Answered step by step

Verified Expert Solution

Question

1 Approved Answer

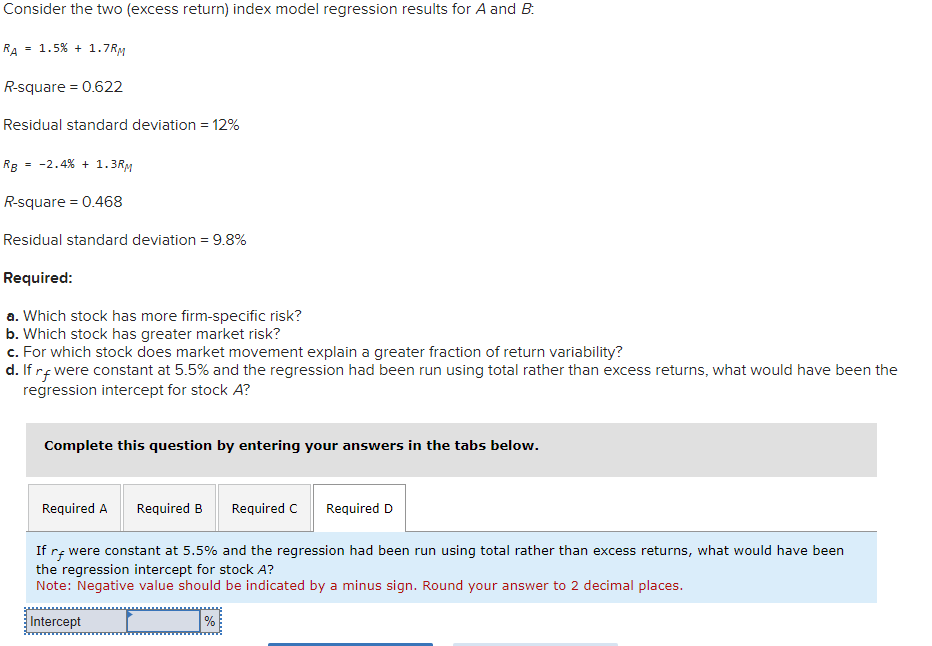

Consider the two ( excess return ) index model regression results for A and B : R A = 1 . 5 % + 1

Consider the two excess return index model regression results for A and :

square

Residual standard deviation

square

Residual standard deviation

Required:

a Which stock has more firmspecific risk?

b Which stock has greater market risk?

c For which stock does market movement explain a greater fraction of return variability?

d If were constant at and the regression had been run using total rather than excess returns, what would have been the

regression intercept for stock

Complete this question by entering your answers in the tabs below.

Required B

If were constant at and the regression had been run using total rather than excess returns, what would have been

the regression intercept for stock

Note: Negative value should be indicated by a minus sign. Round your answer to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started