Answered step by step

Verified Expert Solution

Question

1 Approved Answer

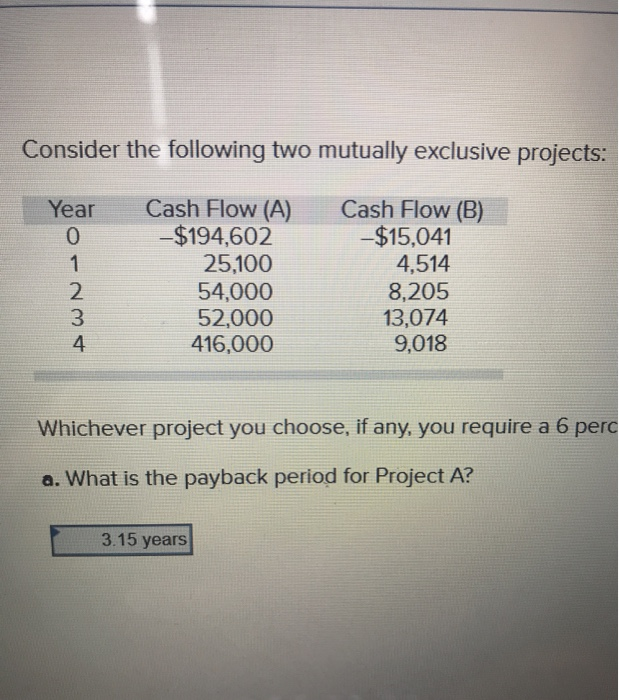

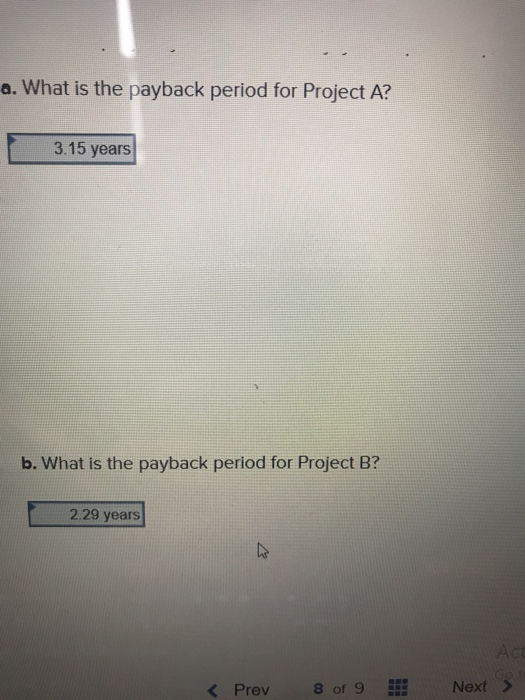

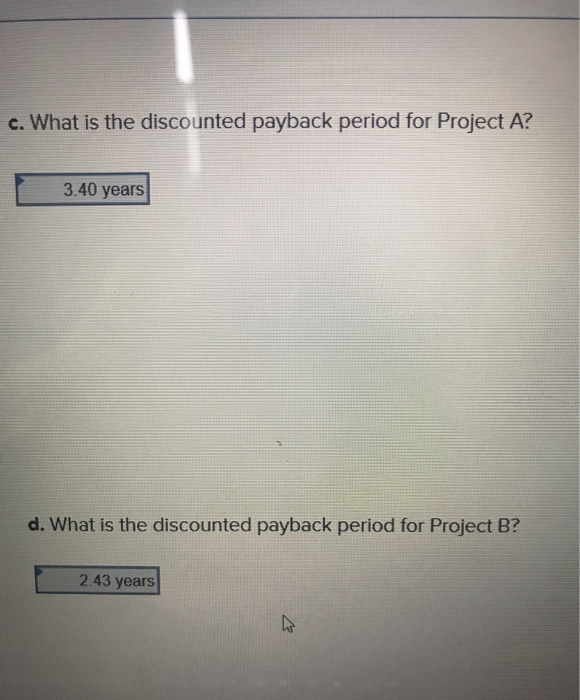

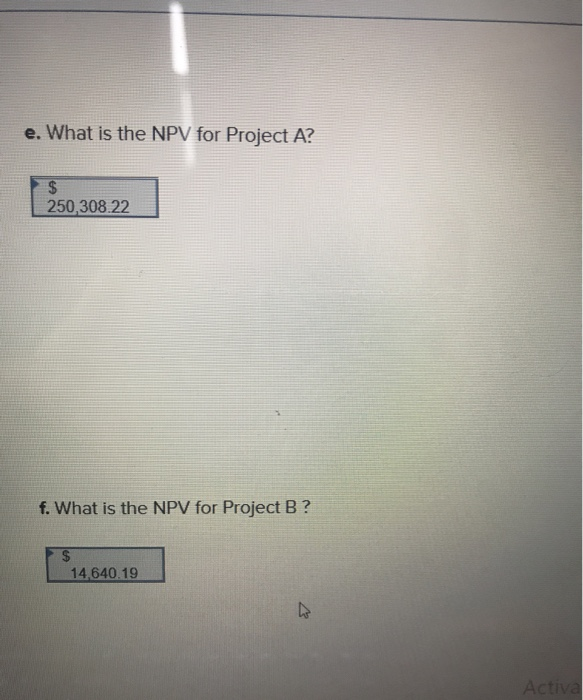

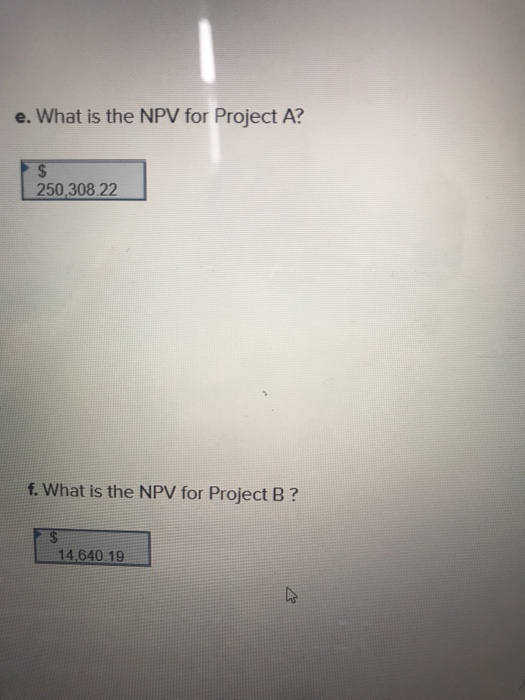

