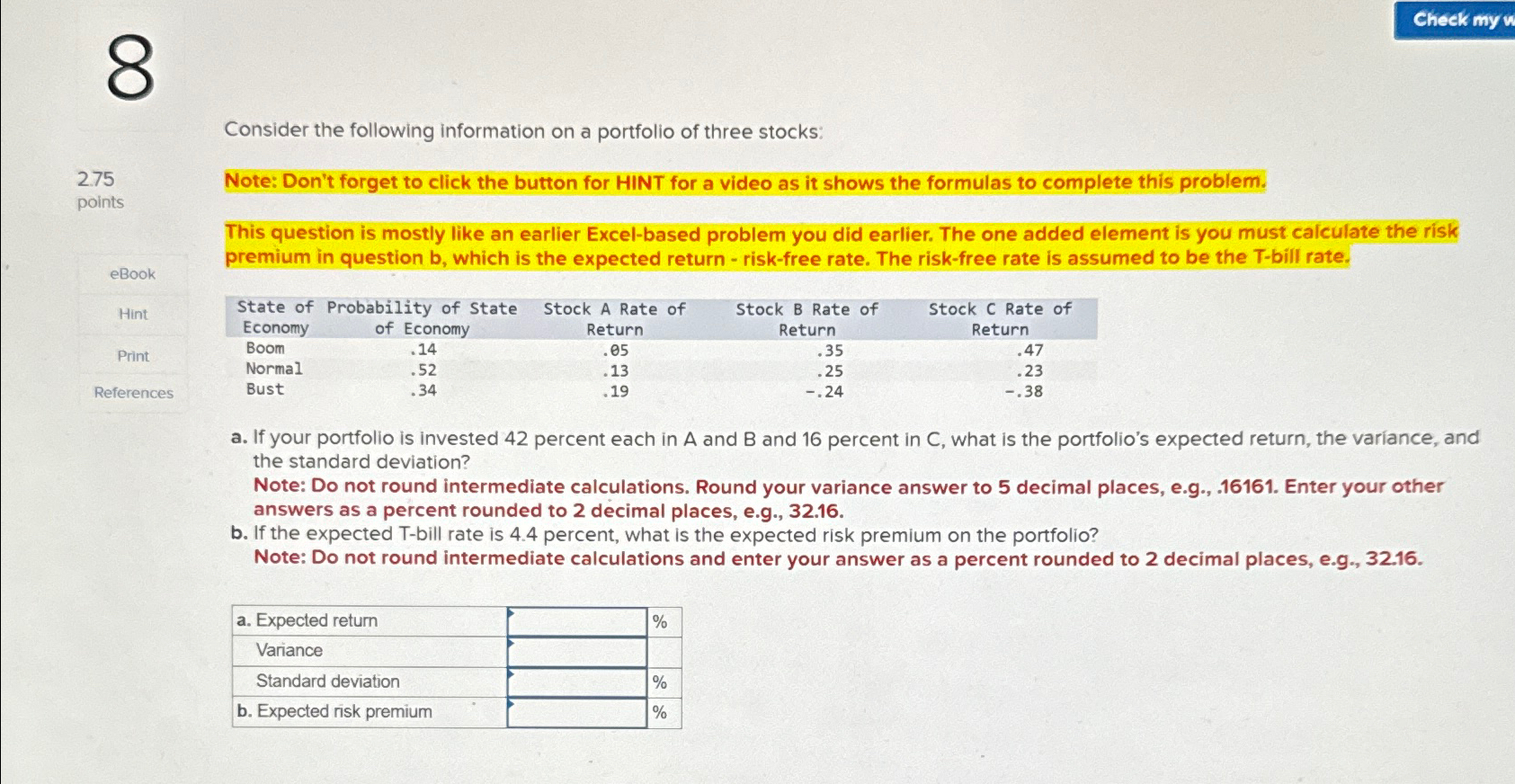

Consider the following information on a portfolio of three stocks:

points

eBook

Mint

Print

References

Note: Don't forget to click the button for HINT for a video as it shows the formulas to complete this problem.

This question is mostly like an earlier Excelbased problem you did earlier. The one added element is you must calculate the risk premium in question which is the expected return riskfree rate. The riskfree rate is assumed to be the bill rate.

tableState of Probability of State,tableStock A Rate ofEconomyof EconomytableStock B Rate ofReturntableStock C Rate ofReturnBoomNormalBust

a If your portfolio is invested percent each in A and and percent in what is the portfolio's expected return, the variance, and the standard deviation?

Note: Do not round intermediate calculations. Round your variance answer to decimal places, eg Enter your other answers as a percent rounded to decimal places, eg

b If the expected Tbill rate is percent, what is the expected risk premium on the portfolio?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to decimal places, eg

tablea Expected return,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started