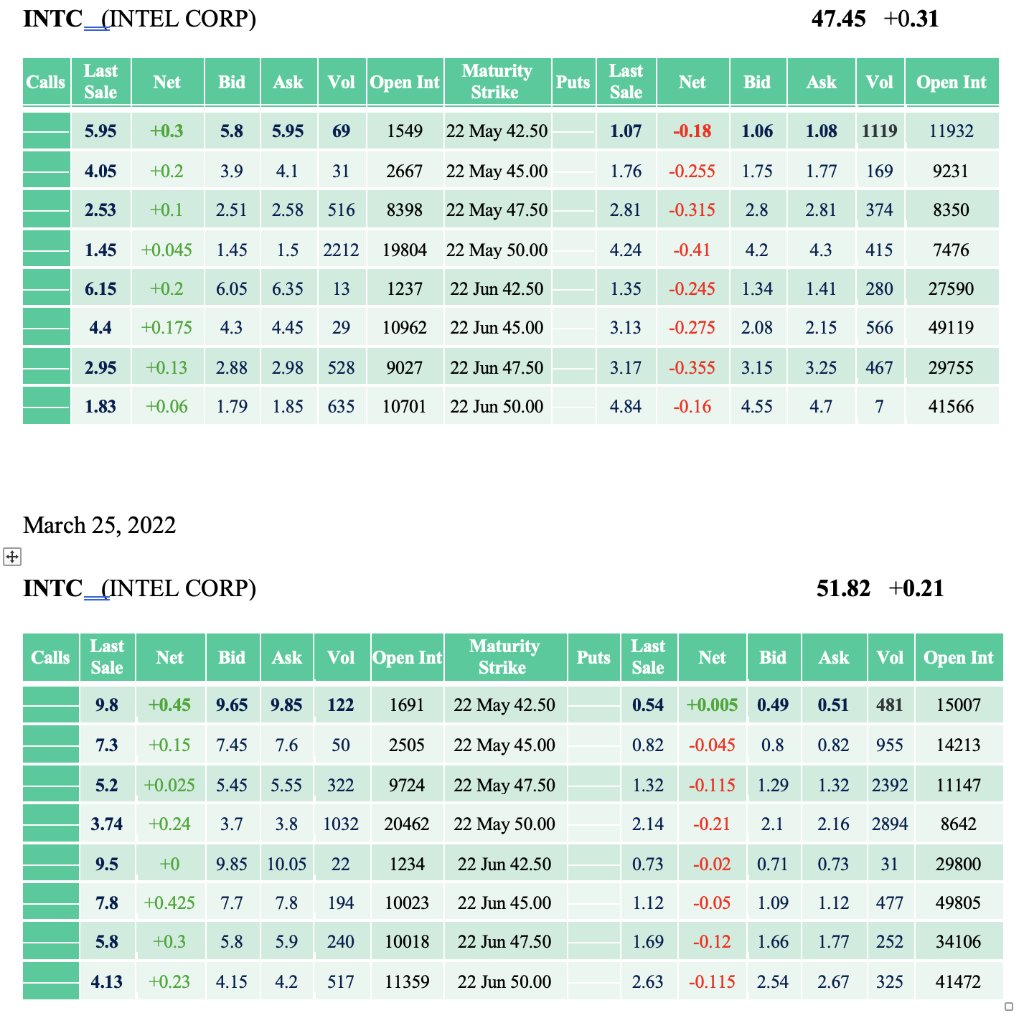

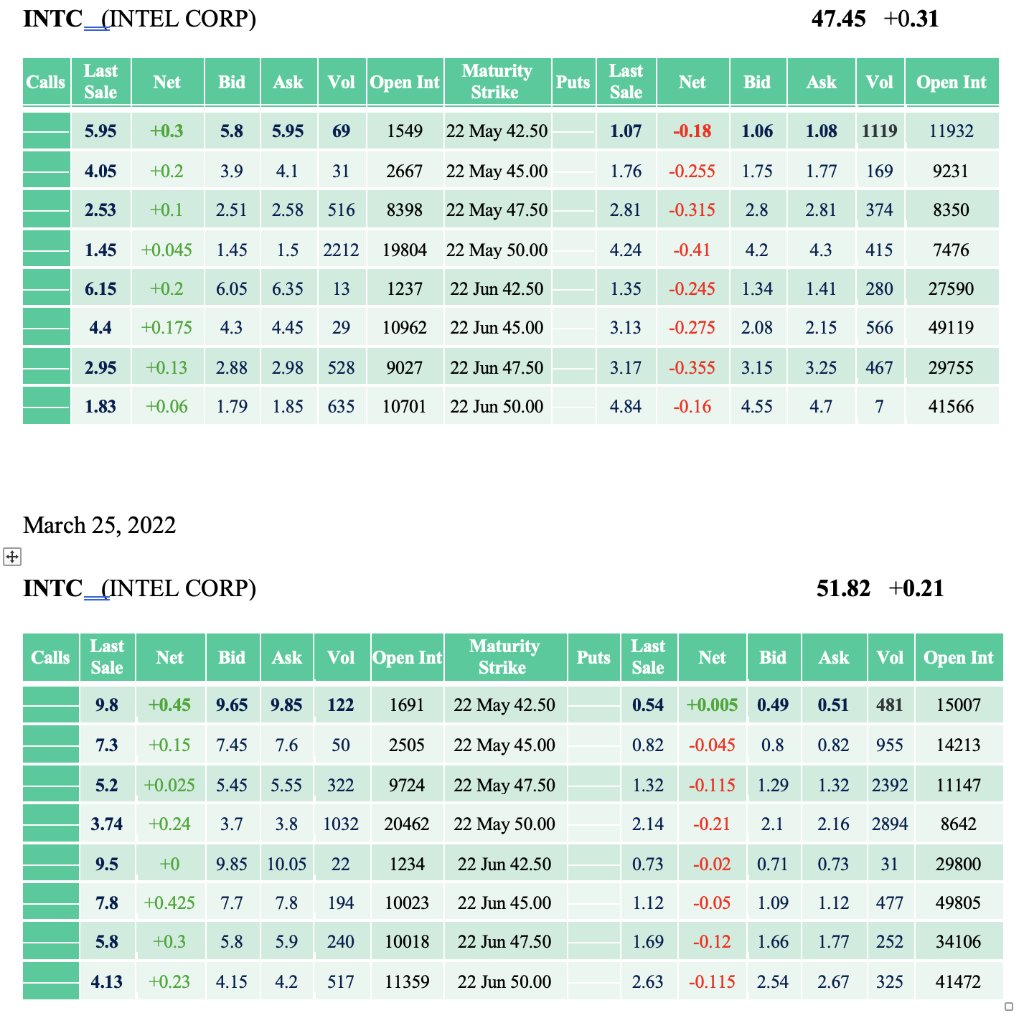

Consider the following positions on the Intel stock. For each of the positions choose the strike X = $45. Choose Juneoption.

a. Short 1 call.

b. Short 1 put.

c. Short 1 call + long 1 put.

d. Long 1 call + long 1 put.

e. Long 1 put with strike $45 and short 1 put with strike $47.5.

f. Long 1 put with strike $45, short 2 puts with strike $47.5, and long 1 put with strike $50.

Assume that you enter and close the positions at the mid point of bid-ask spread.

Assume that you trade each contract on March 18 (i.e. enter the positions). For each position (a-f) answer the following questions:

1. Now assume that you exercise options on March 25. For each position compute your net gain or loss.

2. Close out your positions on March 25. Calculate your net dollar gain or loss.

3. For each position draw the payoff diagram, marking the strikes and the stock price on March 25 clearly, as well as your payoff.

