Question

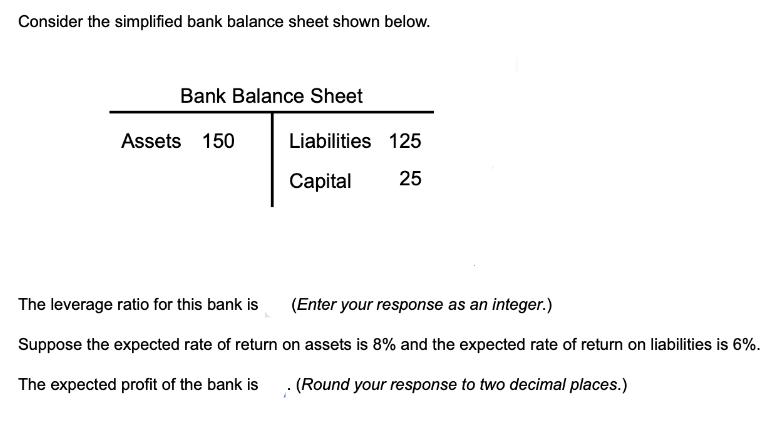

Consider the simplified bank balance sheet shown below. Bank Balance Sheet Assets 150 Liabilities 125 Capital 25 The leverage ratio for this bank is

Consider the simplified bank balance sheet shown below. Bank Balance Sheet Assets 150 Liabilities 125 Capital 25 The leverage ratio for this bank is (Enter your response as an integer.) Suppose the expected rate of return on assets is 8% and the expected rate of return on liabilities is 6%. The expected profit of the bank is (Round your response to two decimal places.)

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The leverage ratio of a bank is calculated as the ratio of its capital t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Economics

Authors: Paul Keat, Philip K Young, Steve Erfle

7th edition

0133020266, 978-0133020267

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App