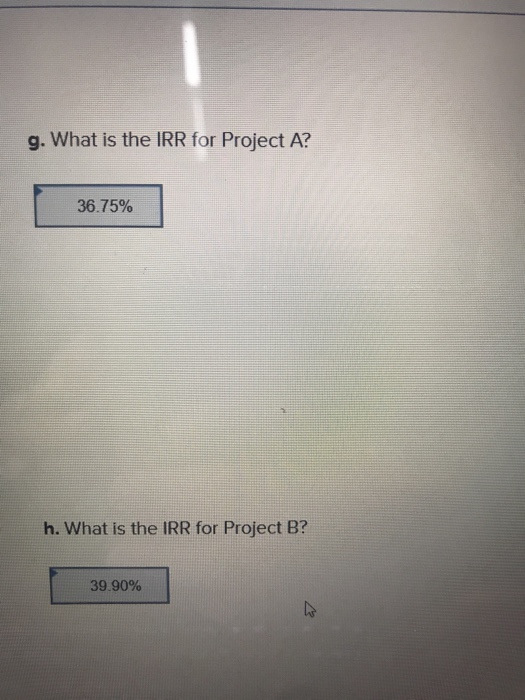

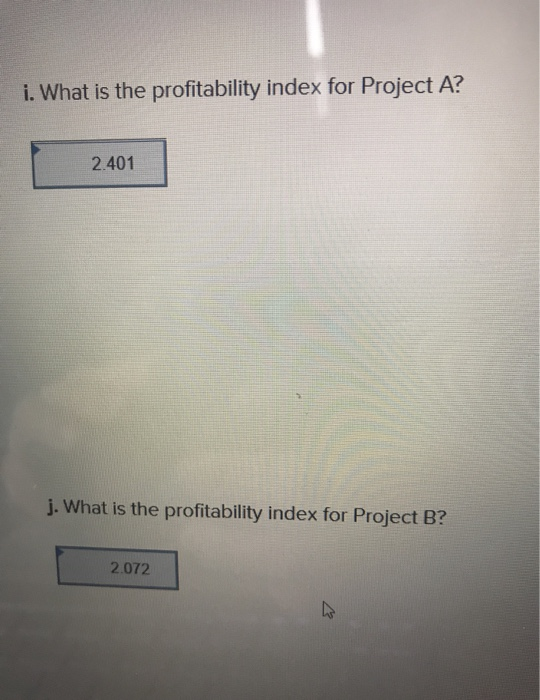

Consider the following two mutually exclusive projects: Year Cash Flow (A) $194,602 25,100 54,000 52,000 416,000 Cash Flow (B) _$15,041 4,514 8,205 13,074 9,018 Nm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started