INTC_(INTEL CORP) 47.45 +0.31 Calls Last Sale Net Bid Ask Vol Open Int Maturity Strike Puts Last Sale Net Bid Ask Vol Open Int 5.95 +0.3 5.8 5.95 69 1549 22 May 42.50 1.07 -0.18 1.06 1.08 1119 11932 4.05 +0.2 3.9 4.1 31 2667 22 May 45.00 1.76 -0.255 1.75 1.77 169 9231 2.53 +0.1 2.51 2.58 516 8398 22 May 47.50 2.81 -0.315 2.8 2.81 374 8350 1.45 +0.045 1.45 1.5 2212 19804 22 May 50.00 4.24 -0.41 4.2 4.3 415 7476 6.15 +0.2 6.05 6.35 13 1237 22 Jun 42.50 1.35 -0.245 1.34 1.41 280 27590 4.4 +0.175 4.3 4.45 29 10962 22 Jun 45.00 3.13 -0.275 2.08 2.15 566 49119 2.95 +0.13 2.88 2.98 528 9027 22 Jun 47.50 3.17 -0.355 3.15 3.25 467 29755 1.83 +0.06 1.79 1.85 635 10701 22 Jun 50.00 4.84 -0.16 4.55 4.7 7 41566 March 25, 2022 INTC_(INTEL CORP) 51.82 +0.21 Calls Last Sale Net Bid Ask Vol Open Int Maturity Strike Puts Last Sale Net Bid Ask Vol Open Int 9.8 +0.45 9.65 9.85 122 1691 22 May 42.50 0.54 +0.005 0.49 0.51 481 15007 7.3 +0.15 7.45 7.6 50 2505 22 May 45.00 0.82 -0.045 0.8 0.82 955 14213 5.2 +0.025 5.45 5.55 322 9724 22 May 47.50 1.32 -0.115 1.29 1.32 2392 11147 3.74 +0.24 3.7 3.8 1032 20462 22 May 50.00 2.14 -0.21 2.1 2.16 2894 8642 9.5 +0 9.85 10.05 22 1234 22 Jun 42.50 0.73 -0.02 0.71 0.73 31 29800 7.8 +0.425 7.7 7.8 194 10023 22 Jun 45.00 1.12 -0.05 1.09 1.12 477 49805 5.8 +0.3 5.8 5.9 240 10018 22 Jun 47.50 1.69 -0.12 1.66 1.77 252 34106 4.13 +0.23 4.15 4.2 517 11359 22 Jun 50.00 2.63 -0.115 2.54 2.67 325 41472 INTC_(INTEL CORP) 47.45 +0.31 Calls Last Sale Net Bid Ask Vol Open Int Maturity Strike Puts Last Sale Net Bid Ask Vol Open Int 5.95 +0.3 5.8 5.95 69 1549 22 May 42.50 1.07 -0.18 1.06 1.08 1119 11932 4.05 +0.2 3.9 4.1 31 2667 22 May 45.00 1.76 -0.255 1.75 1.77 169 9231 2.53 +0.1 2.51 2.58 516 8398 22 May 47.50 2.81 -0.315 2.8 2.81 374 8350 1.45 +0.045 1.45 1.5 2212 19804 22 May 50.00 4.24 -0.41 4.2 4.3 415 7476 6.15 +0.2 6.05 6.35 13 1237 22 Jun 42.50 1.35 -0.245 1.34 1.41 280 27590 4.4 +0.175 4.3 4.45 29 10962 22 Jun 45.00 3.13 -0.275 2.08 2.15 566 49119 2.95 +0.13 2.88 2.98 528 9027 22 Jun 47.50 3.17 -0.355 3.15 3.25 467 29755 1.83 +0.06 1.79 1.85 635 10701 22 Jun 50.00 4.84 -0.16 4.55 4.7 7 41566 March 25, 2022 INTC_(INTEL CORP) 51.82 +0.21 Calls Last Sale Net Bid Ask Vol Open Int Maturity Strike Puts Last Sale Net Bid Ask Vol Open Int 9.8 +0.45 9.65 9.85 122 1691 22 May 42.50 0.54 +0.005 0.49 0.51 481 15007 7.3 +0.15 7.45 7.6 50 2505 22 May 45.00 0.82 -0.045 0.8 0.82 955 14213 5.2 +0.025 5.45 5.55 322 9724 22 May 47.50 1.32 -0.115 1.29 1.32 2392 11147 3.74 +0.24 3.7 3.8 1032 20462 22 May 50.00 2.14 -0.21 2.1 2.16 2894 8642 9.5 +0 9.85 10.05 22 1234 22 Jun 42.50 0.73 -0.02 0.71 0.73 31 29800 7.8 +0.425 7.7 7.8 194 10023 22 Jun 45.00 1.12 -0.05 1.09 1.12 477 49805 5.8 +0.3 5.8 5.9 240 10018 22 Jun 47.50 1.69 -0.12 1.66 1.77 252 34106 4.13 +0.23 4.15 4.2 517 11359 22 Jun 50.00 2.63 -0.115 2.54 2.67 325 41472