Answered step by step

Verified Expert Solution

Question

1 Approved Answer

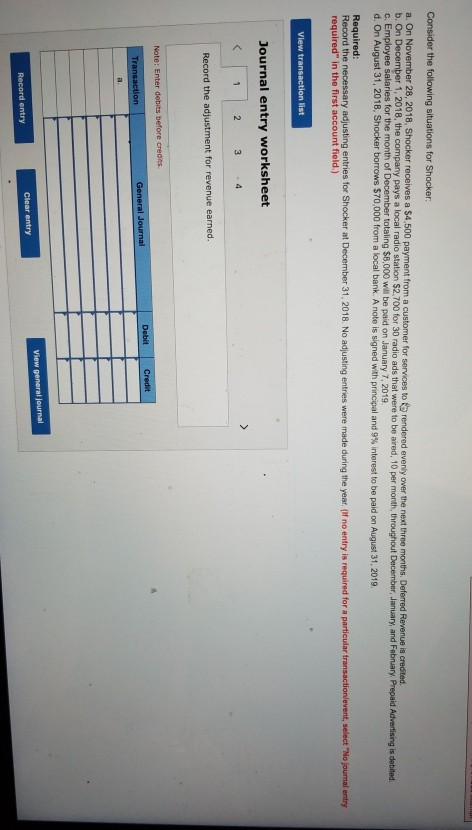

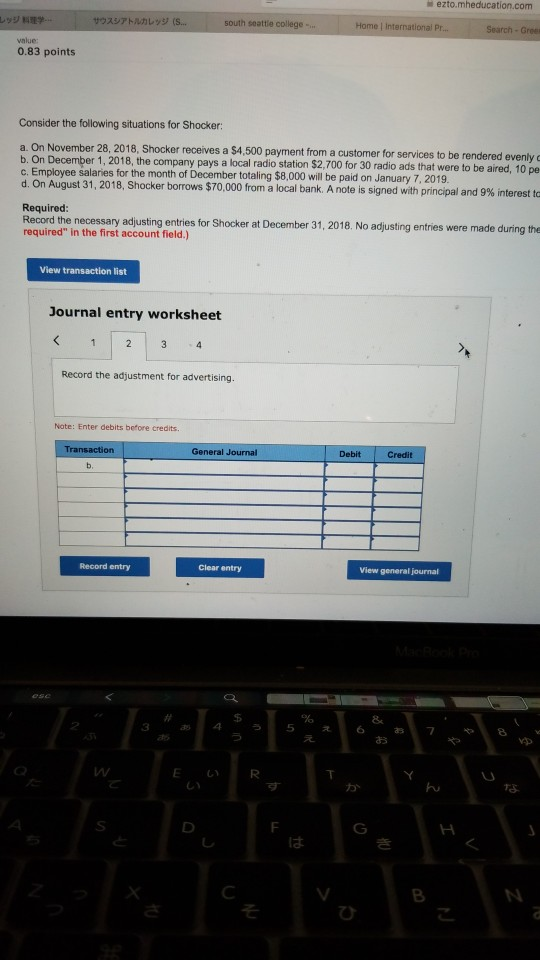

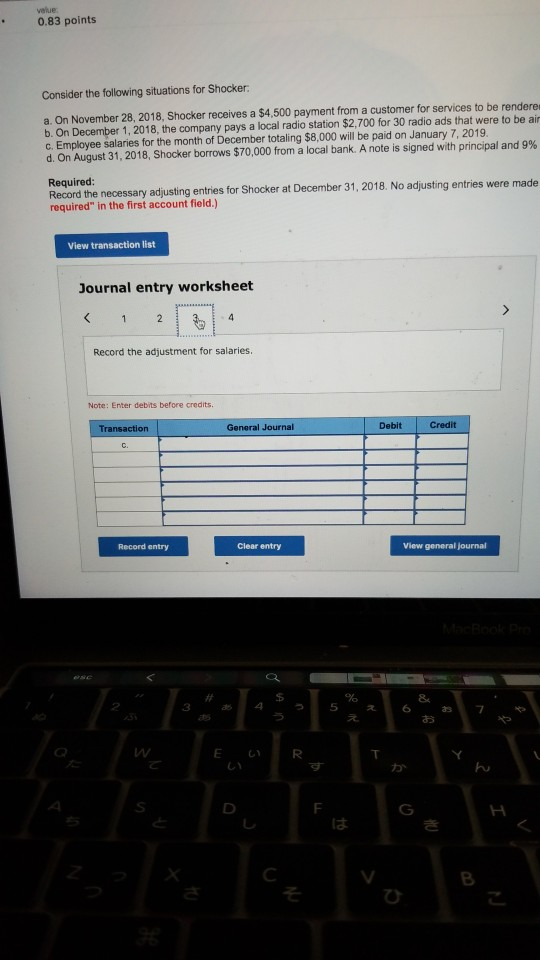

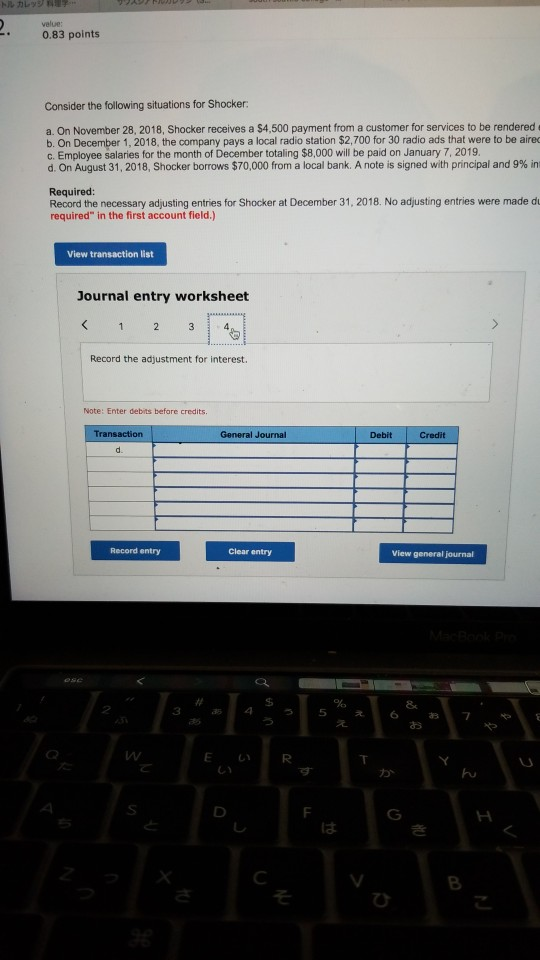

Consider the following situations for Shocker: a. On November 28, 2018, Shocker receives a $4,500 payment from a customer for services to rendered evenly over

Consider the following situations for Shocker: a. On November 28, 2018, Shocker receives a $4,500 payment from a customer for services to rendered evenly over the next three months. Deferred Revenue is credited b. On December 1, 2018, the company pays a local radio station $2.700 for 30 radio ads that were to be aired, 10 per month, throughout December, January, and February. Prepaid Advertising is debited. c. Employee salaries for the month of December totaling $8,000 will be paid on January 7, 2019 d. On August 31, 2018, Shocker borrows $70,000 from a local bank. A note is signed with principal and 9% interest to be paid on August 31, 2019. Required: Record the necessary adjusting entries for Shocker at December 31, 2018. No adjusting entries were made during the year. (If no ent required" in the first account field.) ired for a particular transaction/event, select "No journal entry View transaction list Journal entry worksheet 1 2 3 4 Record the adjustment for revenue earned. Note: Enter debits before credits Debit Credit Transaction General Journal View general Journal Clear entry Record entry Wheula. Y O UTH ... south seattle college Home International Pr... Search - Gres value 0.83 points Consider the following situations for Shocker: a. On November 28, 2018, Shocker receives a $4,500 payment from a customer for services to be rendered evenly b. On December 1, 2018, the company pays a local radio station $2.700 for 30 radio ads that were to be aired, 10 pe c. Employee salaries for the month of December totaling $8,000 will be paid on January 7, 2019. d. On August 31, 2018, Shocker borrows $70,000 from a local bank. A note is signed with principal and 9% interest te Required: Record the necessary adjusting entries for Shocker at December 31, 2018. No adjusting entries were made during the required in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started