Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following interest rate swap between two financial institutions A and B: the notional value is $500,000,000, the fixed rate is 4.5%, the

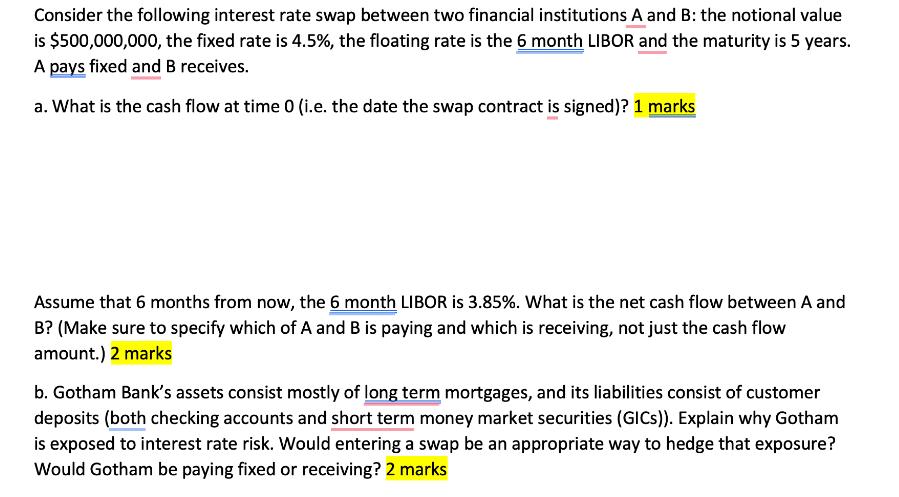

Consider the following interest rate swap between two financial institutions A and B: the notional value is $500,000,000, the fixed rate is 4.5%, the floating rate is the 6 month LIBOR and the maturity is 5 years. A pays fixed and B receives. a. What is the cash flow at time 0 (i.e. the date the swap contract is signed)? 1 marks Assume that 6 months from now, the 6 month LIBOR is 3.85%. What is the net cash flow between A and B? (Make sure to specify which of A and B is paying and which is receiving, not just the cash flow amount.) 2 marks b. Gotham Bank's assets consist mostly of long term mortgages, and its liabilities consist of customer deposits (both checking accounts and short term money market securities (GICs)). Explain why Gotham is exposed to interest rate risk. Would entering a swap be an appropriate way to hedge that exposure? Would Gotham be paying fixed or receiving? 2 marks

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a The cash flow at time 0 when the swap contract is signed can be calculated by considering the noti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started