Question

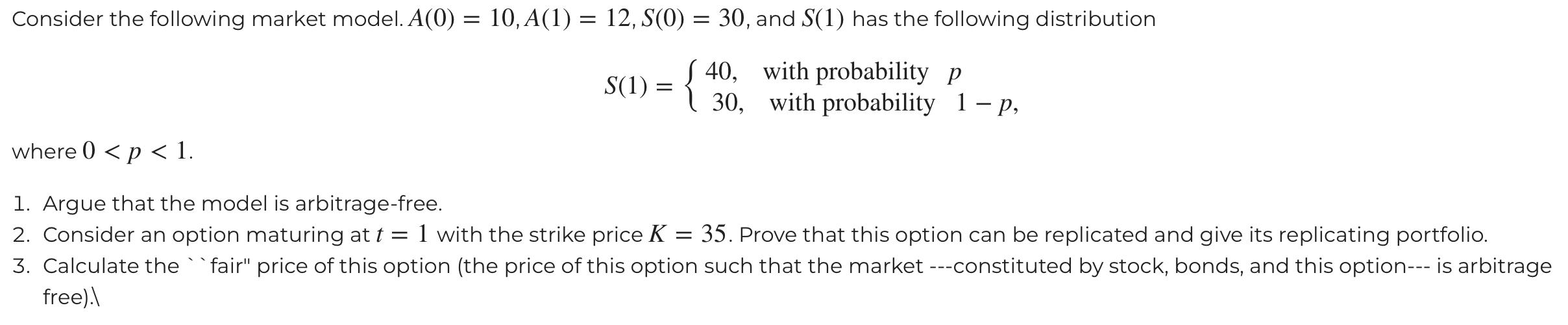

Consider the following market model. A(0) = 10,A(1) = 12, S(0) = 30, and S(1) has the following distribution S(1) = {40, with probability

Consider the following market model. A(0) = 10,A(1) = 12, S(0) = 30, and S(1) has the following distribution S(1) = {40, with probability P p 30, with probability 1- p, where 0 < p < 1. 1. Argue that the model is arbitrage-free. 2. Consider an option maturing at t = 1 with the strike price K = 35. Prove that this option can be replicated and give its replicating portfolio. 3. Calculate the fair" price of this option (the price of this option such that the market ---constituted by stock, bonds, and this option--- is arbitrage free).\

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To argue that the model is arbitragefree we need to show that there are no opportunities for riskfree profits In an arbitragefree market it is not pos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Basic Statistics

Authors: Charles Henry Brase, Corrinne Pellillo Brase

6th Edition

978-1133525097, 1133525091, 1111827028, 978-1133110316, 1133110312, 978-1111827021

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App