Answered step by step

Verified Expert Solution

Question

1 Approved Answer

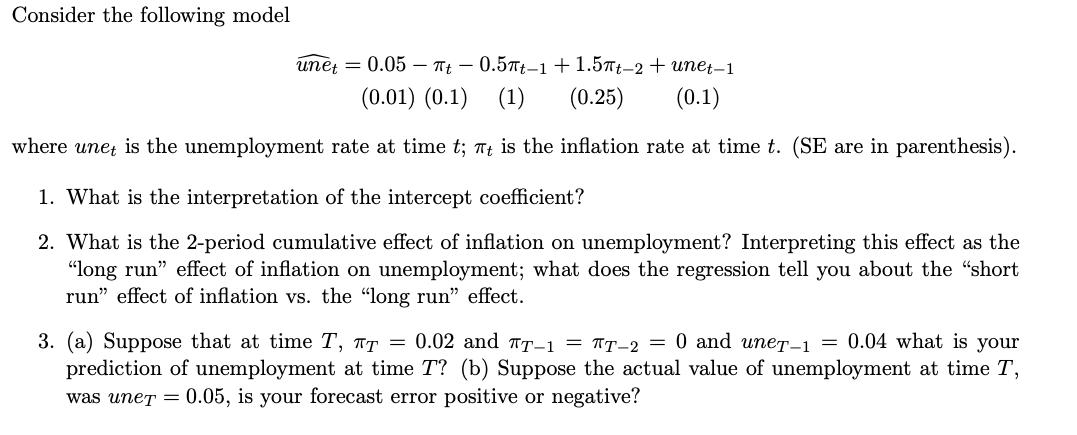

Consider the following model unet = 0.05-t -0.5t-1 +1.5t-2 + unet-1 (0.01) (0.1) (1) (0.25) (0.1) where unet is the unemployment rate at time

Consider the following model unet = 0.05-t -0.5t-1 +1.5t-2 + unet-1 (0.01) (0.1) (1) (0.25) (0.1) where unet is the unemployment rate at time t; t is the inflation rate at time t. (SE are in parenthesis). 1. What is the interpretation of the intercept coefficient? 2. What is the 2-period cumulative effect of inflation on unemployment? Interpreting this effect as the "long run" effect of inflation on unemployment; what does the regression tell you about the "short run" effect of inflation vs. the "long run" effect. 3. (a) Suppose that at time T, T = 0.02 and T1 = T-2 = 0 and uneT-1 = 0.04 what is your prediction of unemployment at time T? (b) Suppose the actual value of unemployment at time T, was unT = 0.05, is your forecast error positive or negative?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The interpretation of the intercept coefficient 005 in the model is the baseline level of unemploy...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started