Question

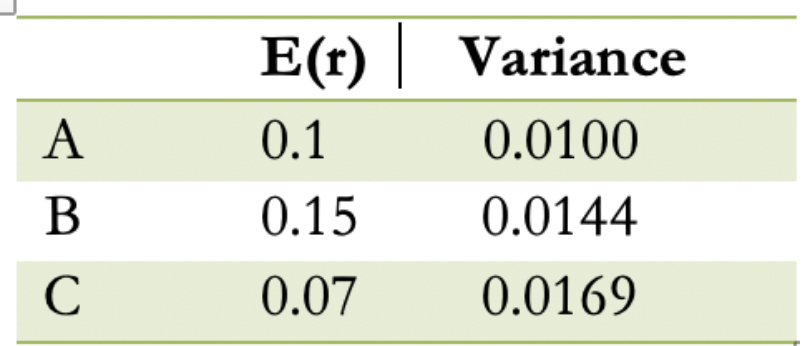

Consider the scenario below to answer 3.1 and 3.2: [3.1, Mark 1] What would be the variance of a portfolio which allocates 0.5 to A,

Consider the scenario below to answer 3.1 and 3.2:

[3.1, Mark 1]What would be the variance of a portfolio which allocates 0.5 to A, 0.3 to B, and 0.2 to C? Show your calculations.

[3.2, Mark 2]Rank A, B and C in increasing order based on their contribution to the overall portfolio variance. Justify your answer with calculations [3.3, Mark 2]Three assets are available to you X, Y and Z. w denotes the vector of weights and V denotes the covariance matrix. Write down the optimization problem to find the minimum variance portfolio under the constraint that no more than 5% of the portfolio is allocated to either X or Z.

Variance E(r) 0.1 A 0.0100 B 0.15 0.0144 0.07 0.0169 Variance E(r) 0.1 A 0.0100 B 0.15 0.0144 0.07 0.0169Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started