Question

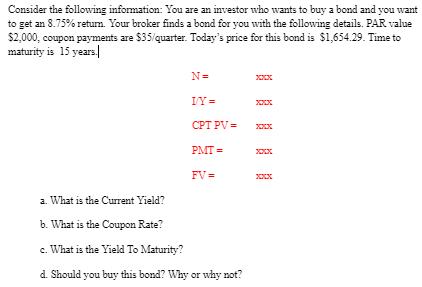

Consider the following information: You are an investor who wants to buy a bond and you want to get an 8.75% return. Your broker

Consider the following information: You are an investor who wants to buy a bond and you want to get an 8.75% return. Your broker finds a bond for you with the following details. PAR value $2,000, coupon payments are $35/quarter. Today's price for this bond is $1,654.29. Time to maturity is 15 years. N= IY= CPT PV= PMT= FV= a. What is the Current Yield? b. What is the Coupon Rate? c. What is the Yield To Maturity? d. Should you buy this bond? Why or why not? XXX Xxx

Step by Step Solution

3.56 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a What is the current yield The current yield is the annual income generated by a bond divided by it...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Small Business Management Entrepreneurship and Beyond

Authors: Timothy s. Hatten

5th edition

538453141, 978-0538453141

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App