Question

Consider the following simplified balance sheet for a bank a. Calculate the value of the Bank's capital (net worth). What is this bank's capital to

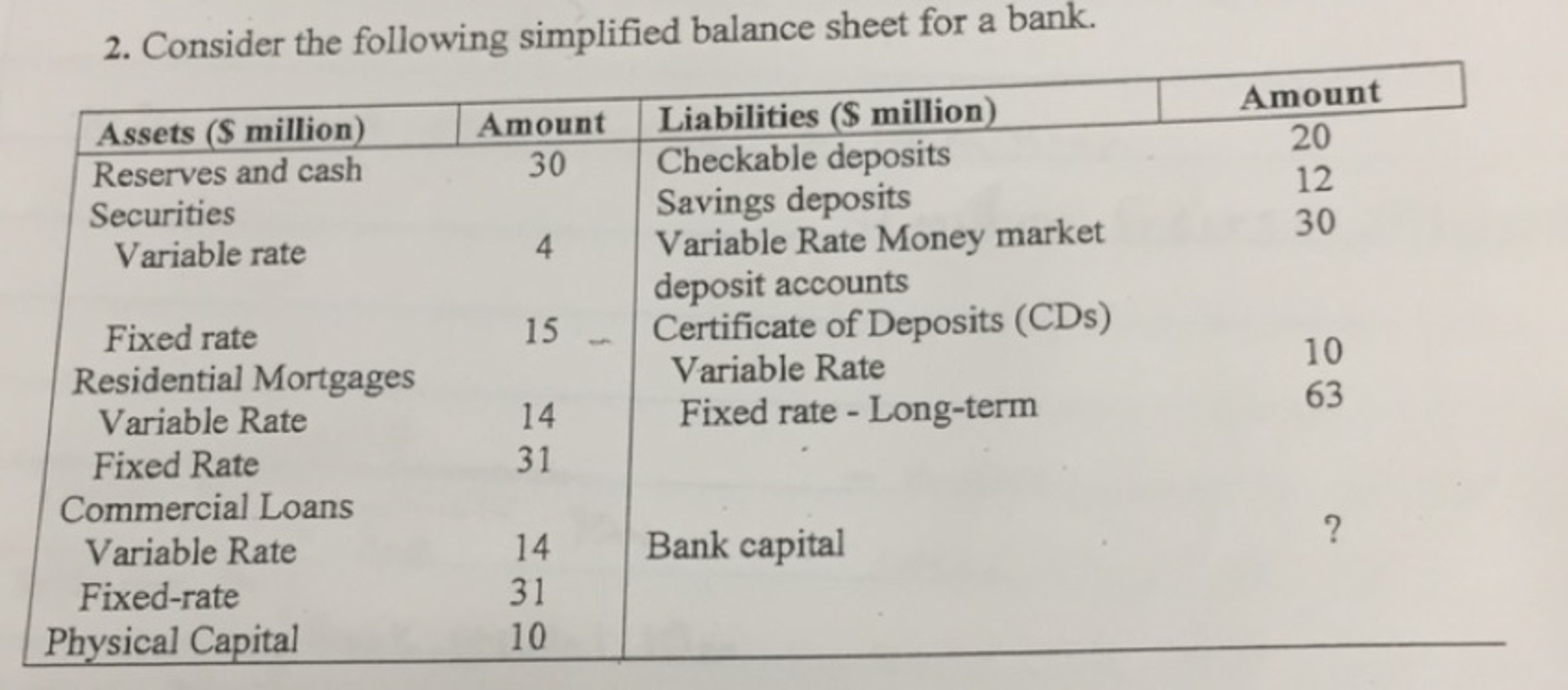

Consider the following simplified balance sheet for a bank

a. Calculate the value of the Bank's capital (net worth). What is this bank's capital to asset ratio?

b. Interest income from which assets (if any) would be significantly affected by changes in interest rates? What is the dollar value of these assets?

c. Interest payments on which liabilities would be significantly affected by changes in interest rates? What is the dollar value of these liabilities?

d. What is the gap (rate sensititve assests - rate sensitive liabilities)? What would be the bank's gain or loss in profits if interest rates decrease by 300 basis points?

e. Calculate the bank's ROE.

f. Suppose the owners wish to increase the ROE to 30%. Assuming the ROA is fixed, what can the bank do in order to acheive this target?

g. What are the hazards of this option?

2. Consider the following simplified balance sheet for a bank. Assets (S million) Amount Liabilities (S million) Reserves and cash Securities Amount 20 12 30 30 Checkable deposits 4 Variable Rate Money market 15 Certificate of Deposits (CDs) 14 Savings deposits deposit accounts Variable Rate Fixed rate - Long-term Variable rate Fixed rate 10 63 Residential Mortgages Variable Rate Fixed Rate 31 Commercial Loans 14 Bank capital Variable Rate Fixed-rate 31 Physical Capital 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started