Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello please help me answer all of this question, as soon as possible 1. Tony currently owns 12,000 shares of GL Tools. He has just

hello please help me answer all of this question, as soon as possible

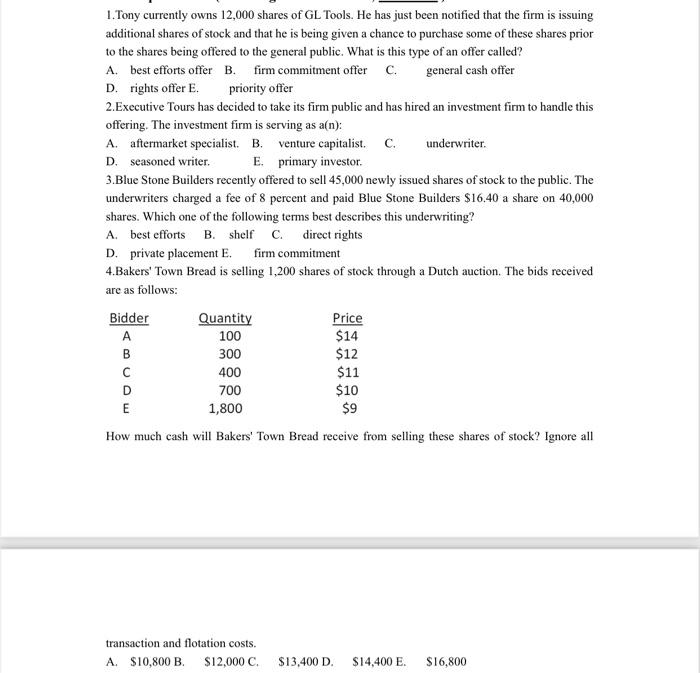

1. Tony currently owns 12,000 shares of GL Tools. He has just been notified that the firm is issuing additional shares of stock and that he is being given a chance to purchase some of these shares prior to the shares being offered to the general public. What is this type of an offer called? A. best efforts offer B. firm commitment offer c. general cash offer D. rights offer E. priority offer 2.Executive Tours has decided to take its firm public and has hired an investment firm to handle this offering. The investment firm is serving as a[n): A. aftermarket specialist. B. venture capitalist. C. underwriter D. seasoned writer E primary investor 3.Blue Stone Builders recently offered to sell 45,000 newly issued shares of stock to the public. The underwriters charged a fee of 8 percent and paid Blue Stone Builders $16.40 a share on 40,000 shares. Which one of the following terms best describes this underwriting? A. best efforts B. shelf c. direct rights D. private placement E. firm commitment 4.Bakers' Town Bread is selling 1,200 shares of stock through a Dutch auction. The bids received are as follows: Bidder Quantity Price A 100 $14 B 300 $12 400 $11 D 700 $10 E 1,800 $9 How much cash will Bakers' Town Bread receive from selling these shares of stock? Ignore all transaction and flotation costs. A. $10,800 B. $12,000 c. $13,400 D. $14,400 E. $16,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started