Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the situation of La Nacion, a hypothetical Latin American country. In 2 0 1 0 La Nacion was a net debtor to the rest

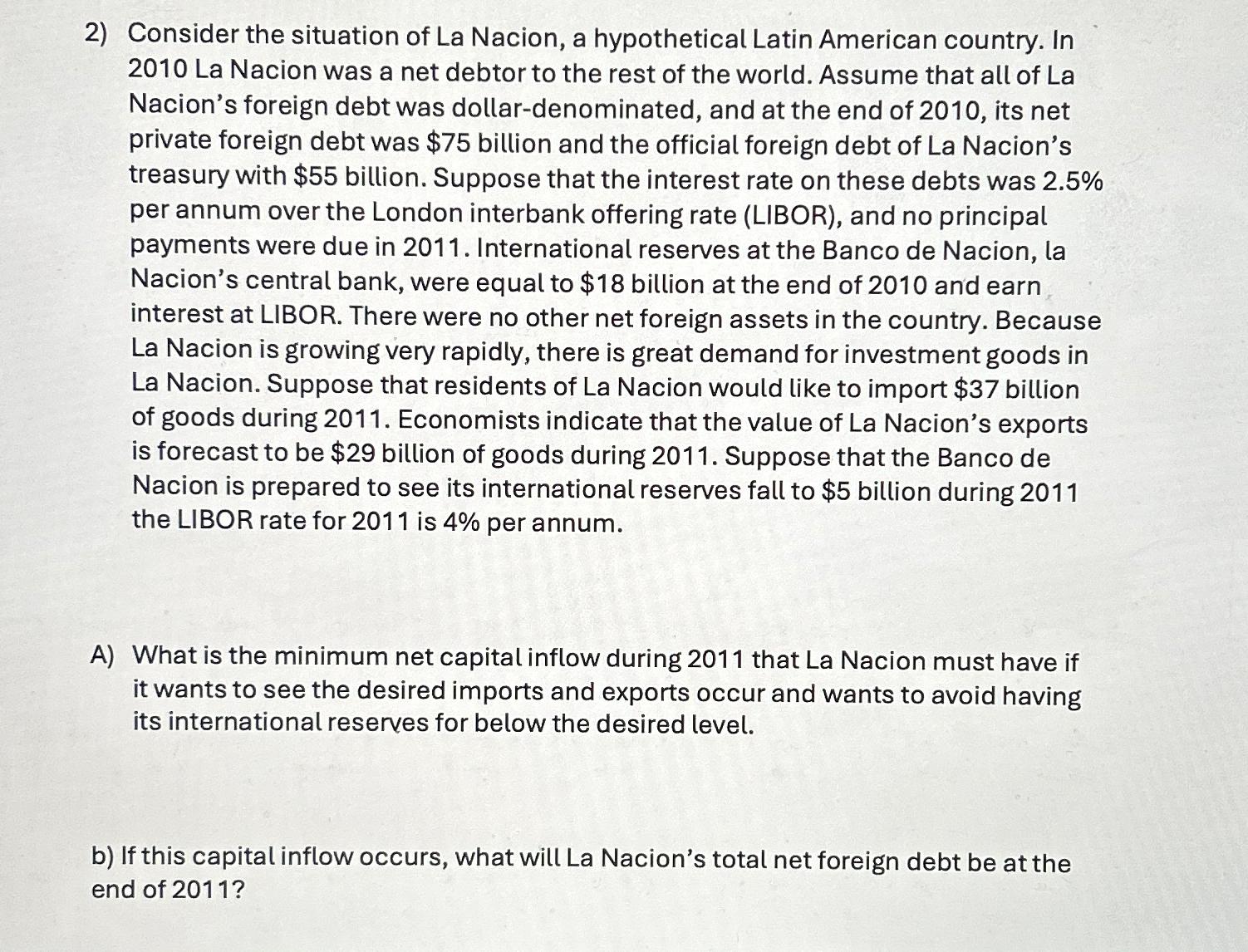

Consider the situation of La Nacion, a hypothetical Latin American country. In La Nacion was a net debtor to the rest of the world. Assume that all of La Nacion's foreign debt was dollardenominated, and at the end of its net private foreign debt was $ billion and the official foreign debt of La Nacion's treasury with $ billion. Suppose that the interest rate on these debts was per annum over the London interbank offering rate LIBOR and no principal payments were due in International reserves at the Banco de Nacion, la Nacion's central bank, were equal to $ billion at the end of and earn interest at LIBOR. There were no other net foreign assets in the country. Because La Nacion is growing very rapidly, there is great demand for investment goods in La Nacion. Suppose that residents of La Nacion would like to import $ billion of goods during Economists indicate that the value of La Nacion's exports is forecast to be $ billion of goods during Suppose that the Banco de Nacion is prepared to see its international reserves fall to $ billion during the LIBOR rate for is per annum.

A What is the minimum net capital inflow during that La Nacion must have if it wants to see the desired imports and exports occur and wants to avoid having its international reserves for below the desired level.

b If this capital inflow occurs, what will La Nacion's total net foreign debt be at the end of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started