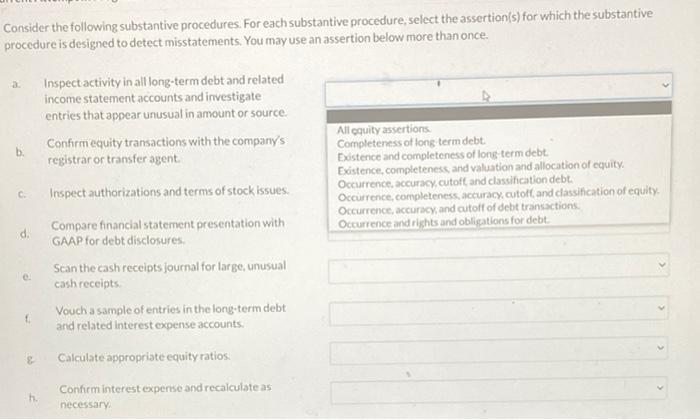

Consider the following substantive procedures. For each substantive procedure, select the assertion(s) for which the substantive procedure is designed to detect misstatements. You may use an assertion below more than once. Inspect activity in all long-term debt and related income statement accounts and investigate entries that appear unusual in amount or source. All equity assertions Confirm equity transactions with the company's registrar or transfer agent. Completeness of long term debt. Existence and completeness of long-term debt. Existence, completeness, and valuation and allocation of equity. Occurrence, accuracy, cutoff, and classification debt. Inspect authorizations and terms of stock issues. Occurrence, completeness, accuracy, cutoff, and classification of equity. Occurrence, accuracy, and cutoff of debt transactions. Occurrence and rights and obligations for debt. Compare financial statement presentation with GAAP for debt disclosures. Scan the cash receipts journal for large, unusual cash receipts. Vouch a sample of entries in the long-term debt and related interest expense accounts. Calculate appropriate equity ratios. Confirm interest expense and recalculate as necessary. b. C. d. e. f & h. Consider the following substantive procedures. For each substantive procedure, select the assertion(s) for which the substantive procedure is designed to detect misstatements. You may use an assertion below more than once. Inspect activity in all long-term debt and related income statement accounts and investigate entries that appear unusual in amount or source. All equity assertions Confirm equity transactions with the company's registrar or transfer agent. Completeness of long term debt. Existence and completeness of long-term debt. Existence, completeness, and valuation and allocation of equity. Occurrence, accuracy, cutoff, and classification debt. Inspect authorizations and terms of stock issues. Occurrence, completeness, accuracy, cutoff, and classification of equity. Occurrence, accuracy, and cutoff of debt transactions. Occurrence and rights and obligations for debt. Compare financial statement presentation with GAAP for debt disclosures. Scan the cash receipts journal for large, unusual cash receipts. Vouch a sample of entries in the long-term debt and related interest expense accounts. Calculate appropriate equity ratios. Confirm interest expense and recalculate as necessary. b. C. d. e. f & h