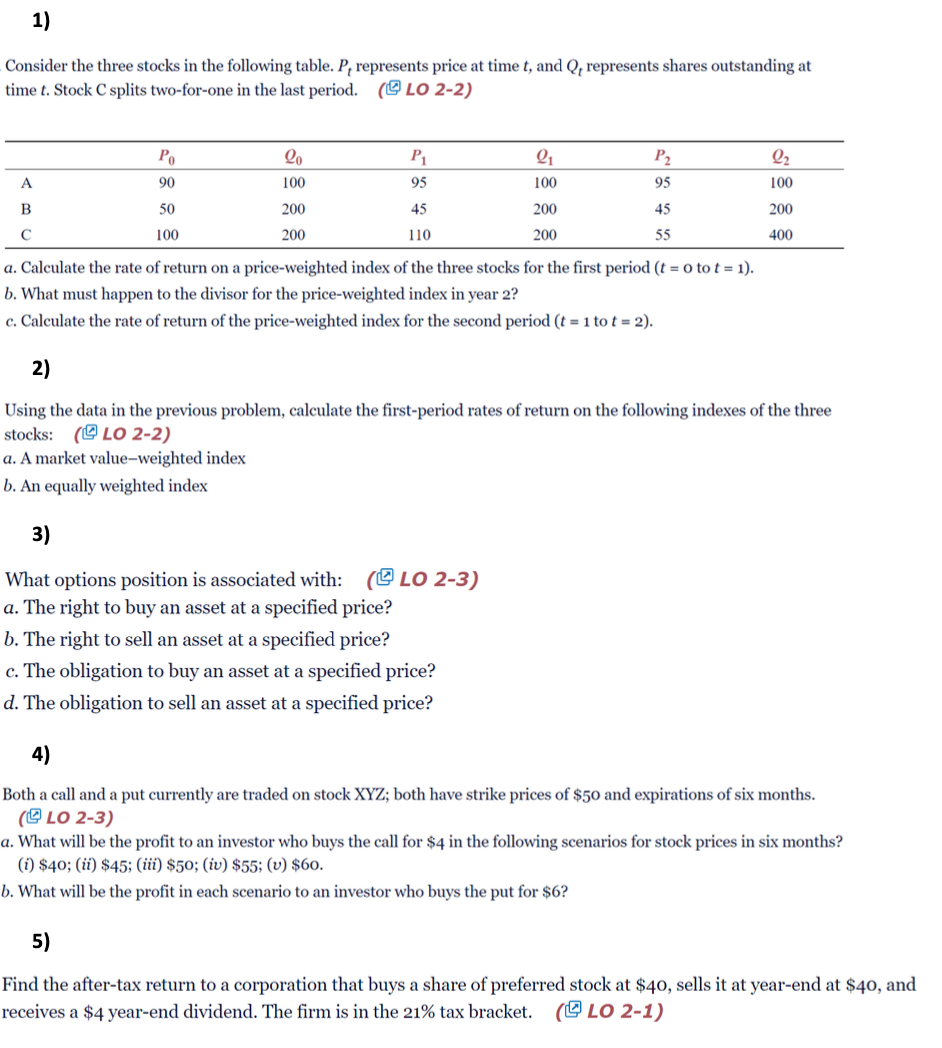

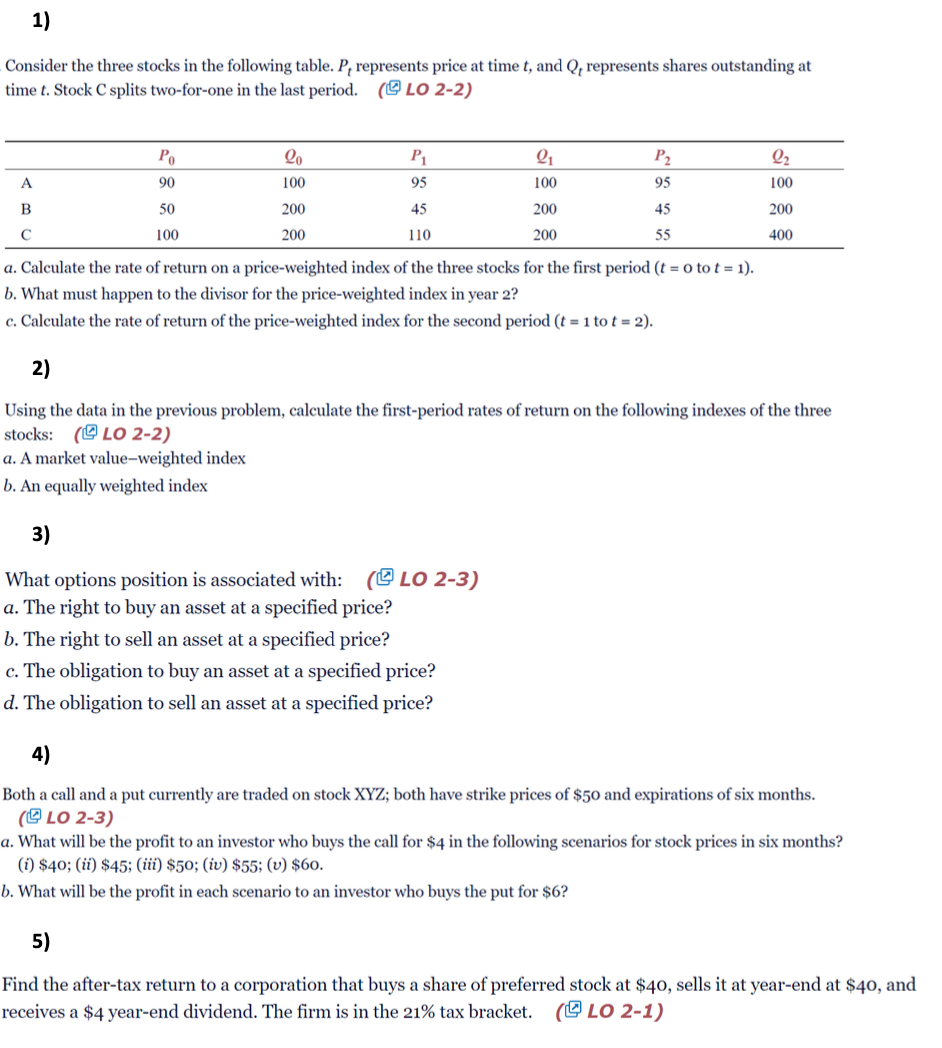

Consider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. ( LO 2-2) a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t=0 to t=1). b. What must happen to the divisor for the price-weighted index in year 2 ? c. Calculate the rate of return of the price-weighted index for the second period (t=1 to t=2). 2) Using the data in the previous problem, calculate the first-period rates of return on the following indexes of the three stocks: ( LO 2-2) a. A market value-weighted index b. An equally weighted index 3) What options position is associated with: ( LO 2-3) a. The right to buy an asset at a specified price? b. The right to sell an asset at a specified price? c. The obligation to buy an asset at a specified price? d. The obligation to sell an asset at a specified price? 4) Both a call and a put currently are traded on stock XYZ; both have strike prices of $50 and expirations of six months. ( LO 2-3) a. What will be the profit to an investor who buys the call for $4 in the following scenarios for stock prices in six months? (i) \$40; (ii) \$45; (iii) \$50; (iv) \$55; (v) \$60. b. What will be the profit in each scenario to an investor who buys the put for $6 ? 