Question

Consider the following table comparing the 4-factor alpha of a portfolio of founder-CEO firms to that of a portfolio of non-founder-CEO firms. (Standard errors are

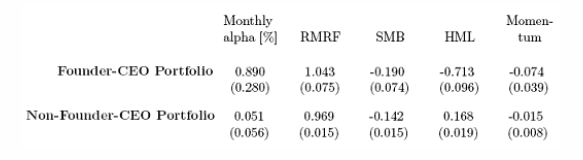

Consider the following table comparing the 4-factor alpha of a portfolio of founder-CEO firms to that of a portfolio of non-founder-CEO firms. (Standard errors are in parentheses.) A founder-CEO firm is defined as a firm in which the founder or co-founder is still the CEO. Eleven percent of the largest public U.S. firms are still headed by a founder.

a) How would you interpret the above results? Are the alphas significantly different from zero?

b) Are these results consistent with the semi-strong form of the efficient market hypothesis? Why or why not?

Founder-CEOPortfolioNon-Founder-CEOPortfolloMonthlyalpha[%]0.890(0.280)0.051(0.056)RMRF1.043(0.075)0.969(0.015)SMB0.190(0.074)0.142(0.015)HML0.713(0.096)0.168(0.019)Momen-tum0.074(0.039)0.015(0.008) Founder-CEOPortfolioNon-Founder-CEOPortfolloMonthlyalpha[%]0.890(0.280)0.051(0.056)RMRF1.043(0.075)0.969(0.015)SMB0.190(0.074)0.142(0.015)HML0.713(0.096)0.168(0.019)Momen-tum0.074(0.039)0.015(0.008)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started