5) Find the after-tax return to a corporation that buys a share of preferred stock at $40, sells it at year-end at $40, and receives a $4 year-end dividend. The firm is in the 21% tax bracket. ( LO21 ) Consider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. ( LO 2-2) a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t=0 to t=1). b. What must happen to the divisor for the price-weighted index in year 2 ? c. Calculate the rate of return of the price-weighted index for the second period (t=1 to t=2). 2) Using the data in the previous problem, calculate the first-period rates of return on the following indexes of the three stocks: ( LO 2-2) a. A market value-weighted index b. An equally weighted index 3) What options position is associated with: ( LO 2-3) a. The right to buy an asset at a specified price? b. The right to sell an asset at a specified price? c. The obligation to buy an asset at a specified price? d. The obligation to sell an asset at a specified price? 4) Both a call and a put currently are traded on stock XYZ; both have strike prices of $50 and expirations of six months. ( LO 2-3) a. What will be the profit to an investor who buys the call for $4 in the following scenarios for stock prices in six months? (i) \$40; (ii) \$45; (iii) \$50; (iv) \$55; (v) \$60. b. What will be the profit in each scenario to an investor who buys the put for $6 ? 5) Find the after-tax return to a corporation that buys a share of preferred stock at $40, sells it at year-end at $40, and receives a $4 year-end dividend. The firm is in the 21% tax bracket. ( LO21 )